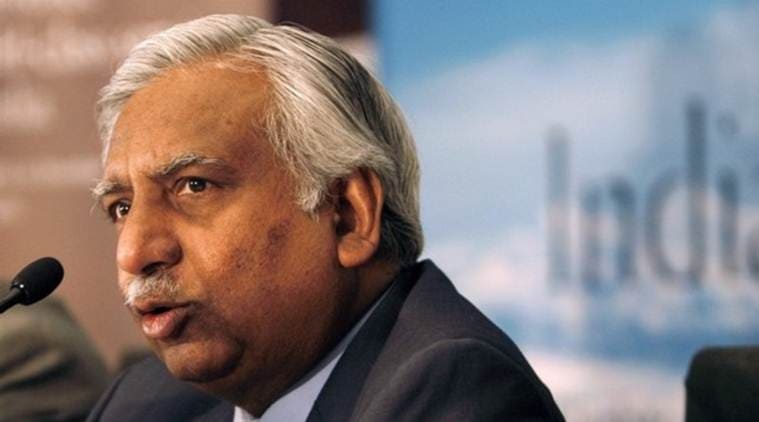

ENDING MONTHS of uncertainty, Naresh Goyal Monday quit as chairman of the board of Jet Airways, which he founded 25 years ago, enabling lenders to extend another lifeline of Rs 1,500 crore in funding support and initiate a bidding process to get a new investor to run the troubled airline.

According to the lenders’ bailout plan, Goyal and his wife Anita Goyal, and one nominee of Etihad Airways, Kevin Knight, will step down from the board. The airline said it will ring-fence its assets to secure existing facilities extended by lenders and the immediate funding support. The board also decided to constitute an interim management committee to manage and monitor the daily operations and cashflow of the company, which has been hit by the grounding of aircraft and cancellation of flights.

Explained | Naresh Goyal’s exit from Jet Airways’ board — why markets are celebrating

According to State Bank of India chairman Rajnish Kumar, lenders will initiate a bidding process for the sale of shares to a new investor or promoter. The process is expected to be completed in the June quarter. The board also approved the issue of 11.4 crore equity shares of the airline to lenders upon conversion of outstanding debt, which would be subject to relevant approvals and laws. Simultaneously, the stake of the Goyals will come down to less than half the current 50.1 per cent.

Jet Airways shares rallied on the stock exchange following the announcement of the bailout. The scrip closed 12.69 per cent higher at Rs 254.50 on the BSE Monday.

Lenders will nominate two directors on the board of the airline. The current plan of the lenders is to identify a suitable investor or promoter through a bidding process and sell their stake to the investor within two months. “The Rs 1,500 crore fresh funding is likely to be a 10-year instrument. We expect to complete the sale process in two months,” Kumar said.

Read | Sad day for Indian aviation, wake up call for policymakers: SpiceJet chief on Jet crisis

According to sources, bankers were forced to seek the resignation of the Goyals as Etihad Airways and other potential bidders refused to participate in the rescue plan if the two promoters continued on the board and called the shots. “There was no other option for banks but to infuse another Rs 1,500 crore into the airline. However, this amount may not be enough. Unless the banks find a new investor at the earliest, lenders may end up putting more funds into the airline,” said sources.

Exit clears way for investors

The resignation of Naresh Goyal could reignite interest in Jet Airways from investors, including the Tata Group. With banks seeking bids from investors, it has become clear that in Jet’s case, the banks are not interested in managing the airline — unlike the Kingfisher Airlines episode where lenders took control only to see the airline become defunct.

The airline has large debt repayments due over December 2018 to March 2019 (Rs 1,700 crore), FY2020 (Rs 2,444.5 crore) and FY2021 (Rs 2,167.9 crore). Besides, the airline will have to pay pending dues to various service providers and employees. Pilots have threatened to go on strike if they are not paid dues by March 31, 2019.

Bankers will decide their share of the Rs 1,500-crore fund infusion without any delay, said a bank official. SBI and Punjab National Bank are the largest lenders, with around Rs 2,000 crore debt stuck in the airline. Kumar had last week said it was in the interest of the lenders and consumers to keep Jet Airways flying and maintained that taking the airline to the bankruptcy court under Insolvency and Bankruptcy Code (IBC) is the last option. On Monday, the SBI chairman said lenders will make provision of 15 per cent towards NPA classification if the rescue plan is considered as a debt restructuring by the regulators.

Passengers have faced the brunt of flight cancellations by Jet Airways, with many complaining of not getting refunds and several getting stranded at various airports as connection flights were cancelled. Government sources said the Directorate General of Civil Aviation (DGCA) has sought details from the airline regarding its aircraft utilisation and slot requirements, after which the regulator would clear Jet’s schedule for April.

Experts said the bailout is only halfway through as much will depend on identifying a buyer who has the capability and resources to turn around the airline. “The Jet Airways debt saga has entered a decisive phase. The saga is moving towards the resolution plan. Naresh Goyal stepping down, ceding control and diluting his 51 per cent stake will help the consortium of banks led by SBI gain the controlling stake. As the equity partners have failed to come to a resolution, banks have no other option but to pick up the major stake and find a new promoter for the debt-laden airline. However, it remains to be seen how successful banks are in managing an airline, going beyond their core competence,” said Rajesh Narain Gupta, managing partner, Sng & Partners.

However, bankers said the interim financing of Rs 1,500 crore will be adequate for a two-month period. The airline started defaulting on its repayment commitments in December 2018. Though there were attempts to rope in Etihad and others for a bailout, the plan didn’t work out as the Goyals refused to give up management control, prompting lenders ask both to resign from the board last week.

The board of directors of the airline now include Rajshree Pathy, whole-time director Gaurang Shetty, Etihad nominee Robin Kamark, former civil servants Ashok Chawla and Nasim Zaidi, and former banker Sharad Sharma.