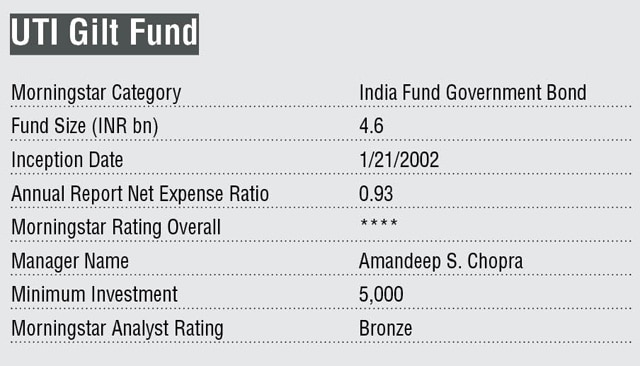

Amandeep Singh Chopra has been managing funds since 2006 and has been at the helm of this strategy since February 2012. He heads the fixed income desk at UTI and is supported by two other portfolio managers with an average experience of around 10 years. The analyst team includes an economist who tracks the domestic and the international macro factors.

Investment strategy

The gilt fund invests in a combination of government securities and State Development Loans (SDLs) with duration positioning based on the team's macro research and its views on the interest-rate directional movements. The team constantly tracks the markets to ensure it is invested in the most liquid papers that ensure tradability. Investments in SDLs are used as a tactical tool to generate additional alpha and can vary significantly. The fund tends to actively trade in gilts to generate alpha and can invest a significant portion of its portfolio in a single sovereign paper.

They track OMOs, trading volumes, broader market interest-rate directional views, and peer positioning actively. The average maturity can fluctuate significantly and is positioned in line with Amandeep Singh Chopra's view of the interest rate environment. He can take significantly large positions in single papers, and we have witnessed high levels of concentration in the past. The process includes a lot of risk-management procedures both on the fund and the business side, and these seem to be followed in a stringent manner. The strategy typically consists of fewer than 10 holdings, and the execution is largely influenced by the team's ability to take the right macro calls and position itself across yield curves.

Trailing returns

The fund has outperformed the benchmark over the one, three, five and 10-year periods.

Portfolio composition

Currently, over 55% of the fund's holding is invested in the 10-year government security, maturing in 2028.