Shabbir Kayyumi of Narnolia Financial Advisors said looking at overbought levels of the majority of oscillators, the possibility of small retracement cannot be ruled out which can fill the bullish gap placed around 10,994-10,998.

After a three-day winning streak, the market took a breather and settled on a flat note on March 7, driven by select banking and financials, infra and FMCG stocks.

The 30-share BSE Sensex was up 89.32 points at 36,725.42 while the Nifty 50 gained 5.20 points at 11,058.20 and formed a small bearish candle resembling a 'Hanging Man' kind of formation on the daily charts.

Most analysts believe that the market seems to be in an overbought zone after the recent rally along with optimism in broader indices, which indicated that consolidation could be seen further.

"A small body negative candle has been formed at highs, with long lower shadow. This is indicating nervousness at the highs," Nagaraj Shetti - Technical Analyst, HDFC Securities told Moneycontrol.

He said the formation of long lower shadows in the last two sessions however indicating an emergence of buying interest at lows, but the Nifty is currently facing stiff resistance at 11,100 mark. "Further consolidation or higher level weakness is likely for the next session," he added.

Shabbir Kayyumi, Head of Technical Research at Narnolia Financial Advisors also said looking at overbought levels of the majority of oscillators, the possibility of small retracement cannot be ruled out which can fill the bullish gap placed around 10,994-10,998.

The broader markets ended marginally lower amid balanced breadth while the sectoral trend was mixed.

We have collated top 15 data points to help you spot profitable trades:

Key support and resistance level for Nifty

The Nifty closed at 11,058.20 on March 7. According to Pivot charts, the key support level is placed at 11,027.2, followed by 10,996.2. If the index starts moving upward, key resistance levels to watch out are 11,089.1 and 11,120.

Nifty Bank

The Nifty Bank index closed at 27,764.60, up 138.95 points on March 7. The important Pivot level, which will act as crucial support for the index, is placed at 27,611.23, followed by 27,457.87. On the upside, key resistance levels are placed at 27,866.73, followed by 27,968.87.

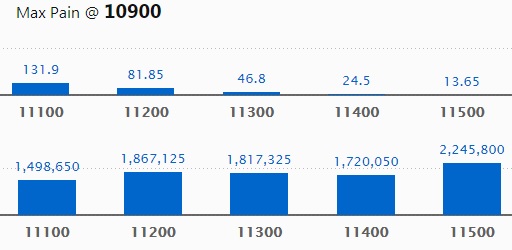

Call options data

Maximum Call open interest (OI) of 22.45 lakh contracts was seen at the 11,500 strike price. This will act as a crucial resistance level for the March series.

This was followed by the 11,200 strike price, which now holds 18.67 lakh contracts in open interest, and 11,300, which has accumulated 18.17 lakh contracts in open interest.

Significant Call writing was seen at the strike price of 11,200, which added 3.40 lakh contracts, followed by 11,300 strike, which added 3.15 lakh contracts and 11,100 strike that added 1.95 lakh contracts.

Call unwinding was seen at the strike price of 10,900 that shed 1.01 lakh contracts, followed by 10,800 strike that shed 0.30 lakh contracts.

Put options data

Maximum Put open interest of 33.88 lakh contracts was seen at the 11,000 strike price. This will act as a crucial support level for the March series.

This was followed by the 10,800 strike price, which now holds 26.70 lakh contracts in open interest, and the 10,700 strike price, which has now accumulated 23.67 lakh contracts in open interest.

Put writing was seen at the strike price of 11,000, which added 4.66 lakh contracts, followed by 10,800 strike that added 3.72 lakh contracts and 10,900 strike that added 2.91 lakh contracts.

There was hardly any Put unwinding seen.

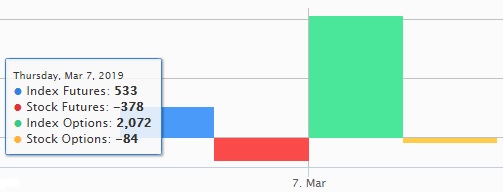

FII & DII data

Foreign Institutional Investors (FIIs) bought shares worth Rs 1,137.85 crore while Domestic Institutional Investors sold Rs 925.46 crore worth of shares in the Indian equity market on March 7, as per provisional data available on the NSE.

Fund flow picture

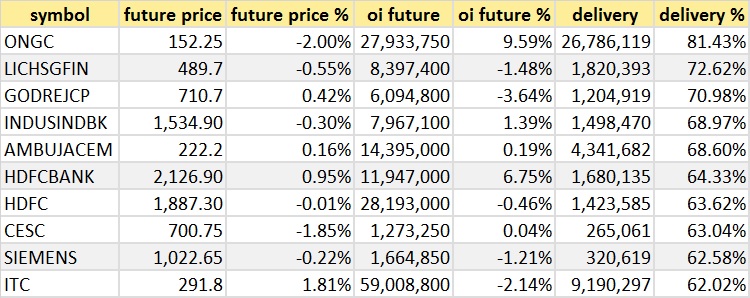

Stocks with a high delivery percentage

High delivery percentage suggests investors are accepting delivery of the stock, which means that investors are bullish on it.

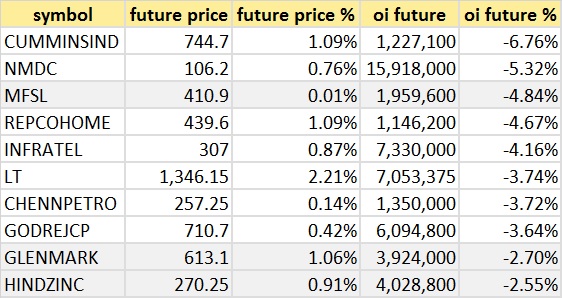

46 stocks saw a long buildup

25 stocks saw short covering

A decrease in open interest along with an increase in price mostly indicates short covering.

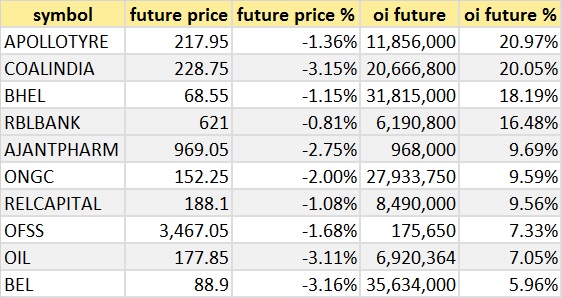

64 stocks saw a short build-up

An increase in open interest along with a decrease in price mostly indicates a build-up of short positions.

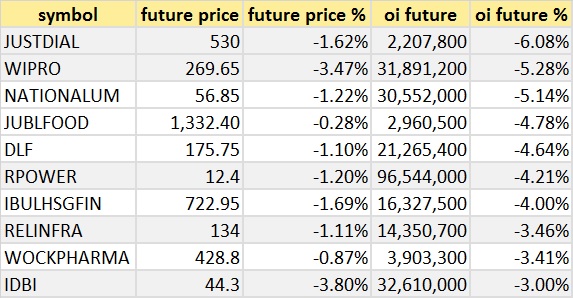

63 stocks saw long unwinding

Bulk Deals on March 07

NSE

Manaksia: Vajra Machineries Private Limited bought 3,43,024 shares of the company at Rs 36.7 per share.

Nagarjuna Oil Refinery: Alpha Leon Enterprises LLP sold 31,08,087 shares of the company and Multiplier S and S Adv Pvt Ltd sold 24,00,004 shares at 45 paise per share.

NIIT: Canara Robeco Mutual Fund A/C Canara Robeco Income Saer Fun bought 12 lakh shares of the company at Rs 92.8 per share.

Vijaya Bank: Morgan Stanley (France) SAS bought 81,29,150 shares of the company at Rs 45.97 per share.

Vikas EcoTech: Margi Jigneshbhai Shah sold 22,75,000 shares of the company at Rs 11 per share.

BSE

Sanghvi Movers: Alpna Enterprises bought 3 lakh shares of the company at Rs 98 per share.

(For more bulk deals, click here)

Analyst or Board Meet/Briefings

Bank of Maharashtra: Meeting of Compensation Committee of the Bank will be held on March 13 at Pune to consider Employee Share Purchase Scheme (BOM - ESPS) for issue of upto 10 crore new equity shares to the eligible employees of the bank and its related matters.

Manappuram Finance: Company's officials will attend Prabhudas Lilladhar Conference on March 8.

SRG Housing Finance: Analyst / Investor Meeting to be held on March 8.

ION Exchange India: Management will be attending the Valorem Analyst Conference 2019, organised by Valorem Advisors to be held on March 12.

Tata Steel: Company's officials will meet fund and broking houses on March 11 and 12.

MAS Financial Services: Board meeting is scheduled on March 14 to consider appointment and re-appointment of board members.

Stocks in news

Bank of India: Compensation cum Allotment Committee (CCAC) of the bank approved allotment of 6,25,52,188 equity shares to eligible employees under Bank of India — Employee Share Purchase Scheme (BOIESPS). Accordingly, the bank has raised a fresh capital of Rs 660.80 crore through B01-ESPS scheme.

Reliance Infrastructure: BC Patnaik, representative of Life Insurance Corporation of India (LIC) has been approved by the board for appointment as a Non Executive Director in place of Shiv Prabhat.

Jet Airways: An additional three aircraft have been grounded due to non-payment of amounts outstanding to lessors under their respective lease agreements.

KNR Constructions: Company bagged Hybrid Annuity Project (HAM) with bid project cost of Rs 920 and 1st year operation & maintenance cost of Rs 3 crore from National Highways Authority of India (NHAI) in Tamil Nadu.

Satin Creditcare Network: Promoter Taco Consultants Private Limited released a pledge on 1.6 lakh shares (representing 0.32 percent of paid-up equity) and Parinita Investments Private Limited also released a pledge on 1.6 lakh shares of the company.

Apex Frozen Foods: CRISIL reaffirmed its long term rating on bank loan facilities of Rs 114.77 crore at A-/Stable.

Indo Us Bio-Tech: Board approved issue of bonus shares.

LT Foods: SBI Mutual Fund cut stake in company by 1.09 percent to 2.53 percent.

Avadh Sugar & Energy: Company has carried out redemption of 2,43,50,000 8.50% unlisted non-convertible cumulative redeemable preference shares of Rs 10 each.

Piramal Enterprises: CARE assigned credit rating for short term non-convertible debentures.

Sadbhav Infrastructure Project: Sadbhav Kim Expressway Private Limited (SKEPL), a wholly owned subsidiary of the company has submitted draft financing documents to NHAI in relation to financial closure.

Reliance Industries: RIL enters into MOU with NMSEZ - First Integrated Industrial Area to implement fourth industrial revolution.

The Investment Trust of India: Board accorded in-principle approval for proposed amalgamation of ITI Reinsurance Limited with the companysubject to: (a) obtaining approval, if required from the IRDAI; (b) on completion of proposed Buyback by ITI Reinsurance Limited and (c) on ITI Reinsurance Limited became a wholly owned subsidiary of the company.

BLS International Services: Company has been signed up by the Embassy of Vietnam to accept visa applications in India.

Zensar Technologies: Zensar selected as IT transformation partner by Vyaire Medical, US.

Lupin: Company receives FDA approval for Atorvastatin Calcium tablets USP, which is used to lower cholesterol in blood.

Shashijit Infraprojects: Company received project from Western Zonal Assembly Mumbai Diocese of the Mar Thoma Church for construction of school building in Vapi, Gujarat. The project cost would be around Rs 3.80-3.90 crore.

Tata Coffee: Subsidiary Tata Coffee Vietnam Company unveiled its state-of-the art freeze dried instant coffee production plant at Binh Duong province of Vietnam.

Infosys: Company to deliver engineering and digital services to Rolls-Royce Group.

KNR Constructions: Company bagged an order worth Rs 135 crore from Karnataka Road Development Corporation for the work of 'development of road Kanchugaranahalli to Jigani via Harohalli and Urgandoddi of Bidadi - Harohalli road in Bengaluru' project in Karnataka.

Tata Motors - JLR February sales: JLR sales fall 4.1 percent to 38,288 units YoY. Land Rover sales drop 8.1 percent to 26,053 units while Jaguar sales rise 5.8 percent to 12,235 units.

Three stocks under ban period on NSE

Securities in ban period for the next day's trade under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

For March 8, IDBI Bank, Reliance Power and Wockhardt are present in this list.

Disclaimer: Reliance Industries Ltd. is the sole beneficiary of Independent Media Trust which controls Network18 Media & Investments Ltd.