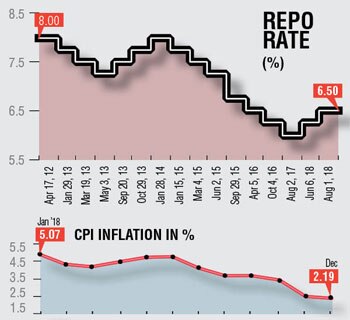

Inflation reined in, RBI may cut rate to bolster growth

Shaktikanta Das Shaktikanta Das

Market is expecting a rate cut with both retail inflation and whole inflation falling to a record low in December 2018. Economists and treasury dealers say the Reserve Bank of India's (RBI) monetary policy committee should cut interest rates when inflation levels seem deflationary.

The Consumer Price Index (CPI)-based inflation fell to 2.19% in December, which is well below the central bank's target of 4%. With softening of food prices the retail inflation has been dipping since July 2018.

"While the entire market is expecting a change in stance from calibrated tightening to neutral, a portion of the market believes that there will be a rate cut. The governor is going to utilise the small window available to cut rates. If he waits further, the base effect will kick in, leaving him with no leeway to bring down rates," said a dealer with a public sector bank.

Economists believe it is time to cut rates to reverse the deflationary trends that have set in the market. "It is time to expect a rate cut with inflation at 2.19%, much below RBI's target band. We have a strict inflation targeting methodology; so when the inflation is falling, RBI needs to respond and there has to be a symmetry. One cannot go on fretting about inflation, particularly when growth has not been buoyant," said Abheek Barua, chief economist at HDFC Bank.

Economists believe it is time to cut rates to reverse the deflationary trends that have set in the market. "It is time to expect a rate cut with inflation at 2.19%, much below RBI's target band. We have a strict inflation targeting methodology; so when the inflation is falling, RBI needs to respond and there has to be a symmetry. One cannot go on fretting about inflation, particularly when growth has not been buoyant," said Abheek Barua, chief economist at HDFC Bank.

"Even for the beginning of the next fiscal, RBI had given a band for inflation at 3.5% to 4.2%. I am expecting inflation to touch about 3.2%," Barua added.

Even the wholesale price index (WPI)-based inflation decelerated to an eight-month low of 3.8% in December from 4.64% in the previous month on the back of softening inflation for fuel as well as manufactured items.

RBI had pegged the retail inflation between 2.7% and 3.2% in the second half (October-March) of 2018-19 in its December policy. The headline inflation at 2.19 % is low and well within the targeted level. With base effect expected to kick in and volatile oil and food prices, there is still no certainty on the inflation trajectory. Higher oil production in the US and global weakening demand for oil helped crude prices cool down by 40% in the last three months.

"Headline inflation still remains significantly benign (to remain likely so till August 19) and growth has hit a soft patch. Sharp revisions in GDP (gross domestic product) growth in FY17 and FY18 imply a sub-7% figure in FY19, clearly implying that we are currently in a slowdown mode. Also, inflation might have just bottomed out in December. The credit growth has declined for the second fortnight in January, implying that incremental credit growth data available till December is showing a significant decline, which might have continued in January," said Soumya Kanti Ghosh, group chief economic advisor, SBI.

INDICATORS FLASHING

- Experts say now is the time to cut rates as the base effect is expected to kick in

- Growth has hit a soft patch. The credit growth declined for the second fortnight in January