Pranav Haldea feels fund raising in 2019-20 is going to be significantly impacted by the outcome of the general elections.

Benchmark indices, Nifty and Sensex, staged a strong performance in FY19 with Nifty gaining 15 percent. But that did not reflect in the primary market majorly due to weak sentiment.

Indian companies through initial public offering, offer for sale, qualified institutional placement, InvITs/ReITs raised only Rs 56,440 crore in year ended March 2019, showed data by PRIME Database.

This compared to DII (institutional investors) inflow of Rs 72,336 crore.

Fund raising through public equity markets in FY19 was 68 percent lower than Rs 1,75,680 crore raised in the preceding year, said PRIME Database release.

During the year, Nifty 50 rallied 1,510 points and Sensex surged 5,704 points, the second highest ever absolute gains in a fiscal. But the broader market underperformed which was one of key reasons (apart from mixed earnings) for slowdown in overall primary market.

The Nifty Midcap Index fell 2.7 percent and BSE Smallcap index declines 11.6 percent in 2018-19.

The fundraising through IPOs (mainboard) as well SME IPOs also declined sharply compared to previous year.

"2018-19 saw fundraising through IPOs drop by a huge 81 percent to just Rs 16,294 in 2018-19 from Rs 83,767 crore in the previous financial year," said Pranav Haldea, Managing Director, PRIME Database Group

During the year, 14 mainboard companies came to the market collectively raising Rs 14,674 crore against 45 IPOs for Rs 81,553 crore in previous year. 106 SME IPOs collected a total of Rs 1,620 crore as compared to Rs 2,213 crore raised through 154 IPOs in FY18.

The largest IPO was from HDFC Asset Management for Rs 2,800 crore in FY19.

The largest IPO was from HDFC Asset Management for Rs 2,800 crore in FY19.

"While 2 IPOs received a mega response of more than 10 times (RITES at 67 times followed by HDFC Asset Management at 60 times) and 4 other IPOs were oversubscribed by more than 3 times, the balance 7 IPOs were oversubscribed between 1 and 3 times only," said Haldea.

Response to IPOs was further affected by poor listing performance, he said. Out of 13 IPOs which got listed (RVNL is yet to be listed), only 2 gave a return of over 10 percent (based on closing price on listing date).

HDFC Asset Management gave a stupendous return of 65 percent followed by RITES' return at 15 percent.

Companies in FY19 raised Rs 21,567 crore through offer for sale, the dilution of promoters' holding, was higher than Rs 17,431 crore last year. It was primarily accounted for by the government’s divestment of Rs 10,649 crore (49 percent of overall amount), Haldea said.

He said already-listed companies barely used the QIP route in financial year 2018-19 with just 13 companies mobilising Rs 10,489 crore, which was 83 percent lower than the Rs 62,520 crore raised in the previous year.

Outlook in FY20

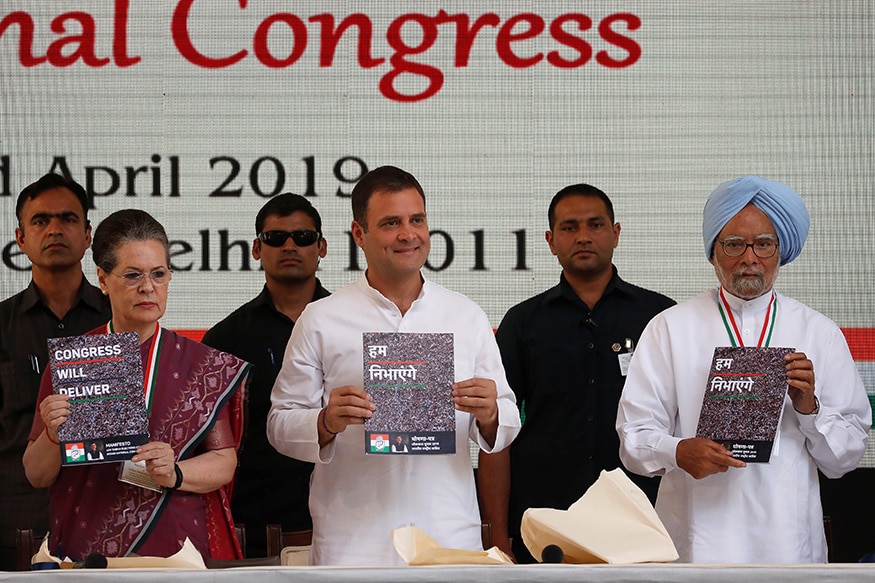

Pranav Haldea feels fund raising in 2019-20 is going to be significantly impacted by the outcome of the general elections.

According to him, if the elections throw up a fractured mandate, many more companies are likely to allow their approval to lapse. "On the other hand, if a stable government comes into power, a flurry of IPOs are likely to be launched."

64 companies have already received SEBI approval to raise over Rs 63,000 crore and another 8 companies await market regulator approval to garner about Rs 7,600 crore, as per primedatabase.

This pipeline can vanish quickly in case markets are volatile and a bearish sentiment is prevailing, he said, adding already in 2018-19, 9 companies which were looking to collectively raise Rs 6,495 crore let their SEBI approval lapse, despite approvals being valid for a period of one year and after having incurred a lot of time and costs.