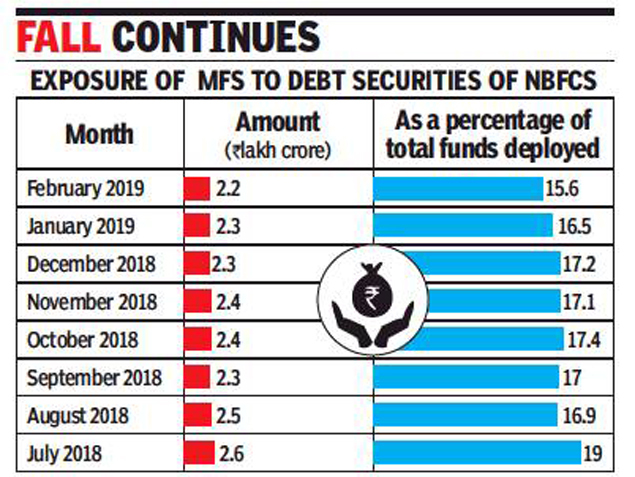

Mutual fund exposure to NBFCs falls by Rs 45,386 crore in 7 months

M Allirajan | TNN | Updated: Mar 22, 2019, 13:13 ISTHighlights

- The overall exposure of debt MFs to NBFCs stood at Rs 2.2 lakh crore in February, a drop of Rs 45,386 crore since July 2018 when the liquidity stress first emerged

- The share of NBFCs in allocations by debt MFs has reduced to 15.6% in February from 19% in July last year

(Representative image)

(Representative image)COIMBATORE: The liquidity crisis in the NBFC (non-banking finance companies) space triggered by the default of infrastructure lending major IL&FS last September is continuing to have an impact on mutual fund (MF) deployments in the sector.

The overall exposure of debt MFs to NBFCs stood at Rs 2.2 lakh crore in February, a drop of Rs 45,386 crore since July 2018 when the liquidity stress first emerged. The share of NBFCs in allocations by debt MFs has reduced to 15.6% in February from 19% in July last year.

The percentage share of funds deployed by MFs in commercial paper (CPs) of NBFCs touched 7.7% in February, the lowest since December 2017. MF allocations to CPs of NBFCs have been falling in recent months — from 11.3% in July or Rs 1.57 lakh crore in July last year to 8.5% or Rs 1.14 lakh crore in December.

After the liquidity crisis, MFs withdrew more than a third of their investments from CPs. As of February, debt MFs held Rs 1.08 lakh crore in CPs of NBFCs. About 29% of the total funds deployed by debt MFs in February were in CPs. Debt MFs invested Rs 4.05 lakh crore in CPs on an overall basis at the end of February compared to Rs 3.06 lakh crore in March last year.

The share of corporate debt paper, which includes including floating rate bonds, non- convertible debentures among others, fell to 31% in February from 38% in March last year. The total exposure of debt MFs to this instrument stood at Rs 4.34 lakh crore at the end of February.

Incidentally, debt MF allocations to G-Secs (government securities) have almost halved since March 2018. The share of certificates of deposit (CDs) and PSU (public sector unit) bonds/ debt dropped marginally in February compared to March last year.

Investment in other asset types almost doubled — from 8% in March last year to 15% in February. This segment includes treasury bills, other money market investments, equity-linked debentures/notes, asset backed securities and bank fixed deposits (FD) among others.

Deployment of funds in corporate debt paper of NBFCs, however, showed a different trend. Though the exposure of debt MFs to NBFCs rose till October last year, it fell again in February to reach Rs 1.12 lakh crore during the month.

Post the IL&FS shock, MF exposure to NBFC debt fell by about 10% in three months from the peak levels seen in July 2018. Their exposure to NBFC CPs fell by nearly 19% during the timeframe.

A bulk of the total NBFC debt owned by MFs is in the form of CPs while the remaining is towards corporate debt (non-convertible debenture, bonds etc.)

The liquidity pressure faced by NBFCs between September and November last year pushed up the cost of borrowings for CPs. The yields however moderated from 8.51% in November 2018 to 7.76% in January.

The overall exposure of debt MFs to NBFCs stood at Rs 2.2 lakh crore in February, a drop of Rs 45,386 crore since July 2018 when the liquidity stress first emerged. The share of NBFCs in allocations by debt MFs has reduced to 15.6% in February from 19% in July last year.

The percentage share of funds deployed by MFs in commercial paper (CPs) of NBFCs touched 7.7% in February, the lowest since December 2017. MF allocations to CPs of NBFCs have been falling in recent months — from 11.3% in July or Rs 1.57 lakh crore in July last year to 8.5% or Rs 1.14 lakh crore in December.

After the liquidity crisis, MFs withdrew more than a third of their investments from CPs. As of February, debt MFs held Rs 1.08 lakh crore in CPs of NBFCs. About 29% of the total funds deployed by debt MFs in February were in CPs. Debt MFs invested Rs 4.05 lakh crore in CPs on an overall basis at the end of February compared to Rs 3.06 lakh crore in March last year.

The share of corporate debt paper, which includes including floating rate bonds, non- convertible debentures among others, fell to 31% in February from 38% in March last year. The total exposure of debt MFs to this instrument stood at Rs 4.34 lakh crore at the end of February.

Incidentally, debt MF allocations to G-Secs (government securities) have almost halved since March 2018. The share of certificates of deposit (CDs) and PSU (public sector unit) bonds/ debt dropped marginally in February compared to March last year.

Investment in other asset types almost doubled — from 8% in March last year to 15% in February. This segment includes treasury bills, other money market investments, equity-linked debentures/notes, asset backed securities and bank fixed deposits (FD) among others.

Deployment of funds in corporate debt paper of NBFCs, however, showed a different trend. Though the exposure of debt MFs to NBFCs rose till October last year, it fell again in February to reach Rs 1.12 lakh crore during the month.

Post the IL&FS shock, MF exposure to NBFC debt fell by about 10% in three months from the peak levels seen in July 2018. Their exposure to NBFC CPs fell by nearly 19% during the timeframe.

A bulk of the total NBFC debt owned by MFs is in the form of CPs while the remaining is towards corporate debt (non-convertible debenture, bonds etc.)

The liquidity pressure faced by NBFCs between September and November last year pushed up the cost of borrowings for CPs. The yields however moderated from 8.51% in November 2018 to 7.76% in January.

Download The Times of India News App for Latest Business News.

All Comments ()+^ Back to Top

Refrain from posting comments that are obscene, defamatory or inflammatory, and do not indulge in personal attacks, name calling or inciting hatred against any community. Help us delete comments that do not follow these guidelines by marking them offensive. Let's work together to keep the conversation civil.

HIDE