Despite registering a fall in March, market leader Maruti Suzuki Ltd (MSL) clocked its highest ever domestic sales in the last fiscal, primarily due to bumper sales in the initial few months of the fiscal.

The company sold 17,53,700 units in domestic market 2018-19 as compared to 16,53,500 units in the corresponding period last year, a 6.1% growth. Its total sales, including exports of 108,749 units, grew 4.7% at 18,62,449 units. The company sold a total 158,076 units in March, including 1,47,613 units in the domestic market and 10,463 units in exports, a fall of 1.6% over the previous fiscal.

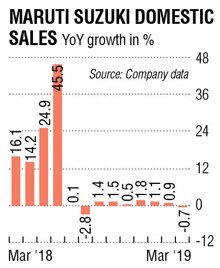

Maruti Suzuki's sales have been subdued for the last six months. Its domestic sales rose a mere 0.9% in February, and in January, December, November, October and September grew just 1.1%, 1.8%, 0.5%, 1.5%, 1.4%, respectively. It reported a 2.8% fall in sales in August, and a mere 0.1% growth in July.

In contrast, the month of June saw a 45.5% rise in sales. Similarly, May, April, March witnessed a rise of 24.9%, 14.2% and 16.1%, respectively. "We have never seen such a prolonged period of slowness since a very long time," said a Mumbai-based Maruti Suzuki dealer.

In contrast, the month of June saw a 45.5% rise in sales. Similarly, May, April, March witnessed a rise of 24.9%, 14.2% and 16.1%, respectively. "We have never seen such a prolonged period of slowness since a very long time," said a Mumbai-based Maruti Suzuki dealer.

Similar is the predicament of other automakers. Homegrown automaker Mahindra & Mahindra's domestic sales rose 9% in the last fiscal at 5,70,001 units compared to 5,20,932 units during fiscal 2018 while including exports it grew 11%.

Rajan Wadhera, president, automotive sector, M&M, said, "We have closed fiscal 2019 with robust double digit growth of 11% at an overall level, despite strong headwinds faced by the Indian automotive industry this year."

The prolonged slowdown has even prompted companies, including Maruti Suzuki, to cut production.

One of the primary reasons cited by executives across the OEMs, retailers, component makers is tightening of liquidity by non-banking financial companies following the Infrastructure Leasing & Financial Services (IL&FS) crisis. The other prominent reasons include a rise in fuel prices, which have though softened in the past few months, rural distress due to lack of rains in certain regions, severe floods in Kerala during August, new insurance laws leading to increase in its costs, slowdown in certain industries leading to dip in consumer sentiment.

Hyundai Motor India, the country's second-largest car manufacturer, posted a 1.7% growth in domestic sales at 5,45,243 units. Honda Cars India's domestic sales grew 8% to 1,83,787 units in fiscal 2019.

However, Tata Motors's passenger vehicle sales in the domestic market for fiscal 2019 were the highest ever in the last six years at 2,10,143 units, a growth of 12% over 1,87,321 units sold in the last fiscal.

According to Sridhar V, partner, Grant Thornton India LLP, if one considers the March sales in passenger cars, then overall it has shown a marginal growth in sales year on year. However, if one were to look at the growth over the preceding month it has been a high single-digit growth, mainly driven by new models and variants, price discounts and incremental demand due to expectations of price increase from April 1.

"The numbers over a 12-month period in fiscal 2019 have been encouraging since it is almost an addition of more than a million more cars on the road."

BRAKING DOWN

- Mahindra & Mahindra's domestic sales rose 9% in the last fiscal at 5,70,001 units compared to 5,20,932 units during fiscal 2018

- Tata Motors's passenger vehicle sales in the domestic market for fiscal 2019 were the highest ever in the last six years at 2,10,143 units, a growth of 12%