On a weekly basis, the rupee fell marginally as it ended at 71.24 on February 1 against January 25 closing of 71.18.

Sensex and Nifty rose 1 percent during the week ended February 1 amid Interim Budget, F&O expiry and earnings from India Inc.

Market started the week on a weaker note and remained volatile for next two days but ended strongly on F&O expiry and extended gains on the Budget day.

For the week Sensex rose 1.23 percent or 443.89 points, to end at 36,469.43, while Nifty gained 1.04 percent, or 113.1 points, to close at 10,893.65.

The index formed a bullish candle on the weekly scale with long lower shadow but still got stuck in the broader trading boundary, said Chandan Taparia of Motilal Oswal Financial Services.

On a weekly basis, the rupee fell marginally as it ended at 71.24 on February 1 against January 25 closing of 71.18.

According to Amar Ambani of Yes Securities, all pre-election budgets are expected to be ‘populist’ in nature. Therefore, the single biggest fear that the stock market had was ‘over-populism’ by the government, leading to a significant deviation from the fiscal roadmap. However, that did not materialize, if the government achieves its stated figures.

The government did announce sops for farmers, middle-class and small-businesses, but slipped on the fiscal deficit front by 10 basis points only, he added.

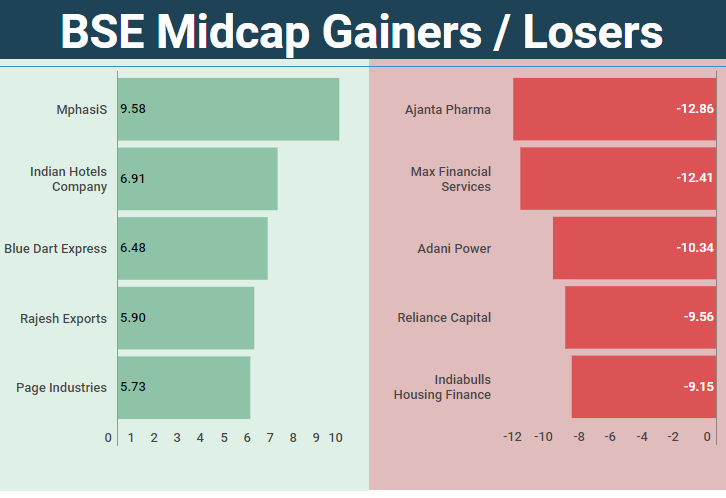

The S&P BSE Largecap was up 0.95 percent, while S&P BSE Midcap index and Smallcap Index was down 0.28 percent and 0.36 percent, respectively.

The Nifty Media index has outperformed other sectoral indices with nearly 6 percent gain during the week.

On the BSE, TCS gained the most in terms of market value followed by Maruti Suzuki, while on the other hand, Vedanta lost the most in terms of market value.