Taxmen try gentle method to make 294 farmers pay dues post-land acquisition

TNN | Updated: Feb 27, 2019, 07:35 IST Picture used for representational purpose only

Picture used for representational purpose onlyCHANDIGARH: The Income Tax department is trying out a new way to recover dues from farmers who benefited monetarily by acquisitions by government or purchase of their land by private developers but defaulted on tax payments owing to lack of awareness.

The department with the help of local district administration has identified 294 farmers who have not been able to file their returns post-land acquisition in the last few years.

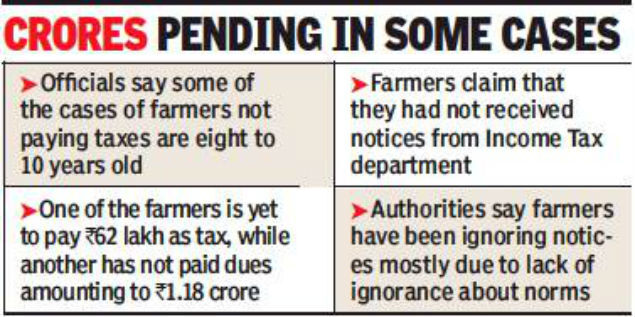

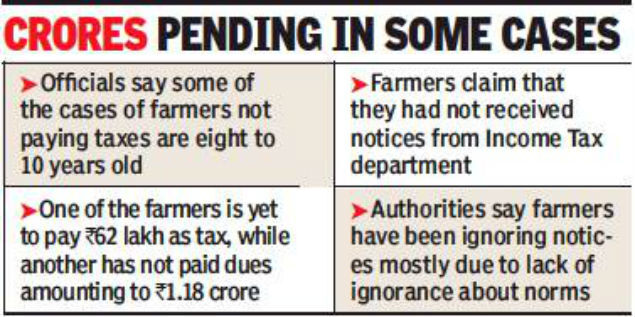

Bhav Singh, a farmer from Sukhwana village, is one of them. He said, “An amount of Rs 62 lakh was to be paid as tax after the sale of land. And this is pending from 2010.’’ He claimed they had not received any notice from the department and this amount had come as a shocker for them. Another farmer who too had sold his land now has to pay Rs 1.18 crore.

But instead of cracking down on farmers like Bhav Singh, the tax authorities are reaching out to them, attempting to create awareness and help them pay up after getting acquainted with the tax payment procedures. It was in this connection that the tax authorities in north western region (NWR) conducted an out-reach programme at the newly-inaugurated IT office in Mohali on Tuesday. Around two dozen-odd farmers attended the session.

The NWR covers states of Jammu and Kashmir, Himachal Pradesh, Punjab, Haryana and UT Chandigarh. The states have seen a huge acquisition of land for infrastructure build up and real estate developments, particularly in rural areas in immediate vicinity of urban centres. And in many cases, farmers who are not well-versed with tax norms are rendered tax defaulters inadvertently.

Binay Jha, principal chief commissioner of the north western region, said, “This is the first such attempt by the department to coordinate with the local administration to identify farmers who have not been able to file their returns.’’ Rather than issue lookout notice to defaulters, especially in the rural sector, the better way was to work in tandem with district-level officials and ensure them to pay up the pending amount. The IT department of NWR is hoping to recover the pending amount before the end of the financial year, Jha hoped.

Officials pointed out that some of these cases are also eight to 10 years old. Even as farmers claim that they had not received notices from the department, officials point out that the recipients have been ignoring them mostly due to lack of ignorance about tax norms.

For Bhav Singh, the outreach programme was beneficial. “Now with the help of the IT officials, we will be able to settle the amount,” he said, but added, “we would also need to approach the tribunal to see if the amount is correct or not.’’

The department with the help of local district administration has identified 294 farmers who have not been able to file their returns post-land acquisition in the last few years.

Bhav Singh, a farmer from Sukhwana village, is one of them. He said, “An amount of Rs 62 lakh was to be paid as tax after the sale of land. And this is pending from 2010.’’ He claimed they had not received any notice from the department and this amount had come as a shocker for them. Another farmer who too had sold his land now has to pay Rs 1.18 crore.

But instead of cracking down on farmers like Bhav Singh, the tax authorities are reaching out to them, attempting to create awareness and help them pay up after getting acquainted with the tax payment procedures. It was in this connection that the tax authorities in north western region (NWR) conducted an out-reach programme at the newly-inaugurated IT office in Mohali on Tuesday. Around two dozen-odd farmers attended the session.

The NWR covers states of Jammu and Kashmir, Himachal Pradesh, Punjab, Haryana and UT Chandigarh. The states have seen a huge acquisition of land for infrastructure build up and real estate developments, particularly in rural areas in immediate vicinity of urban centres. And in many cases, farmers who are not well-versed with tax norms are rendered tax defaulters inadvertently.

Binay Jha, principal chief commissioner of the north western region, said, “This is the first such attempt by the department to coordinate with the local administration to identify farmers who have not been able to file their returns.’’ Rather than issue lookout notice to defaulters, especially in the rural sector, the better way was to work in tandem with district-level officials and ensure them to pay up the pending amount. The IT department of NWR is hoping to recover the pending amount before the end of the financial year, Jha hoped.

Officials pointed out that some of these cases are also eight to 10 years old. Even as farmers claim that they had not received notices from the department, officials point out that the recipients have been ignoring them mostly due to lack of ignorance about tax norms.

For Bhav Singh, the outreach programme was beneficial. “Now with the help of the IT officials, we will be able to settle the amount,” he said, but added, “we would also need to approach the tribunal to see if the amount is correct or not.’’

All Comments ()+^ Back to Top

Refrain from posting comments that are obscene, defamatory or inflammatory, and do not indulge in personal attacks, name calling or inciting hatred against any community. Help us delete comments that do not follow these guidelines by marking them offensive. Let's work together to keep the conversation civil.

HIDE