Homebuyers demand higher delay payment amount paid by NBCC and shorter timelines for completion of units.

State-owned NBCC has assured Jaypee homebuyers that it would deliver the projects within three years along with amenities promised.

NBCC will also share a tower-wise completion plan and ensure that there is no escalation in unit prices.

NBCC has submitted a resolution plan to take over the realty firm and complete the stalled projects that has left 32,000 homebuyers in the lurch. Mumbai-based Suraksha Group has also made an offer of about Rs 20 crore as upfront payment and land worth Rs 5,000 crore. It has promised to complete pending projects in three years.

In October 2018, Insolvency Resolution Professional Anuj Jain started a fresh initiative to revive Jaypee Infratech on the NCLT direction after lenders rejected the over Rs 7,000-crore bid of Suraksha Group.

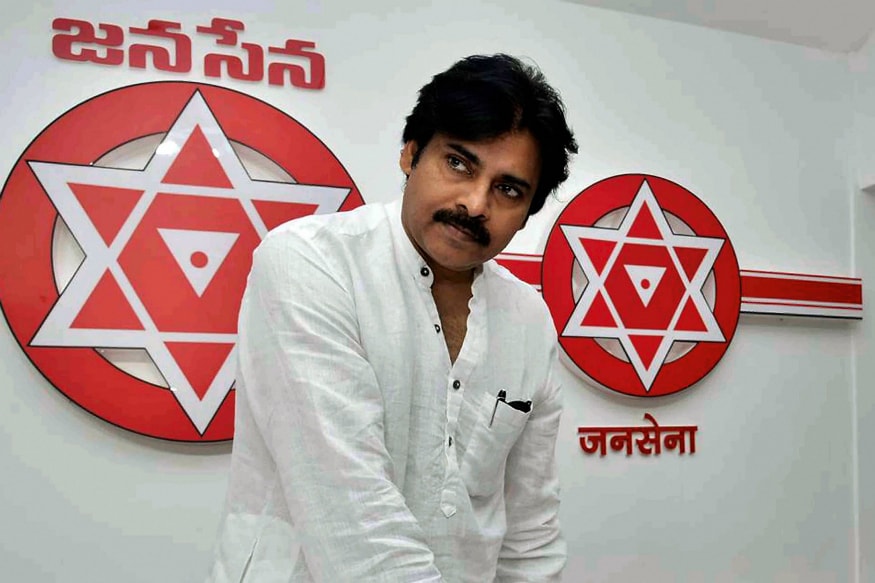

At a meeting convened by NBCC in the Capital that was attended by over 300 homebuyers on March 11, CMD AK Mittal assured buyers that they would get their house "within three years",

"Perhaps this is a conservative time and we will try it reduce as far as possible. We took a tour of the projects last week and realised that some of them can be completed sooner. We will be providing a detailed schedule. The more the delay, more overheads we will have to incur. All amenities as planned and committed earlier would be provided," he said.

As for the demand by homebuyers for a forensic audit of the company right from inception, he said that NBCC will start from a clean slate and will not carry any baggage from the old company.

Homebuyers' representative Kuldeep Verma brought to the notice of senior officials of NBCC that 97 percent of the homebuyers who had voted in the 6th CoC meeting have voted unanimously in favour of the resolution for conduct forensic audit of Jaypee since inception of the company until 2014, but 40 percent of the banks voted against the resolution. Hence, the mandatory 51 percent of the votes could not be achieved and the resolution failed.

Another concern raised by homebuyers was with regard to swapping of their units. Mittal said that "it will be done only after the consent of home buyers is obtained, if it happens it would mostly be within the same project."

On the issue of delay in compensation, Mittal said that his company has promised to honour 25 percent of the contracted delay compensation (Rs 5 per sq ft). “Now, in the revised bid, it will definitely not be lower than 25 percent. I will not comment on whether we will increase or not, please wait for our revised bid,” he said.

Homebuyers Moneycontrol spoke to hoped that all these assurances would be captured in the revised bid.

Verma is expected to collate all suggestions by homebuyers and send them to NBCC. The date for the next Committee of Creditors meeting (COC) has not been announced yet, sources said, adding NBCC and Suraksha may submit their revised bids in the next five days.

This may be followed by negotiations by the COC with both the bidders, suggestions being incorporated and submission of the final bids. The COC would later discuss both the bids and approve one of them. The final bid will then be put to vote. A minimum of 70 percent votes are required to pass the resolution, sources said.

It is noteworthy to mention that in the last COC meeting, banks had voted against the resolution and homebuyers had voted in favour of the resolution, resulting in its failure. Homebuyers and bankers have now to break this log jam to ensure that the final resolution goes through.

Homebuyers had raised several concerns with regard to the resolution plan submitted by NBCC last month. NBCC has proposed incorporation of an NBCC SPV for the purpose of acquiring a majority stake in the corporate debtor. It has proposed pumping in an upfront amount of Rs 500 crore (part equity and part debt) within 90 days of the approval date to acquire the embattled company.

It has offered 1,400 acre land worth Rs 3,000 crore as well as Yamuna Expressway highway to lenders. NBCC has suggested that banks should raise about Rs 2,000 crore against the expressway and provide half of the amount (Rs 1,000 crore) to the PSU, which will utilise this fund as an upfront payment. NBCC will also fund the gap of about Rs 1,500 crore between estimated construction cost and receivables from customers.

What this means is that the lenders effectively receive Rs 6,000 crore worth of the expressway (from the Expressway SPV) and Rs 3,000 crore for the land bank (from the Land Bank SPV). A total of about Rs 9,000 crore.

In its bid, NBCC had promised to deliver flats to homebuyers in four to five years from the transfer date, subject to the availability of the cash flows from the respective projects. The delivery of plots will begin in 2020 and most of the villas and apartments are expected to be delivered by 2021 until 2024.

NBCC has proposed that the delay penalty (accrued on account of delay in giving possession of the flats) shall be settled at 25 percent of the amount due prior to the commencement of the CIRP process which started from August 9, 2017. But no penalty shall be paid from the commencement of the process till expiry of the additional moratorium of six months from the delivery dates. Also, if units are not handed over even after six months from the revised delivery dates, the delay penalty at the rate of Rs 5 per sq ft will apply, says the proposal.

NBCC had also said in its proposal that NBCC SPV and the corporate debtor has the right to change the units of the respective homebuyers in Noida and Mirzapur based on future development plans, 'though the resolution applicant will try to ensure that the homebuyer from the respective project is allocated project in the same or the nearby project', sources say.

It had also submitted that the resolution plan is on a 'balance cost to complete basis as provided by the Interim Resolution Professional in the information memorandum, Any escalation thereto shall be borne by the respective homebuyers.'

At the meeting, homebuyers raised several concerns.

"Super area should not be increased and cost should not increase. Amenities should be provided as per plan. Even after NBCC takes over the company they should assure homebuyers that they would facilitate a forensic audit so that Rs 13000 crore collected from them is accounted for. Nonetheless, it is reassuring to know that a fair delay compensation may be provided and there would not be movement of flats," said Prem Khamesra.

Unfair benefits to the secured financial creditors, say buyers

It is our understanding that NBCC's endeavour in submitting the Bid is to achieve an equitable resolution of the issues currently plaguing the stakeholders in Jaypee Infratech Limited. However, on reviewing the Bid, it is our belief that the benefits that are likely to accrue to the secured financial creditors (banks) are far greater as compared to the homebuyers and the issues and concerns that have been faced by the homebuyers for years, homebuyers said.

While banks appear to have obtained a significant benefit in the treatment of their financial debts: Upfront payment of Rs 1000 crore upon the Expressway SPV receiving an indebtedness to settle a portion of the Secured Financial Creditor’s debt upon the novation / transfer of the Corporate Debtor’s debt to the Expressway SPV. Transfer of 100 percent shareholding in the Land Bank SPV (to settle a debt of INR 3001 crores). Transfer of 100 percent shareholding in the Expressway SPV (to settle a debt of Rs 5782 crore), homebuyers said.

Thus, the entire admitted financial debt of the secured financial creditors is being fulfilled by NBCC. However, on the other hand, not only are the homebuyers expected to receive deliveries of their respective units no earlier than October 2020 (extending till March 2024), they will have significantly reduced compensation payable to them for the delays caused in respect of the prior allotment, miniscule delays if the revised allotments are not made on time and that too, with a moratorium period, complete liability towards any cost escalations towards the construction, etc.

Homebuyers said that the Admitted Financial Debt of the homebuyers aggregates to Rs 13,839 crore while that of the Secured Financial Creditors only amounts to Rs 9782 crores.

"Thus, even from an economic perspective, NBCC is required to ensure that the interests and requests of the homebuyers are clearly and adequately addressed and fulfilled. However, the present language of the Bid does not provide the adequate comfort and support that the homebuyers are seeking and expecting of a large and respectful public sector undertaking such as NBCC," said homebuyers.

Delay payments for failure to abide by delivery scheduleHomebuyers would consider a higher delay payment amount paid by NBCC, and shorter timelines for release of the delay payments, homebuyers said.

The period for commencement of delivery of units is significantly longer than what the homebuyers anticipated. The homebuyers will continue to incur costs till the asset is delivered that would allow them to recoup some losses by monetising such assets. NBCC should endeavour to provide the delivery of the flats at a shorter time frame than what is provided under the Bid. The period computation of the delay penalty (Rs 5 per sq ft) must be clarified as to whether such payment is accrued on a daily basis or a monthly basis or an absolute amount.

“Any cost escalation must be borne by NBCC. It would not be equitable to transfer this burden onto the homebuyers who are already managing significant financial burdens of their own. NBCC must conduct its own detailed diligence exercise to identify the approximate costs to complete the construction. It must provide the findings and conclusion of such diligence while identifying the proposed costs for construction in the Bid. NBCC must make a suitable provision in the Bid stating that no cost-escalations shall be recoverable from the homebuyers under any circumstances,” homebuyers said.

No deviation in super area. NBCC must provide a specific undertaking that there would be no illegal increase in the super area for any of the units / projects under any circumstance, homebuyers said.

No change in flats or projects and no deviation from the original plansIn clause 3 of the Bid under the heading “Houses under Construction” it is specified that NBCC would have a right to change the unit(s) of the HB in Noida based on “future development plans”. This is reiterated in Step 10 (Point 6) under Schedule 2 of the Bid, wherein the Bid notes that the unit(s) allotted to the homebuyers in Noida and Mirzapur may be changed and that NBCC will “try and ensure that the home buyer… is allocated a flat (sic) in the same or nearby project”. Thus, NBCC seeks to obtain a right to shift the homebuyers from not merely the unit but even the project.

“While the homebuyers are cognizant of logistical issues in completing all projects, they are not agreeable to change in the projects. The homebuyers may only be amenable to a change in the unit(s) or even a different tower, subject to the unit(s) being similar to the original unit(s). However, the homebuyers will not accept a change in the project,” says Ranjeet Jha, a Jaypee homebuyer.

Some homebuyers argued that since they have paid a premium for preferential location charges (PLC) for their units, they should not be ‘moved around’.

No dilution of promised amenitiesIn the event NBCC propose to utilise additional FAR, it must ensure that such utilization shall take place subject to no dilution or reduction in space, area or features, for any amenities such as the green space, parks, open areas, club houses, homebuyers said.

vandana.ramnani@nw18.com