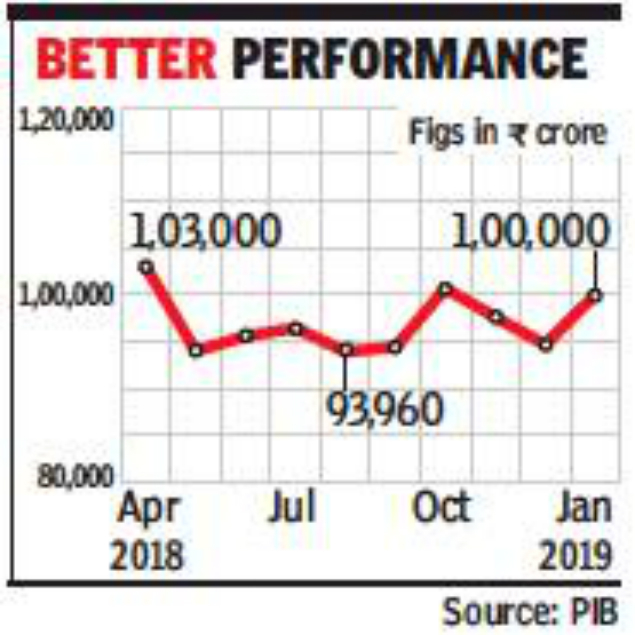

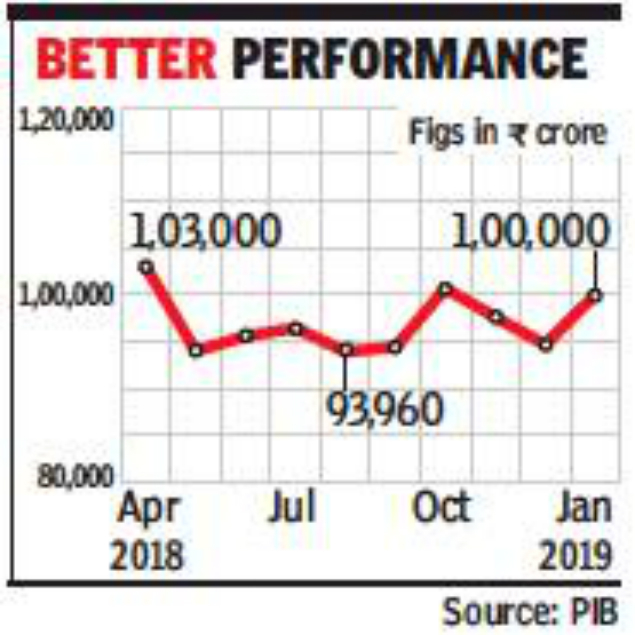

January GST collections top Rs 1 lakh crore after 2 months

Agencies | Feb 1, 2019, 06:55 IST Union minister Piyush Goyal (AP)

Union minister Piyush Goyal (AP) NEW DELHI: GST collections in January crossed the Rs 1-lakh-crore mark after a gap of two months, the finance ministry said on Thursday. “This has been a significant improvement over collection of Rs 94,725 crore during last month and Rs 89,825 crore during the same month last year,” the ministry tweeted. This is the third time in the current fiscal that GST collections have crossed the Rs 1-lakh-crore mark. Previously in April and October, the collections had surpassed this milestone.

“Robust Economy: Gross GST Revenue in Jan 2019 crossed Rs 1 lakh crore... This has been achieved despite huge reduction in tax rates for various items benefiting poor, farmers & middle class,” finance minister Piyush Goyal tweeted.

PwC India partner & leader, indirect tax, Pratik Jain said it comes as a welcome relief for the government, particularly after some dip in the last month. “This again underlines that collections are increasing steadily as compliances are getting simplified, rates are getting reduced and administration is getting sharper. It’s clear that overall collection for the entire year would be significantly lower than what was budgeted,” Jain said.

“Robust Economy: Gross GST Revenue in Jan 2019 crossed Rs 1 lakh crore... This has been achieved despite huge reduction in tax rates for various items benefiting poor, farmers & middle class,” finance minister Piyush Goyal tweeted.

PwC India partner & leader, indirect tax, Pratik Jain said it comes as a welcome relief for the government, particularly after some dip in the last month. “This again underlines that collections are increasing steadily as compliances are getting simplified, rates are getting reduced and administration is getting sharper. It’s clear that overall collection for the entire year would be significantly lower than what was budgeted,” Jain said.

Download The Times of India News App for Latest Business News.

All Comments ()+^ Back to Top

Refrain from posting comments that are obscene, defamatory or inflammatory, and do not indulge in personal attacks, name calling or inciting hatred against any community. Help us delete comments that do not follow these guidelines by marking them offensive. Let's work together to keep the conversation civil.

HIDE