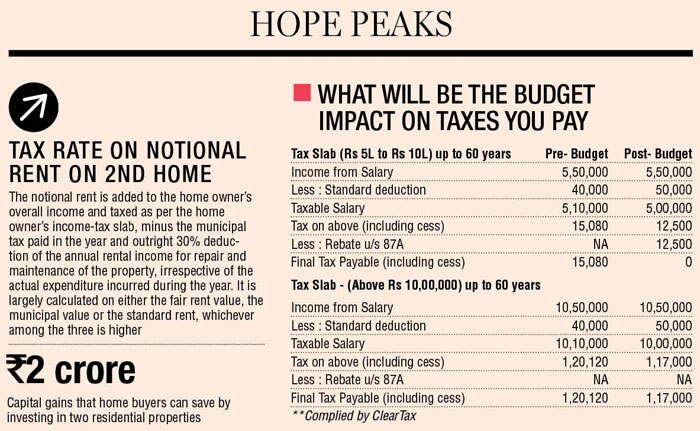

The doing away with the tax on notional rent for second self-occupied home and allowing tax benefit on capital gains from house property by investing in two residential properties may encourage more people to buy two homes.

The Interim Budget 2019-20 has given relief to those owning two homes and have to pay tax on the notional rental income, even if it is not given on rent. But those earning rental income from the second home, have to pay tax on it.

In his Budget speech, Finance Minister Piyush Goyal said, "Currently, income tax on notional rent is payable if one has more than one self-occupied house. Considering the difficulty of the middle class having to maintain families at two locations on account of their job, children's education, care of parents, etc, I am proposing to exempt levy of income tax on notional rent on a second self-occupied house."

About the capital gains exemption, the Finance Minister said, "The benefit of rollover of capital gains under section 54 of the Income Tax Act will be increased from investment in one residential house to two residential houses for a taxpayer having capital gains up to Rs 2 crore. This benefit can be availed once in a lifetime."

This means an individual can now buy two houses from the capital gains earned by selling one house and get tax exemption.

Once implemented, the proposal will benefit a large number of home buyers who purchase second homes. It will also benefit those who looking to earn rental income by investing in a second house.

Currently, under Section 54 of the Income Tax Act, a consumer is allowed to save tax on the capital gains made from selling a residential property by buying one more home property.

Once the new proposal comes into effect, a homebuyer can save tax on capital gains of up to Rs 2 crore by investing in buying two houses.

"No notional rent levied on second self-occupied homes and capital gains up to Rs 2 crore which can be used for buying up to two houses, provide much-needed impetus to the demand for homes," said Sanjay Dutt, MD & CEO, Tata Realty Limited. However, this change is not only for properties in the country. "The status of the second property for the purposes of exemption from notional rent could be outside India also, which may be beneficial for Indians holding property outside," said Amit Maheshwari, managing partner and international tax lead of Ashok Maheshwary & Associates.

Besides, the Budget has increased the exemption limit on tax deducted at source (TDS) on rental income from Rs 1.8 lakh to Rs 2.4 lakh.

This will directly benefit those who own two houses and give another on rent.

INTERIM BUDGET 2019-20

Rs 15,000 – Monthly income of workers for whom pension has been proposed

80% – Growth in Tax Base: Number of Returns Filed increased from 3.79 crore to 6.85 Crore since 2013-14

Rs 3,000 – Proposed monthly pension for unorganised sector workers from age 60 years

Rs 10 cr – Number of workers expected to benefit form Pradhan Mantri Shram-Yogi Maandhan