Budget 2019: Income tax limit raised to Rs 5 lakh, Piyush Goyal says

TIMESOFINDIA.COM | Updated: Feb 1, 2019, 13:54 IST

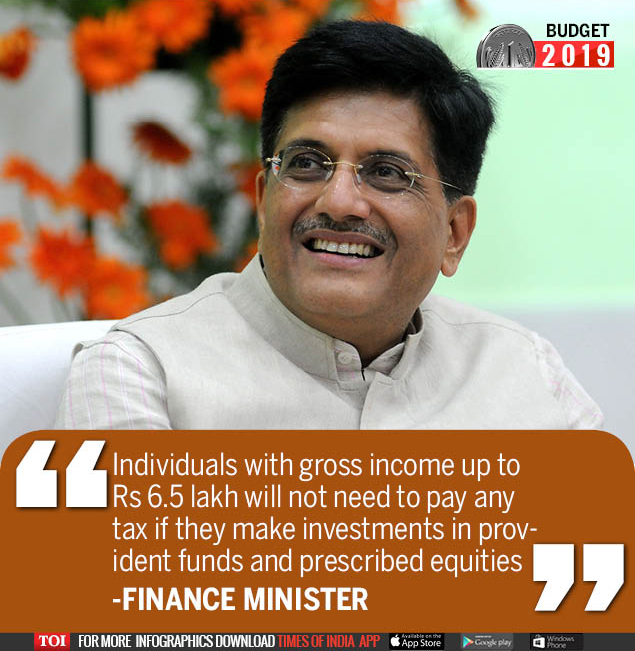

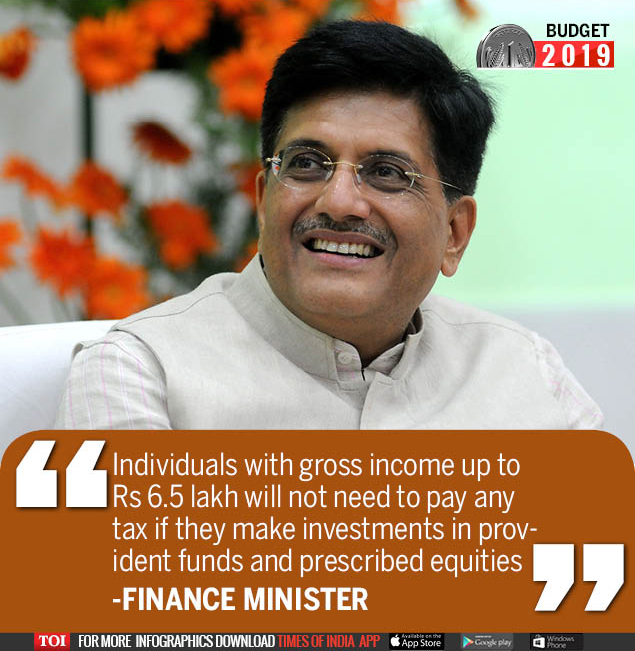

NEW DELHI: Finance minister Piyush Goyal on Friday said tax payers with annual income up to Rs five lakh will get full tax rebate.

"Individuals with income up to Rs 5 lakh will not be required to pay any tax," Goyal said while presenting the Budget for 2019-20 in Lok Sabha.

Individuals with gross income up to Rs 6.5 lakh will not need to pay any tax if they make investments in provident funds and prescribed equities that are tax-saving schemes, while it may move up further with additional avenues like NPS, medical insurance and home loan interest payment, the finance minister said.

Around three crore middle class taxpayers will get tax exemption due to this measure, Goyal stated while presenting the Budget proposals.

Goyal said the standard tax deduction for salaried persons is raised from Rs 40,000 to Rs 50,000, while the TDS threshold on interest on bank and post office deposits is raised from Rs 10,000 to Rs 40,000.

The Budget also proposed to exempt tax on notional rent for unsold housing units for two years. Goyal also said the benefit of rollover of capital tax gains will be increased from investment in one residential house to that in two residential houses, for a taxpayer having capital gains up to Rs 2 crore, the finance minister announced. He said this can be exercised once in a lifetime.

Doubling the threshold exemption limit will increase the burden on the exchequer by Rs 18,500 crore.

Ahead of the Budget, tax benefits were expected for the middle class -- a key constituency for the Modi government ahead of the Lok Sabha elections this spring/summer.

The government was in 2018 also widely expected to tweak tax rates but refrained from doing so due to fiscal implications.

Read this story in Bengali

"Individuals with income up to Rs 5 lakh will not be required to pay any tax," Goyal said while presenting the Budget for 2019-20 in Lok Sabha.

Individuals with gross income up to Rs 6.5 lakh will not need to pay any tax if they make investments in provident funds and prescribed equities that are tax-saving schemes, while it may move up further with additional avenues like NPS, medical insurance and home loan interest payment, the finance minister said.

Around three crore middle class taxpayers will get tax exemption due to this measure, Goyal stated while presenting the Budget proposals.

Goyal said the standard tax deduction for salaried persons is raised from Rs 40,000 to Rs 50,000, while the TDS threshold on interest on bank and post office deposits is raised from Rs 10,000 to Rs 40,000.

The Budget also proposed to exempt tax on notional rent for unsold housing units for two years. Goyal also said the benefit of rollover of capital tax gains will be increased from investment in one residential house to that in two residential houses, for a taxpayer having capital gains up to Rs 2 crore, the finance minister announced. He said this can be exercised once in a lifetime.

Doubling the threshold exemption limit will increase the burden on the exchequer by Rs 18,500 crore.

Ahead of the Budget, tax benefits were expected for the middle class -- a key constituency for the Modi government ahead of the Lok Sabha elections this spring/summer.

The government was in 2018 also widely expected to tweak tax rates but refrained from doing so due to fiscal implications.

Read this story in Bengali

Download The Times of India News App for Latest India News.

All Comments ()+^ Back to Top

Refrain from posting comments that are obscene, defamatory or inflammatory, and do not indulge in personal attacks, name calling or inciting hatred against any community. Help us delete comments that do not follow these guidelines by marking them offensive. Let's work together to keep the conversation civil.

HIDE