L&T unveils near Rs 11,000 crore unsolicited bid for Mindtree

Reeba Zachariah | TNN | Updated: Mar 19, 2019, 11:46 ISTHighlights

- L&T has also placed an order with its broker for an additional 15% of Mindtree at the same price of Rs 980 apiece, signalling that it is in control of the transaction

- If L&T’s move succeeds, it will acquire 66.32% of Mindtree for Rs 10,669 crore

(Representative image)

MUMBAI: In an unsolicited takeover attempt that India Inc has not seen in recent times, the $18 billion diversified conglomerate Larsen & Toubro (L&T) has unveiled a Rs 10,669 crore bid for Mindtree as part of its strategy to “focus on services and assetlight businesses to drive profitable future growth”.

On Monday, the S N Subrahmanyan-led L&T signed an agreement to acquire Mindtree’s largest shareholder V G Siddhartha’s 20.32% for Rs 3,269 crore, or Rs 980 apiece. L&T has also placed an order with its broker for an additional 15% of Mindtree at the same price of Rs 980 apiece, signalling that it is in control of the transaction. Besides, it is making an open offer for a further 31%, in line with the takeover regulations.

If L&T’s move succeeds, it will acquire 66.32% of Mindtree for Rs 10,669 crore. In a statement, L&T said that it has sufficient financial flexibility to fund the entire transaction through its existing financial resources. After a successful acquisition, L&T intends to maintain Mindtree as an independent listed entity.

L&T’s statement added that Mindtree will benefit from access to a larger client base and wider product offerings under a common parentage, giving higher returns to shareholders of Mindtree.

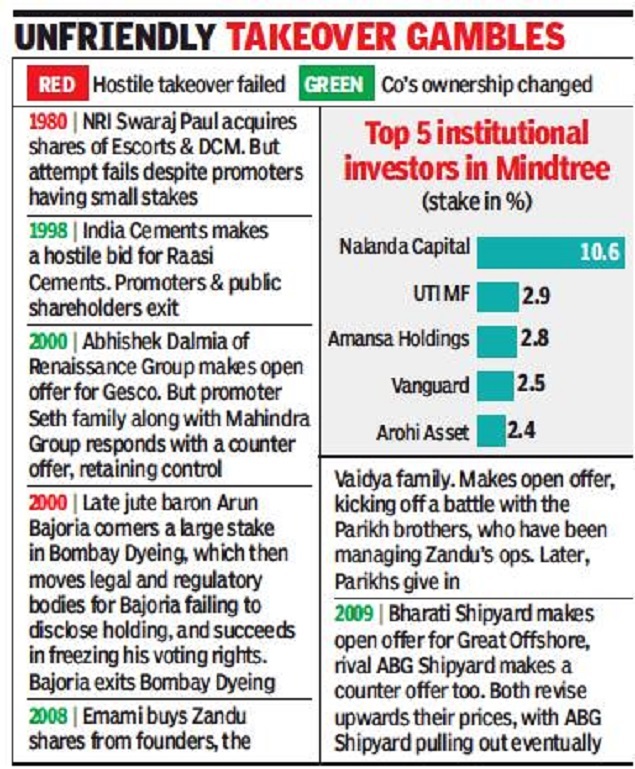

However, the promoters of Mindtree, who together own 13.3%, are resisting the L&T bid. To fend off L&T, the promoters would need a white knight that would match the engineering major’s financial muscle. Interestingly, Siddhartha, who also owns the Cafe Coffee Day chain, has been a white knight for Mindtree for almost two decades.

If the Mindtree promoters decide to make a counter bid, they will have to offer a price higher than Rs 980. The Rs 980 price values Mindtree at Rs 16,088 crore. On Monday, the shares of Mindtree closed 1.7% higher at Rs 963 on the BSE. Mindtree’s management has already reached out to key non-promoter shareholders to fend off L&T’s takeover bid.

“The acquisition will help propel L&T’s technology portfolio into the top tier of Indian IT companies,” said Subrahmanyan. In the past, L&T had looked at several IT companies, including Satyam, Mphasis and Hexaware, but none of these translated into any successful M&A deals.

L&T’s announcement comes a couple of days ahead of the Mindtree board’s meeting scheduled for Wednesday, when it will consider a share buyback proposal. Rules allow a company to repurchase its own shares up to 10% of its reserves. But since L&T has already announced its acquisition move, rules now don’t allow Mindtree to use the 10% of its reserves for a share buyback programme.

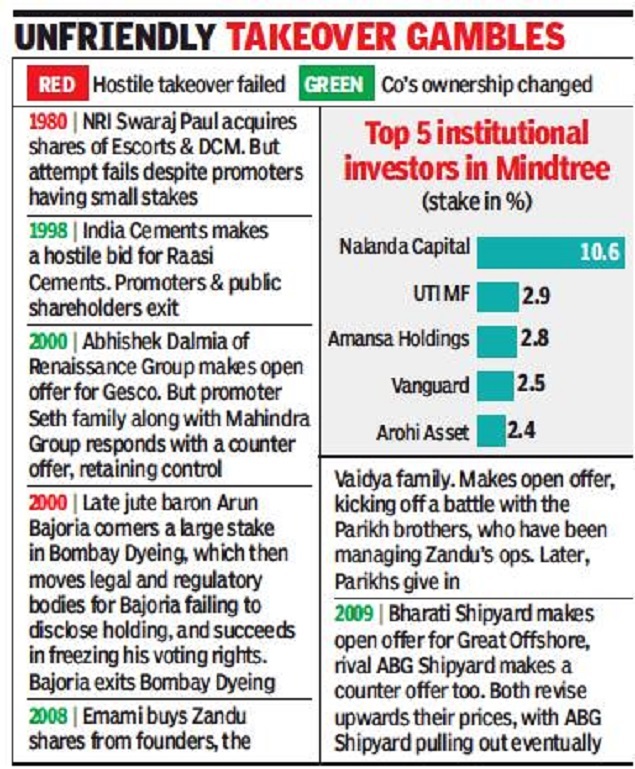

The L&T-Mindtree deal, where KPMG Corporate Finance is lead transaction adviser, is subject to regulatory and other customary approvals. Interestingly, L&T itself has been a hostile takeover target in the past. And it has successfully managed to thwart overtures by the Ambanis and Birlas.

On Monday, the S N Subrahmanyan-led L&T signed an agreement to acquire Mindtree’s largest shareholder V G Siddhartha’s 20.32% for Rs 3,269 crore, or Rs 980 apiece. L&T has also placed an order with its broker for an additional 15% of Mindtree at the same price of Rs 980 apiece, signalling that it is in control of the transaction. Besides, it is making an open offer for a further 31%, in line with the takeover regulations.

If L&T’s move succeeds, it will acquire 66.32% of Mindtree for Rs 10,669 crore. In a statement, L&T said that it has sufficient financial flexibility to fund the entire transaction through its existing financial resources. After a successful acquisition, L&T intends to maintain Mindtree as an independent listed entity.

L&T’s statement added that Mindtree will benefit from access to a larger client base and wider product offerings under a common parentage, giving higher returns to shareholders of Mindtree.

However, the promoters of Mindtree, who together own 13.3%, are resisting the L&T bid. To fend off L&T, the promoters would need a white knight that would match the engineering major’s financial muscle. Interestingly, Siddhartha, who also owns the Cafe Coffee Day chain, has been a white knight for Mindtree for almost two decades.

If the Mindtree promoters decide to make a counter bid, they will have to offer a price higher than Rs 980. The Rs 980 price values Mindtree at Rs 16,088 crore. On Monday, the shares of Mindtree closed 1.7% higher at Rs 963 on the BSE. Mindtree’s management has already reached out to key non-promoter shareholders to fend off L&T’s takeover bid.

“The acquisition will help propel L&T’s technology portfolio into the top tier of Indian IT companies,” said Subrahmanyan. In the past, L&T had looked at several IT companies, including Satyam, Mphasis and Hexaware, but none of these translated into any successful M&A deals.

L&T’s announcement comes a couple of days ahead of the Mindtree board’s meeting scheduled for Wednesday, when it will consider a share buyback proposal. Rules allow a company to repurchase its own shares up to 10% of its reserves. But since L&T has already announced its acquisition move, rules now don’t allow Mindtree to use the 10% of its reserves for a share buyback programme.

The L&T-Mindtree deal, where KPMG Corporate Finance is lead transaction adviser, is subject to regulatory and other customary approvals. Interestingly, L&T itself has been a hostile takeover target in the past. And it has successfully managed to thwart overtures by the Ambanis and Birlas.

Download The Times of India News App for Latest Business News.

All Comments ()+^ Back to Top

Refrain from posting comments that are obscene, defamatory or inflammatory, and do not indulge in personal attacks, name calling or inciting hatred against any community. Help us delete comments that do not follow these guidelines by marking them offensive. Let's work together to keep the conversation civil.

HIDE