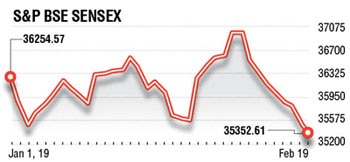

Under bear hug, Sensex sees longest losing streak since 2011

BSE

Equity market investors continue to plunder stocks at will as bears further tightened their grip on the market, leaving key equity benchmark indices reeling under the twin effects of mixed global market sentiment and persisting foreign fund outflows.

On Tuesday, the 30-share benchmark Sensex fell for the ninth straight session, registering its longest losing streak since 2011. The broader Nifty50 index also fell for eight straight session.

Investors remained cautious following a sell-off in IT stocks with geopolitical concerns and oil prices surging to a three-month high further worsening the sentiment, said dealers.

"Markets opened on a positive note as the transfer of interim dividend from Reserve Bank of India to government helped the indices to rebound after several days of correction. However, the reversal was short lived due to mixed global market sentiment and investors' strategy to book profit on every rally," Vinod Nair, head of research at Geojit Financial Services, said.

Although the markets started on a positive note, Sensex ended weak at 35352.61, tumbling 145.83 points, or 0.41%, after touching an intra-day low of 35287.16. In the last nine sessions, the index has slumped 1,618.48 points, or 4.38%, since February 7.

Although the markets started on a positive note, Sensex ended weak at 35352.61, tumbling 145.83 points, or 0.41%, after touching an intra-day low of 35287.16. In the last nine sessions, the index has slumped 1,618.48 points, or 4.38%, since February 7.

After a flat opening, the broader Nifty also lost 36.60 points, or 0.34%, to settle at 10604.35. During intra-day trade, the index touched a low of 10585.65. Since February 8, the 50-share index has shed 339.25 points, or 3.10%, in the past eight sessions losing 339.25 points, or 3.10%.

"A volatile session ended in red as Nifty forms an Inverted Hammer at crucial supports of 10600-10620," Mustafa Nadeem, CEO of Epic Research wrote in a note on Tuesday. An Inverted hammer is a reversal pattern that has a higher shadow which is as twice as the real body and a negligible or small lower wick.

According to a report by Motilal Oswal Financial Services, India VIX moved up by 2.60% at 18.46 levels on Tuesday. The surge in the VIX restricts immediate upside in the near-term.

"Earlier it was midcap and smallcap gauges which were correcting but now the large-cap index also joined the fall. Due to lack of liquidity and investors' confidence the benchmark indices are falling. Also, political conditions in the country and election uncertainty continue to be a concern," said G Chokkalingam, founder and managing director at Equinomics Research and Advisory. "The index stock may fall further but the broader market will see a revival," he further added.

Political uncertainty ahead of the general election is making foreign investors nervous as they continue to fled domestic equities. As per the provisional data, the FPIs sold shares worth Rs 813.76 crore on Tuesday, while domestic institutional investors (DII) bought shares of Rs 1,163.85 crore on a net basis.

"Not only the political scenario and upcoming elections, but the earnings also failed to impress the market. Corporate governance, the IL&FS issue continue to worry the investors too. The indices may see two-three days of rally in the near-term but post that it will again start correcting," said AK Prabhakar, head of research at IDBI Capital.

Technology stocks were major losers on the bourses. TCS dropped 3% to close at Rs 1,905. Infosys, Tech Mahindra and HCL Tech declined up to 1-2%. Pharma stocks like Dr Reddy's and Aurobindo Pharma also fell 1% each. Meanwhile, Emami surged 13% to close at Rs 410 after founders divested 10% stake in the company for Rs 1,600 crore to pare debt.