Shabbir Kayyumi of Narnolia Financial Advisors said sustained trade above April's mid-point (11,690) will accelerate upmove to take the index higher towards life high placed around 11,760 levels.

The market maintained its uptrend on first day of financial year 2019-20, but closed off day's high due to selling pressure in last hour of trade on April 1.

The 30-share BSE Sensex hit an intraday record high of 39,115.57, before closing 198.96 points higher at 38,871.87.

Although Nifty spot index could not cross its life high (11,760), Nifty future contract hit a record high (11,822) as compared to the previous life high of 11,793 levels.

The Nifty50 rose 45.25 points to close at 11,669.15 and formed 'Gravestone Doji' kind of pattern on daily charts, suggesting selling pressure on the higher side, experts said.

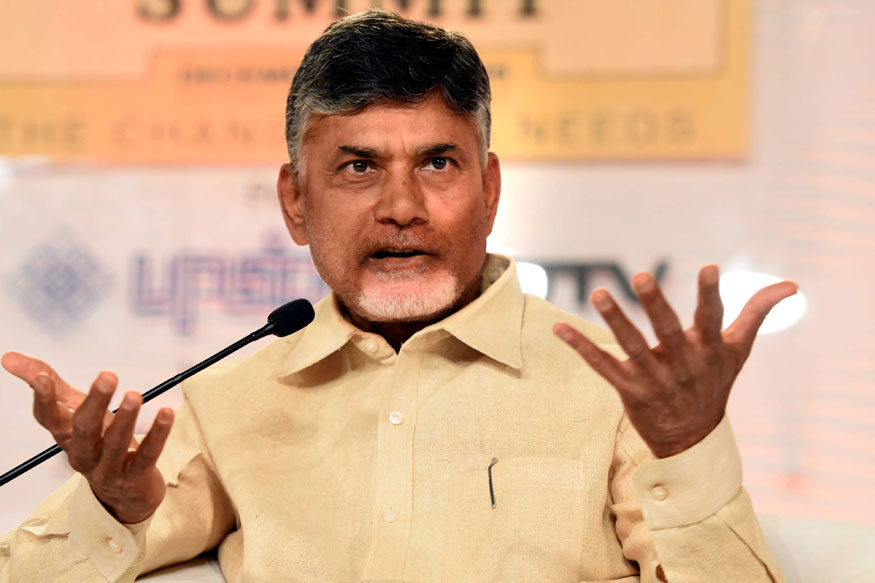

"Nevertheless looking at the uncertain indication of the pattern, breaching of high or low of doji will decide the further direction," Shabbir Kayyumi, Head of Technical Research, Narnolia Financial Advisors told Moneycontrol.

He said sustained trade above April's mid-point (11,690) will accelerate upmove to take the index higher towards life high placed around 11,760 levels.

Moreover, a decisive close below the strong support of 2-day low (11,570) or 5-day EMA (11,570) will push prices lower towards 11,540 levels, he added.

A Gravestone Doji is formed when open, low and the closing price are all at a similar level. The candle would have a long upper shadow that would depict a fall from the intraday high and no lower shadow.

The market breadth was positive throughout the day. More than two shares advanced for every share falling on the NSE. The Nifty Midcap index gained 0.4 percent and Smallcap index jumped 1 percent.

We have collated top 15 data points to help you spot profitable trades:

Key support and resistance level for Nifty

The Nifty closed at 11,669.15 on April 1. According to the Pivot charts, the key support level is placed at 11,629.96, followed by 11,590.73. If the index starts moving upward, key resistance levels to watch out are 11,723.26 and 11,777.33.

Nifty Bank

The Nifty Bank index closed at 30,326.50, down 100.30 points on April 1. The important Pivot level, which will act as crucial support for the index, is placed at 30,147.17, followed by 29,967.83. On the upside, key resistance levels are placed at 30,576.96, followed by 30,827.43.

Call options data

Maximum Call open interest (OI) of 21.43 lakh contracts was seen at the 12,000 strike price. This will act as a crucial resistance level for the April series.

This was followed by 11,800 strike price, which now holds 14.36 lakh contracts in open interest, and 12,200, which has accumulated 13.36 lakh contracts in open interest.

Significant Call writing was seen at the 12,200 strike price, which added 5.46 lakh contracts, followed by 11,800 strike that added 2.16 lakh contracts and 12,100 strike that added 1.81 lakh contracts.

Call unwinding was seen at the strike price of 11,600 that shed 2.34 lakh contracts, followed by 12,000 strike that shed 1.24 lakh contracts and 11,500 strike that shed 1.07 lakh contracts.

Put options data

Maximum Put open interest of 17.77 lakh contracts was seen at 11,500 strike price. This will act as a crucial support level for April series.

This was followed by 11,200 strike price, which now holds 14.39 lakh contracts in open interest, and 11,300 strike price, which has now accumulated 12.30 lakh contracts in open interest.

Put writing was seen at the strike price of 11,800, which added 2.44 lakh contracts, followed by 11,600 strike that added 1.31 lakh contracts and 11,400 strike that added 1.2 lakh contracts.

Put unwinding was seen at the strike price of 11,500, which shed 3.56 lakh contracts, followed by 12,000 strike which shed 2.22 lakh contracts.

FII & DII data

Foreign Institutional Investors (FIIs) bought shares worth Rs 898.79 crore while Domestic Institutional Investors (DIIs) sold Rs 1,032.81 crore worth of shares in the Indian equity market on April 1, as per provisional data available on the NSE.

Fund flow picture

Stocks with a high delivery percentage

High delivery percentage suggests investors are accepting the delivery of the stock, which means that investors are bullish on it.

57 Stocks saw a long buildup

62 stocks saw short covering

A decrease in open interest along with an increase in price mostly indicates short covering.

44 stocks saw a short build-up

An increase in open interest along with a decrease in price mostly indicates a build-up of short positions.

34 stocks saw long unwinding

Bulk deals on April 1

(For more bulk deals, click here)

Analyst or Board Meet/Briefings

Coromandel International: Board, on April 23, to consider the audited financial results of the company for the year ended March 2019.

Bajaj Consumer Care: Board to consider FY19 results & final dividend on April 9.

Infosys: Company to Announce fourth quarter and annual results on April 12.

MT Educare: Company's officiails will meet Avinash Gorakshkar, Head of Research, Joindre Capital Services on April 2.

Stocks in news

Karnataka Bank: Bank targets Rs 1,44,000 crore business turnover for FY20.

Banswara Syntex: CRISIL has extended its rating in respect to the total bank loan facilities of the company - long-term rating at BBB/Stable and Short-Term Rating at A3+.

Elantas Beck India: Board appointed Srikumar Ramakrishnan as President of the Company, M Srikumar Ramakrishnan will be appointed as successor of M Ravindra Kumar, Managing Director in due course.

Tata Power: Tata Power SED handed over indigenous combat management system to Indian Navy.

M&M: Company set up armoured vehicle unit in Jordan.

Taneja Aerospace & Aviation: Company has received upgraded credit rating of C for its long term bank facilities and A4 for short term bank facilities from the credit rating agency, CARE Ratings Limited.

NMDC: lnspite of suspension of Donimalai Mine operations for 5 months, no exports upto August 2018, highest rainfall in Bailadila Sector and poor off take in Karnataka in 01, NMDC has produced 32.44 MT and sales of 32.38 MT iron ore during FY-19.

Cyient: Delivery of order worth $5 million delayed due to delay in regulatory clearances. "We see decline in January-March revenues due to order delay and see marginal QoQ growth of 1-2 percent in services."

IDBI Bank: Bank seeks transaction advisor for divestment of stake in IDBI Asset Management.

Godrej Properties: Company sold over 2,900 homes with a booking value in excess of Rs 2,100 crore in Q4 FY19

Gateway Distriparks: Company completed acquisition of entire stake held by Blackstone in arm for Rs 850 crore on March 29.

PVR: Company opened 4 screens multiplex at The Celebration Bazaar, Khanna in Punjab and 5 screens multiplex at City Centre Mall, Guwahati in Assam.

Centrum Capital: Company has sold its entire equity holding in its wholly-owned subsidiary company, Centrum Defence System Limited and Centrum Infrastructure Advisory Limited.

Dr Lal PathLabs: Company unit approved acquisition of Bawankar Pathology.

Jet Airways: DGCA approves summer schedule of company till April 25 - CNBC-TV18.

Three stocks under ban period on NSE

Securities in ban period for the next day's trade under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

For April 2, Adani Power, IDBI Bank and Reliance Power are present in this list.