Do retirement funds work? Things to know

Sanket Dhanorkar | TOI Contributor | Updated: Feb 25, 2019, 11:34 ISTHighlights

- Experts say retirement funds have no material benefits over regular mutual funds

- 'Opting for a dedicated retirement fund has more psychological significance than any performance benefit,' says a certified financial planner

(File photo)

(File photo)NEW DELHI: Investors tend to be sceptical about the suitability of ordinary mutual funds when it comes to building a retirement corpus. Mutual funds specifically targeted towards planning for one’s sunset years seek to address this mindset. But can dedicated retirement funds do a better job of creating a nest egg? Also, do these offer any benefits over savings vehicle like the NPS?

The solution-oriented funds

Most dedicated retirement funds have only been around for a few years. Recently, Sebi sought to define such products by carving out a separate category—solution-oriented funds. Retirement funds come under this basket and carry a lock-in of five years or until retirement, whichever is earlier. The lock-in—introduced to encourage long-term savings—distinguishes these from regular funds. These also levy a hefty exit load (3-4%) if withdrawn prematurely. Besides, these funds also qualify for tax deductions under Section 80C, like ELSS.

Most retirement funds also have 3-4 variants geared towards different investor profiles. HDFC Retirement Savings Fund for instance, offers three plans—a pure equity plan, a hybrid equity plan and a hybrid debt plan, while Tata Retirement Savings and Principal Retirement Savings come with conservative, moderate and progressive plans. Each plan carries a different asset mix and the investor is free to choose one that is most suited to his requirements. ICICI Prudential MF has just launched ICICI Prudential Retirement Fund.

How it works

Most retirement funds allow the investor to switch to different plans at any time without any exit load. The lock-in is not applicable at every switch; it is only from the time of initial investment. The investor can make this switch on his own at a time of his choosing, or opt for the auto-switch option wherein his money invested in any plan will be deployed into another plan on a pre-defined date. All these funds allow investors to set up a systematic withdrawal plan (SWP) at the time of retirement so that they can draw a steady income as per their requirements. A couple of funds—UTI Retirement Benefit Pension Fund and Franklin India Pension Fund—are only named as such but are not strictly pension or annuity offerings. They also offer cash payout in the form of either SWP or regular dividends after retirement.

Who should invest?

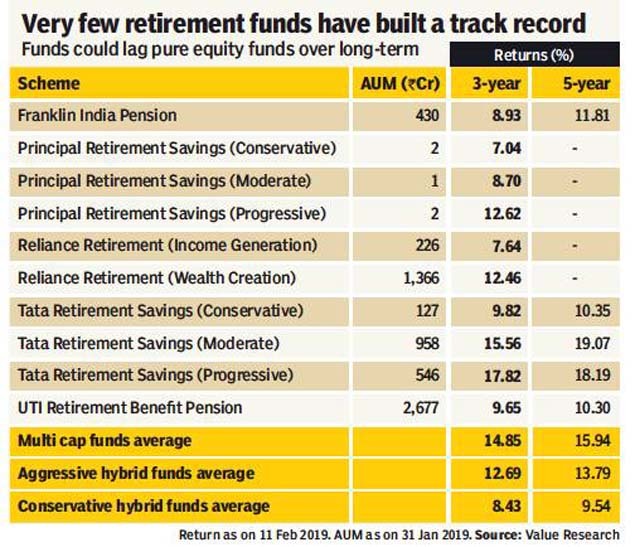

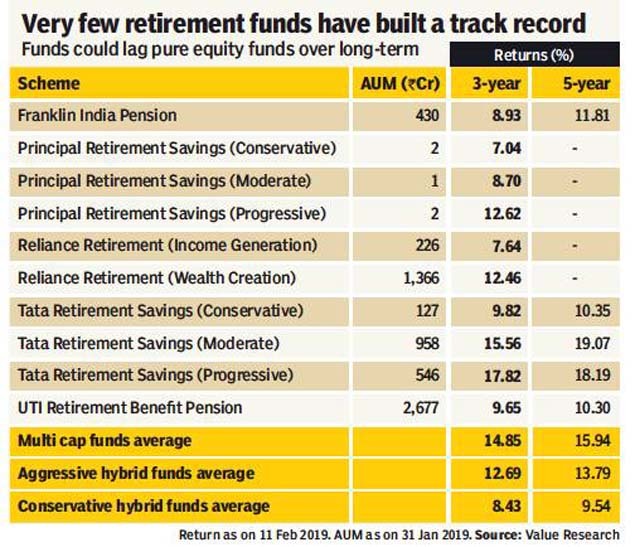

While this is a promising concept, very few retirement funds have a track record. Since most are hybrid in nature, performance is not on par with pure equity funds over the long-term. Experts say retirement funds have no material benefits over regular funds, other than the mental accounting aspect of a goal-oriented fund. Dedicated retirement funds make sense if the investor is more inclined to remain invested in the fund on account of the retirement tag associated with them. Many investors dip into their mutual fund savings indiscriminately, putting financial goals in peril. But if the investment is specifically earmarked towards a critical goal, investors typically don’t misuse it. “Opting for a dedicated retirement fund has more psychological significance than any performance benefit,” contends Nisreen Mamaji, certified financial planner and CEO, Moneyworks Financial Advisors. “Being goal-oriented, it is ideal for those lacking the discipline to hold on to their investment,” argues Amol Joshi, Founder, PlanRupee Investment Services. He insists retirement goals can be achieved using regular funds, provided the savings discipline is maintained throughout.

Pick the auto-switch option

Investors who do not have the time, inclination or know-how to rejig their portfolio on their own may find the auto-switch option between different plans a blessing. By changing the equity-debt asset mix at different intervals, the fund can protect the corpus as the investors near retirement. However, investors have to bear tax on any capital gains at every switch.

This facility of auto-switch between plans can also be found in the NPS, which lets you carry out the switch without incurring any tax liability. If you are keen on doing retirement planning on your own but can’t be bothered about asset allocation and rebalancing, this may be a more suitable option. Contribution to NPS up to 10% of basic also fetches tax deduction under Section 80C, with additional tax deduction up to ₹50,000 available over and above this limit. On retirement, 60% of the corpus in NPS can be withdrawn without any tax liability, the rest has to be directed towards annuity, income from which is taxable.

The solution-oriented funds

Most dedicated retirement funds have only been around for a few years. Recently, Sebi sought to define such products by carving out a separate category—solution-oriented funds. Retirement funds come under this basket and carry a lock-in of five years or until retirement, whichever is earlier. The lock-in—introduced to encourage long-term savings—distinguishes these from regular funds. These also levy a hefty exit load (3-4%) if withdrawn prematurely. Besides, these funds also qualify for tax deductions under Section 80C, like ELSS.

Most retirement funds also have 3-4 variants geared towards different investor profiles. HDFC Retirement Savings Fund for instance, offers three plans—a pure equity plan, a hybrid equity plan and a hybrid debt plan, while Tata Retirement Savings and Principal Retirement Savings come with conservative, moderate and progressive plans. Each plan carries a different asset mix and the investor is free to choose one that is most suited to his requirements. ICICI Prudential MF has just launched ICICI Prudential Retirement Fund.

How it works

Most retirement funds allow the investor to switch to different plans at any time without any exit load. The lock-in is not applicable at every switch; it is only from the time of initial investment. The investor can make this switch on his own at a time of his choosing, or opt for the auto-switch option wherein his money invested in any plan will be deployed into another plan on a pre-defined date. All these funds allow investors to set up a systematic withdrawal plan (SWP) at the time of retirement so that they can draw a steady income as per their requirements. A couple of funds—UTI Retirement Benefit Pension Fund and Franklin India Pension Fund—are only named as such but are not strictly pension or annuity offerings. They also offer cash payout in the form of either SWP or regular dividends after retirement.

Who should invest?

While this is a promising concept, very few retirement funds have a track record. Since most are hybrid in nature, performance is not on par with pure equity funds over the long-term. Experts say retirement funds have no material benefits over regular funds, other than the mental accounting aspect of a goal-oriented fund. Dedicated retirement funds make sense if the investor is more inclined to remain invested in the fund on account of the retirement tag associated with them. Many investors dip into their mutual fund savings indiscriminately, putting financial goals in peril. But if the investment is specifically earmarked towards a critical goal, investors typically don’t misuse it. “Opting for a dedicated retirement fund has more psychological significance than any performance benefit,” contends Nisreen Mamaji, certified financial planner and CEO, Moneyworks Financial Advisors. “Being goal-oriented, it is ideal for those lacking the discipline to hold on to their investment,” argues Amol Joshi, Founder, PlanRupee Investment Services. He insists retirement goals can be achieved using regular funds, provided the savings discipline is maintained throughout.

Pick the auto-switch option

Investors who do not have the time, inclination or know-how to rejig their portfolio on their own may find the auto-switch option between different plans a blessing. By changing the equity-debt asset mix at different intervals, the fund can protect the corpus as the investors near retirement. However, investors have to bear tax on any capital gains at every switch.

This facility of auto-switch between plans can also be found in the NPS, which lets you carry out the switch without incurring any tax liability. If you are keen on doing retirement planning on your own but can’t be bothered about asset allocation and rebalancing, this may be a more suitable option. Contribution to NPS up to 10% of basic also fetches tax deduction under Section 80C, with additional tax deduction up to ₹50,000 available over and above this limit. On retirement, 60% of the corpus in NPS can be withdrawn without any tax liability, the rest has to be directed towards annuity, income from which is taxable.

All Comments ()+^ Back to Top

Refrain from posting comments that are obscene, defamatory or inflammatory, and do not indulge in personal attacks, name calling or inciting hatred against any community. Help us delete comments that do not follow these guidelines by marking them offensive. Let's work together to keep the conversation civil.

HIDE