We certainly expect FY20 earnings to be closer to the average growth we have seen in the last few years. A lot will depend on how the numbers of auto companies and PSU banks will pan out.

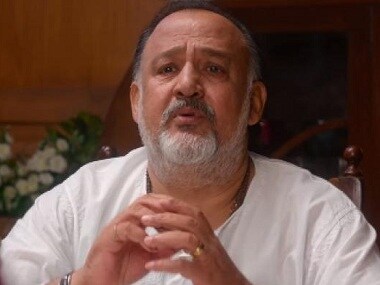

In terms of trailing earnings, the market is currently quoting at a P/E of 27x but if you consider forward P/E for 2020 March, it is more to the tune of 22x. This is not unreasonable for the markets when the economy is growing at a GDP growth rate of over 7 percent, Amar Singh, Head - Advisory at Angel Broking said in an interview to Moneycontrol's Sunil Shankar Matkar.

Edited excerpts:

Q: What is your call on the market, given the rally in FY19?

A: We believe that the market earnings may be mixed across sectors. While Industrials may perform better, autos are likely to remain under pressure.

Meanwhile, PSU banks will have to make greater provision for delayed NCLT cases and that will impact their profits.

In terms of trailing earnings, the market is currently quoting at a P/E of 27X but if you consider the forward P/E for 2020 March, then the P/E is more like 22X, which is not unreasonable for the markets, when the economy is growing at a GDP growth rate of over 7 percent.

While the market is likely to be buoyant in 2019, it may become a more stock-specific alpha market with pockets of outperformance.

Q: What is your view on the auto sector? Is it indicative of a slowdown in consumption?A: The recent consumption survey done by CSFB across Asia has put India on top of the consumption score. However, the survey has also pointed out that people are now more than willing to postpone high-value purchases. This is not great news for auto companies.

While there is some slowdown in consumption, the bigger problem is the cost and the availability of funds. Auto loan costs have gone up and most banks are tightening the flow of credit to the consumer sector.

These factors are putting pressure on the profits of auto companies as well as its topline growth.

We believe that investors should wait for the consumption theme to return in a bigger way before buying auto stocks.

Q: How should investors approach cement stocks after the price hike?

A: Cement stocks have had two unique characteristics about them. Firstly, they are good proxies for the expansion of construction and infrastructure sector.

Also, companies have seen prices going up with cement pricing power coming back to the producers.

However, in the recent quarter, we did see some backtracking on price in the North and South India.

The only worry on cement stocks is that valuations have already run up and hence the margin of safety might be limited.

Q: What is your call on the overall banking sector?

A: Private banks have been market heavyweights adding heft to the rally. Meanwhile, for private banks valuations have not been a problem as long as the bank is able to sustain growth on a consistent basis.

Investors will have to be a little more careful about investing in private banks with relatively poorer asset quality. PSU banks are a slightly different ball game as they are a play on the turnaround.

ICRA expects all the PSU banks to report combined profits of over Rs 35,000 crore next years.

However, the delay in NCLT resolution of some key high profile companies like Essar Steel, Bhushan Power and Alok Industries will mean that higher provisions may be required and that is likely to work against the PSU banks in the coming year.

Q: Do you expect big growth in earnings in FY20?

A: We expect FY20 earnings to be closer to the average growth we have seen in the last few years. A lot will depend on how the numbers of auto companies and PSU banks will pan out.

Sectors like telecom are still a major overhang with companies like Vodafone Idea now reporting quarterly losses in excess of Rs 5,000 crore.

The profitability of PSU banks will also depend on how the power sector dues are handled.

Q: What are your views on IT stocks which rallied strongly in 2018?

A: IT stocks rallied from fairly attractive valuations and tech spending is also picking up globally.

However, the focus will be more on largecaps that are able to leverage the power of emerging digital technologies like mobility, social media, and analytics and cloud computing.

Also, the dollar swap bonds have the purpose of preventing the rupee from strengthening and that is likely to favour the IT companies.

Disclaimer: Moneycontrol.com advises users to check with certified experts before taking any investment decisions.