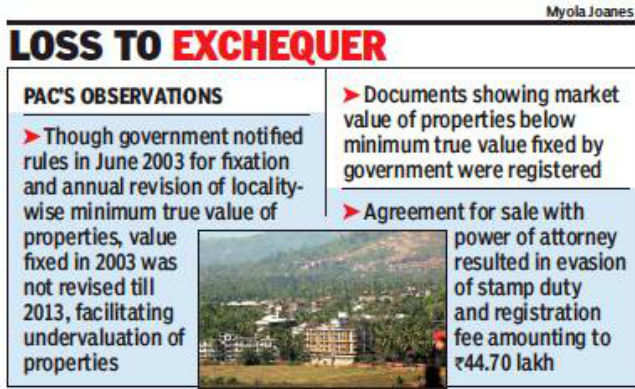

The PAC has said that the laxity can allow vested interests to get away with transfer of lands at way below the stipulated minimum rate, depriving the state of revenue.

The PAC has asked for status of cases where land was thus undervaluated and below minimum rate of tax levied from 2009, taluka-wise for all lands above 1 lakh sq m. The panel noted that the notification for the special committee came in 2009, but the committee was constituted only in 2013.

“This laxity shows a lack of transparency in the working of the department allowing vested interests to get away with transfer of lands way below the stipulated minimum rate, thereby depriving the government of levy of stamp duties and fees on true value of the lands,” the PAC report states.

The committee also said that there was an inordinate delay in computerisation of the department “due to its lackadaisical attitude”.

The PAC also sought an explanation as to why there was no mandatory annual revision of land rates as per the Goa Stamp Rule, 2003, “as this resulted in a loss to the exchequer by way of wrongly levied stamp duty”.

The PAC also sought an explanation as to why there was no mandatory annual revision of land rates as per the Goa Stamp Rule, 2003, “as this resulted in a loss to the exchequer by way of wrongly levied stamp duty”.