Coal remains the principal energy driver in the near term as India still depends on the polluting fuel for three-fourths of its energy requirements.

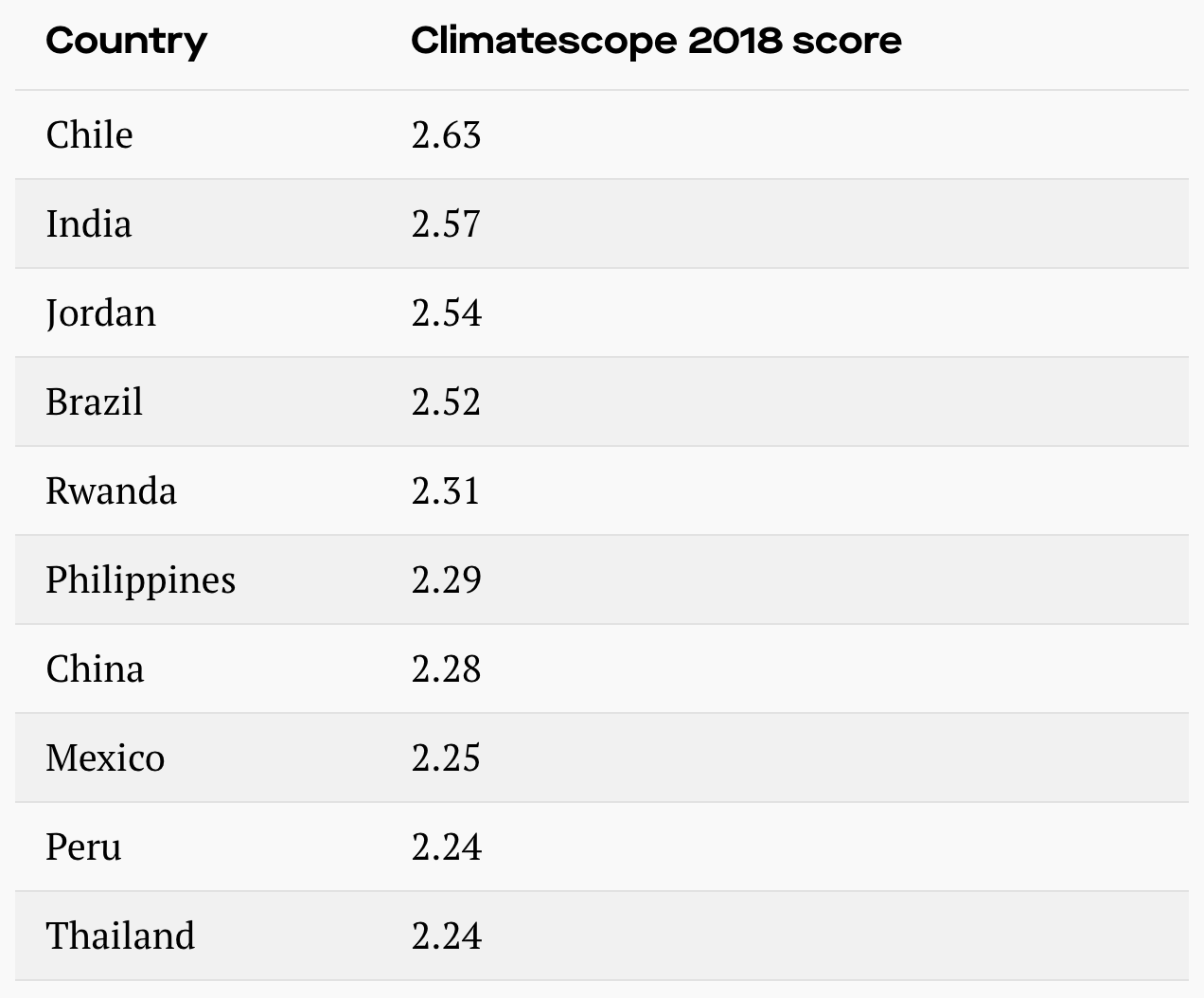

India ranks second only to Chile among emerging economies to lead the transition to clean energy, according to a 2018 Climatescope report by energy researcher BloombergNEF.

India climbed three spots since last year on the back of the government's strong commitment and support towards renewable energy over increased investments, clean energy installations and being host to the world's largest renewables auction market.

The report factored in over 80 indicators such as clean energy policies, power sector structures, emissions and the installed capacities of 103 countries around the world.

In June 2018, renewables accounted for 71 GW of India's installed generating capacity, according to the Climatescope report. The country's renewables auctioned capacity increased by 68 percent since 2017, making it home to the most competitive auctions in the world.

Clean energy investments, mostly related to solar power projects, added up to $7.4 billion in the first half of 2018.

India also has been reducing its dependence on coal for generating energy, which factored in its ranking second on the 2018 Climatescope report. However, not everything is rosy in India's renewables market.

According to a report by renewable energy consultancy firm Bridge to India, poor policies have raised uncertainty over the duties on imported solar panels, causing a sharp decline in new solar capacity additions in 2018.

"Total installation (of utility projects) in the financial year 2018-19 is expected at only 4.1 GW, down a very significant 55 percent over previous year and well short of MNRE’s (ministry of new and renewable energy) 16 GW annual plan," Bridge to India said.

Read: Dear PM Modi, here's how bureaucrats are planning to scuttle your rooftop solar, employment plansIn the third quarter of 2018, India added 1,697 megawatts (MW) of solar power capacity. While this is marginally better than the previous quarter when the numbers fell to their lowest level since early 2017, it is still far below the 4,130 MW added in the first quarter of this year.

The Narendra Modi-led government has set an ambitious goal to generate 175 GW of clean energy by March 2022, of which 100 GW be from solar energy, 60 GW from wind power and 15 GW from other sources.

In July 2018, India imposed a safeguard duty on solar panel imports from China and Malaysia -- 25 percent for one year, 20 percent for the next six months, and 15 percent for the subsequent six months.

While the government has imposed this duty to protect domestic players from a steep rise in the inbound shipments of the product, analysts have warned that the move is expected to slow capacity addition, making it hard for India to reach its ambitious National Solar Mission target to add 100 GW of solar power capacity by 2022, according to a report by the ratings agency Crisil.

However, owing to the lack of a renewable energy policy, India may miss this target, as per the State of Renewable Energy in India 2019 report by city-based think tank Centre for Science and Environment (CSE). Uncertainty over the safeguard duty indicate the need for a renewable energy policy.

Read: Opinion | How the govt has left the solar sector in darkness

Considering the myriad challenges, India may achieve about 76 percent of the 175 GW target of renewable power generation capacity by the scheduled date of 2022, Wood Mackenzie's solar analyst Rishab Shrestha told PTI.

"The recent cancellation of auctions risks jeopardising investor confidence. Various duties on equipment and the associated uncertainty has led to a short-term uptick in solar prices. This leads to the knock-on effect on already cash-strapped state distribution companies who are showing an unwillingness to green light high priced solar projects," Shrestha added.

Read: DATA STORY | States set to miss UDAY target; here are the 3 major hurdles that lie aheadThe continuous industrial production growth has been pushing up coal's demand. "We have increased India's imports for thermal coal from 158 million tonnes to 164 million tonnes in 2018 with a further upside risk of 3-4 million tonnes as coal stocks at Indian power plants and Coal India Ltd are at historically low levels," said Pralabh Bhargava, Wood Mackenzie's principal coal analyst.