Your wait for lower interest rates on home loans and car loans may be over with banks likely to reduce their lending rates after Reserve Bank of India (RBI) cut interest rates for a second time this calendar year.

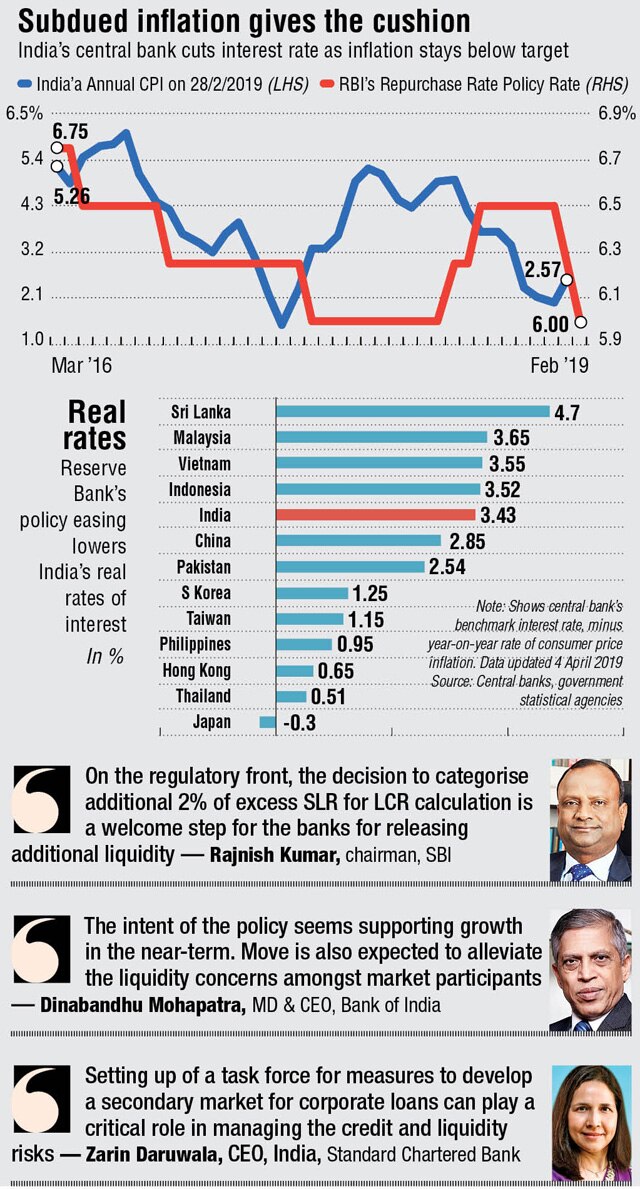

Even if you are an existing borrower, banks will offer you rates if your reset date is due. RBI on Thursday cut interest rates (repo – the rate at which it lends short-term money to banks) by 25 basis points to 6%. One basis point is one hundredth of a percentage point.

RBI governor Shaktikanta Das said in a press conference, "Monetary transmission is an issue."

Banks will find it harder to sit tight this time, especially after RBI governor, Shaktikanta Das highlighted some concerns with transmission as the first two rate cuts so far have resulted in only in five to 10 bps cut in the marginal cost of funds-based lending rate (MCLR).

After the last rate cut by RBI, State Bank of India (SBI) cut rates by 10 basis points. This was followed by several other banks that lowered their MCLRs in select tenors by 5-15 basis points in the past month, including ICICI Bank, HDFC Bank, Bank of Baroda, Punjab National Bank, Kotak Mahindra Bank, YES Bank and Union Bank of India. The Monetary Policy Committee (MPC) decided to cut the repo rate by 25 bps to 6.0% by 4-2 vote and decided to maintain the neutral stance.

After the last rate cut by RBI, State Bank of India (SBI) cut rates by 10 basis points. This was followed by several other banks that lowered their MCLRs in select tenors by 5-15 basis points in the past month, including ICICI Bank, HDFC Bank, Bank of Baroda, Punjab National Bank, Kotak Mahindra Bank, YES Bank and Union Bank of India. The Monetary Policy Committee (MPC) decided to cut the repo rate by 25 bps to 6.0% by 4-2 vote and decided to maintain the neutral stance.

But with the first quarter being one with s sluggish credit growth, banks will be tempted to give lower rates to lure customers and also not lose existing customers who may shift to other banks for lower rates. "Banking credit continued to post double-digit growth, registering 14.1% increase on-year as of March 15, 2019. However, growth was still not broad-based as industrial credit growth continued to remain anaemic," rating agency Crisil said in a report.

The rate cut was possible due to the lower food inflation rates and fall in fuel prices. "Taking into consideration the factors and assuming a normal monsoon in 2019, the path of CPI inflation is revised downwards to 2.4% in the fourth quarter and 2.9% to 3% in the first half of 2019-20 and 3.5% to 3.8% in the second half of 2019-20," the central bank said.

"The 25 basis point repo rate cut along with the recent three-year swap announcements and the higher Statutory Liquidity Ratio / Liquidity Coverage Ratio (SLR/LCR) overlap, will not only aid in monetary transmission, but will also increase the flow of credit to the system," said Zarin Daruwala, chief executive officer India, Standard Chartered Bank.

MONETARY POLICY

- Repo rate reduced by 25 basis points to 6%

- This is the second back-to-back rate cut

- Reserve Bank maintains Neutral stance on the monetary policy

- Four out of six Monetary Policy Committee members voted in favour of the rate cut

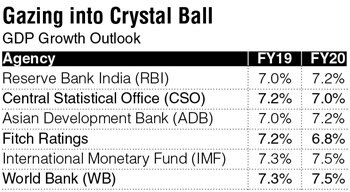

- Gross domestic product growth projection lowered to 7.2% for 2019-20

- RBI revises downward retail inflation estimate to 2.4% in Q4 FY19

- MPC notes output gap remains negative and domestic economy facing headwinds

- The next monetary policy statement on June 6