Nagaraj Shetti of HDFC Securities said a lack of strength to sustain above 10,850-10,800 levels is likely to result in further weakness.

The Sensex on February 13 gave up early gains to end 119 points lower as investors booked profits in banking, auto, metal and pharma stocks in the last hour of trade while the Nifty ended tad below 10,800 levels.

"As Nifty has closed below 50 DMA (10,817), prices will trade lower towards 10,740 levels, from where some sort of relief can be expected. On the contrary, a close above 10,860 will change the current sentiment," Shabbir Kayyumi, Head of Technical Research at Narnolia Financial Advisors, told Moneycontrol.

Nagaraj Shetti, Technical Research Analyst at HDFC Securities, said a lack of strength to sustain above 10,850-10,800 levels is likely to result in further weakness.

The broader markets also closed the session lower with Nifty Midcap index falling 0.33 percent and Smallcap index losing 0.85 percent.

Among sectors, Nifty Auto and Metal indices slipped a percent each followed by Bank, FMCG and Pharma whereas IT outperformed to close 0.65 percent higher.

We have collated top 15 data points to help you spot profitable trades:

Key support and resistance level for Nifty

The Nifty closed at 10,793.65 on February 13. According to Pivot charts, the key support level is placed at 10,746.62, followed by 10,699.58. If the index starts moving upward, key resistance levels to watch out are 10,866.17 and then 10,938.68.

Nifty Bank

The Nifty Bank index closed at 26,885.40, down 125.35 points on February 13. The important Pivot level, which will act as crucial support for the index, is placed at 26,780.30, followed by 26,675.20. On the upside, key resistance levels are placed at 27,049.25, followed by 27,213.10.

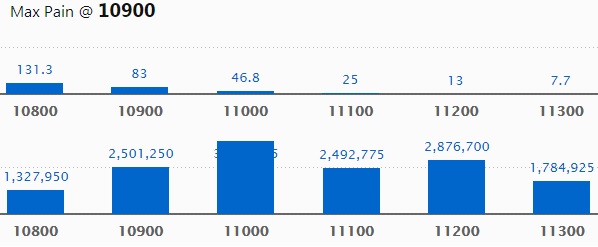

Call Options Data

Maximum Call open interest (OI) of 39.03 lakh contracts was seen at the 11,000 strike price. This will act as a crucial resistance level for the February series.

This was followed by the 11,200 strike price, which now holds 28.76 lakh contracts in open interest, and 10,900, which has accumulated 25.01 lakh contracts in open interest.

Meaningful Call writing was seen at the strike of 10,900 which added 4.46 lakh contracts, followed by 10,800 strike which added 0.95 lakh contracts and 11,100 strike which added 0.93 lakh contracts.

Call unwinding was seen at the strike price of 11,300 which shed 1.07 lakh contracts.

Put Options data

Maximum Put open interest of 31.68 lakh contracts was seen at the 10,400 strike price. This will act as a crucial support level for the February series.

This was followed by the 10,700 strike price, which now holds 27.40 lakh contracts in open interest, and the 10,500 strike price, which has now accumulated 24.18 lakh contracts in open interest.

Put writing was seen at the strike price of 10,600, which added 2.01 lakh contracts, followed by 10,400 which added 0.46 lakh contracts.

Put unwinding was seen at the strike price of 11,000 which shed 2.57 lakh contracts, followed by 10,900 strike which shed 1.51 lakh contracts and 10,700 strike which shed 1.11 lakh contracts.

FII & DII data

Foreign Institutional Investors (FIIs) sold shares worth Rs 676.63 crore while Domestic Institutional Investors bought Rs 713.1 crore worth of shares in the Indian equity market on February 13, as per provisional data available on the NSE.

Fund Flow Picture

Stocks with high delivery percentage

High delivery percentage suggests that investors are accepting delivery of the stock, which means that investors are bullish on it.

18 stocks saw a long buildup

41 stocks saw short covering

A decrease in open interest along with an increase in price mostly indicates short covering.

80 stocks saw a short build-up

An increase in open interest along with a decrease in price mostly indicates a build-up of short positions.

61 stocks saw long unwinding

Bulk Deals on February 13

GPT Infraprojects: Kuber India Fund sold 1,85,425 shares of the company at Rs 41 per share on the NSE.

SREI Infrastructure: Norges Bank AC Government Petroleum Fund purchased 30,15,264 shares of the company at Rs 25.29 per share on the NSE.

Zee News: IFCI sold 30,00,000 shares of the company at Rs 14.07 per share on the NSE.

TeamLease Services: Goldman Sachs Asset Management A/C GS FDS SICAV GS Global Emerging Markets Equity Portfolio sold 90,531 shares of the company at Rs 2,898.2 per share on the BSE.

(For more bulk deals, click here)

Analyst or Board Meet/Briefings

Kiri Industries: Conference Call to be held on February 15 to discuss the financial performance of the company for the quarter and nine months ended on December 2018.

Asian Paints: Company's officials will be attending Edelweiss Investor Conference on February 14, IIFL Investor Conference on February 14 and meeting analysts/investors in UBS Road Show on February 18.

Stocks in news

Results on February 14: Oil & Natural Gas Corporation, Ashok Leyland, Jet Airways (India), Indiabulls Real Estate, Glenmark Pharmaceuticals, Voltas, Shree Renuka Sugars, Vikas EcoTech, Liberty Shoes, AVT Natural Products, Megasoft, TPL Plastech, S&S Power Switchgears, Mohit Industries, Gammon Infrastructure Projects, Thiru Arooran Sugars,

IFCI, Parsvnath Developers, Magnum Ventures, Uttam Value Steels, Wanbury, Impex Ferro Tech, Provogue (India), Mandhana Industries, Videocon Industries, Visesh Infotecnics, W S Industries (I), Lypsa Gems & Jewellery, Nitin Fire Protection Industries, JMT Auto, Pearl Polymers,

India Tourism Development Corporation, Tata Teleservices (Maharashtra), Prime Securities, Ahluwalia Contracts (India), Vipul, GlaxoSmithKline Consumer Healthcare, Texmo Pipes and Products, Neueon Towers, Cox & Kings, The Motor & General Finance, United Breweries, Sunil Hitech Engineers,

Tilaknagar Industries, Empee Distilleries, Parenteral Drugs (India), DSJ Communications, Technofab Engineering, JK Tyre & Industries, Brooks Laboratories, S Chand And Company, Lakshmi Energy and Foods, Surya Roshni, Petron Engineering Construction, Refex Industries, Dynacons Systems & Solutions,

Jain Studios, Ducon Infratechnologies, Eveready Industries India, Eastern Silk Industries, BAG Films and Media, IMP Powers, Kaveri Seed Company, LCC Infotech, Landmark Property Development Company, Rajvir Industries, Simplex Infrastructures, Bharat Rasayan, Vishnu Chemicals, Orient Refractories,

Bharat Dynamics, La Opala RG, Mindteck (India), MBL Infrastructures, Sumeet Industries, Ortel Communications, Sadbhav Engineering, Unitech, Vaswani Industries, Raj Oil Mills, Talwalkars Healthclubs, Bkm Industries, Pritish Nandy Communications, Kavveri Telecom Products, PNB Gilts, Simbhaoli Sugars,

Ess Dee Aluminium, Bilpower, Mahanagar Telephone Nigam, High Ground Enterprise, KSS, Regency Ceramics, Mohota Industries, Nitco, Nagreeka Capital & Infrastructure, CMI, Albert David, Rollatainers, BGR Energy Systems, Superhouse, Sujana Universal Industries, Orient Press, Tarmat, Deep Industries,

Shri Lakshmi Cotsyn, Bartronics India, Infibeam Avenues, Manaksia, Easun Reyrolle, Sharon Bio-Medicine, Bharatiya Global Infomedia, Eon Electric, Sathavahana Ispat, Panacea Biotec, Prajay Engineers Syndicate, Gayatri Projects, Responsive Industries, Mcleod Russel India, MVL, Williamson Magor & Company,

Venus Remedies, Deepak Fertilizers and Petrochemicals Corporation, Nagreeka Exports, Time Technoplast, Agarwal Industrial Corporation, RPP Infra, Pochiraju Industries, Syncom Healthcare, Dalmia Bharat Sugar and Industries, Antarctica, AMD Industries, Asian Hotels (West), Shiva Texyarn,

NCL Industries, Cerebra Integrated Technologies, Sakthi Sugars, Rana Sugars, Prime Focus, Gokul Agro Resources, SMS Pharmaceuticals, Donear Industries, AMD Industries, Kellton Tech Solutions, Adhunik Metaliks, Castex Technologies, Gabriel India, Valecha Engineering, GI Engineering Solutions,

Bil Energy Systems, Puravankara, Genesys International Corporation, Nitin Fire Protection Industries, GMR Infrastructure, Splendid Metal Products, Steel Strips Wheels, MEP Infrastructure Developers, North Eastern Carrying Corporation, Talbros Automotive Components, Paisalo Digital, Jindal Cotex,

Rajshree Sugars & Chemicals, Khaitan (India), India Glycols, Shri Lakshmi Cotsyn, Zylog Systems, MSP Steel & Power, Sreeleathers, Advani Hotels & Resorts (India), MSP Steel & Power, Ortel Communications, Uniply Industries, Kesar Terminals & Infrastructure, Gokul Refoils and Solvent, Ducon Infratechnologies,

Nesco, Adroit Infotech, Weizmann, Bombay Rayon Fashions, Uttam Sugar Mills, Winsome Yarns, Page Industries, Alok Industries, Shiva Mills, ISMT, Kridhan Infra, KSK Energy Ventures, Global Offshore Services, Alankit, Goenka Diamond and Jewels, Manaksia Steels, Anant Raj, Cubex Tubings,

CCL Products (India), Tara Jewels, Patel Integrated Logistics, Talwalkars Healthclubs, Cura Technologies, ICSA (India), Radha Madhav Corporation, Creative Eye, Rainbow Papers, OM Metals Infraprojects, Palred Technologies, Kohinoor Foods, Tera Software, Vivimed Labs, Nahar Industrial Enterprises,

Bhandari Hosiery Exports, GVK Power & Infrastructure, PDS Multinational Fashions, Ortin Laboratories, Arihant Foundations & Housing, Kitex Garments, Nalwa Sons Investments, Ujaas Energy, Karda Constructions, Celestial Biolabs, Vijay Shanthi Builders, APL Apollo Tubes, Housing Development and Infrastructure,

Somi Conveyor Beltings, Sita Shree Food Products, Austral Coke & Projects, Hi-Tech Pipes, Salora International, Ganesh Housing Corporation, SMS Lifesciences India, Sezal Glass, Karma Energy, Sri Havisha Hospitality and Infrastructure, Abhishek Corporation, Visagar Polytex, Responsive Industries,

MMTC, Autolite (India), Ankit Metal & Power, Finolex Cables, Kaushalya Infrastructure Development Corporation, Patel Integrated Logistics, Bannari Amman Spinning Mills, Paras Petrofils

A2Z Infra Engineering Q3: Profit increases to Rs 5.7 crore versus Rs 1.02 crore; revenue rises to Rs 152 crore versus Rs 89.44 crore YoY.

Ansal Properties and Infrastructure Q3: Loss at Rs 19.65 crore versus loss Rs 25.81 crore; revenue rises to Rs 117.5 crore versus Rs 94 crore YoY.

Quick Heal Technologies Q3: Profit jumps to Rs 16.09 crore versus Rs 7.97 crore; revenue rises to Rs 65.9 crore versus Rs 63.6 crore YoY.

Tamil Nadu Newsprint & Papers Q3: Profit surges to Rs 50 crore versus Rs 27 crore; revenue rises to Rs 1,103 crore versus Rs 944 crore YoY.

Reliance Capital Q3: Profit at Rs 89 crore versus loss Rs 603 crore; revenue falls to Rs 568 crore versus Rs 639 crore YoY.

HPL Electric & Power Q3: Consolidated profit at Rs 6.61 crore versus Rs 8.8 crore; revenue falls to Rs 259.44 crore versus Rs 276.3 crore YoY.

NBCC India Q3: Consolidated profit rises to Rs 83.65 crore versus Rs 68.34 crore; revenue jumps to Rs 2,438.8 crore versus Rs 1,886.3 crore YoY.

CreditAccess Grameen: Company completed a direct assignment of Rs 275.28 crore. With this transaction, the company has completed six securitisation and four direct assignment transactions totaling to Rs 1,573.22 crore in FY19.

Six stocks under ban period on NSE

Securities in ban period for the next day's trade under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

For February 14, Adani Enterprises, Jet Airways, Reliance Capital, Reliance Power, Jain Irrigation Systems and IDBI Bank stocks are present in this list.