"We are seeing a rotation from developed markets to emerging market funds," said EPFR Global's Cameron Brandt.

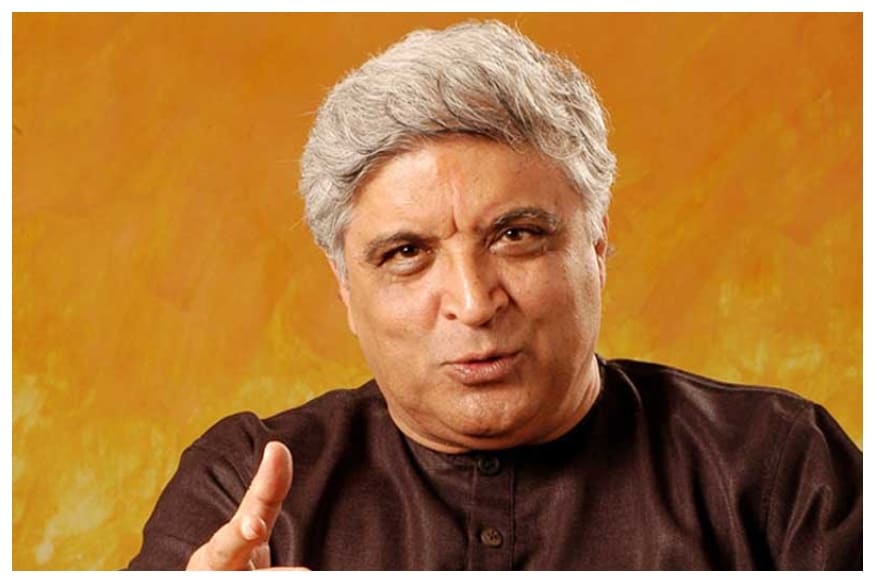

Foreign investors are returning to Indian stock markets amid hopes that the incumbent NDA government will win the second term. Cameron Brandt, director of research at EPFR Global, spoke to CNBC-TV18 about the overseas inflows into the Indian stocks and trends in the global markets.

"I am seeing enough come into both the mutual funds and the exchange-traded funds (ETFs) to make me think that it is more driven by fundamentals," said Brandt.

According to Brandt, "We are seeing a rotation from developed markets to emerging market funds."

With regards to Prime Minister Narendra Modi's chances for re-election this year, Brandt said, "The Modi administration off and on has been seen as a reformist one so hopes are building again that he will have a mandate and there will be another surge of reforms post-election."

Talking about inflows into India, Brandt said, "It is certainly coming in shaded to the ETFs and that is money that can leave as fast as it came in."

"The backdrop for emerging markets looks more benign than it did 4 months ago," he added.

Source: CNBC-TV18Not sure which mutual funds to buy? Download moneycontrol transact app to get personalised investment recommendations.