Small funds, big returns: Things to know

Sanket Dhanorkar | ET Bureau | Updated: Jan 28, 2019, 16:21 ISTHighlights

- Many small funds have given better risk-adjusted returns compared to their larger peers

- A small fund can manoeuvre its portfolio better compared to a large-sized fund

(Representative image)

(Representative image)NEW DELHI: Small may be beautiful, but it seems size alone matters to mutual fund advisers and distributors. Even though several small-sized schemes have delivered stellar returns, advisers and distributors recommend only schemes promoted by established players or funds that have assumed a certain size. “Most schemes below a certain size fly below the radar as large distributors, such as banks, have limits on the size of the funds they recommend,” says Kaustubh Belapurkar, director, fund research, Morningstar Investment Advisor.

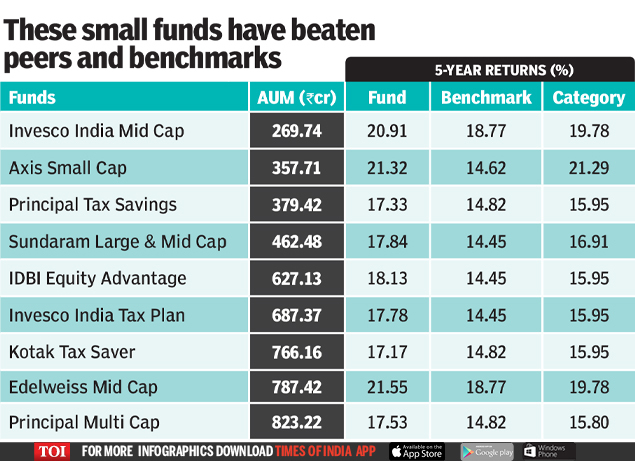

The numbers show the extent of the indifference to the Cinderalla funds. Invesco India Mid Cap Fund has been a strong performer over the years and is the best performing mid-cap scheme on 10-year returns. An investment of ₹10,000 made 10 years ago would now be worth over ₹84,000. Yet the fund has an AUM of only ₹270 crore, which is a tiny fraction of the total AUM of the mid-cap category. Axis Small Cap Fund was the best performing small-cap scheme in 2018, but its AUM is only ₹358 crore. This clearly indicates that advisers shy away from recommending well-performing schemes to clients just because of their small size.

Bigger funds usually hit headlines and get advertised more because fund houses like to flaunt their gigantic AUMs and lengthy track record.

It is also not surprising that the top 10 fund houses in the country by asset size account for 81% of the total assets of equity mutual funds in India, while the bottom 20 manage just 3.4%.

We have identified nine diversified equity schemes that are punching above their weight. These schemes have delivered healthy risk-adjusted returns over the past five years, but are yet to see high inflows like their larger counterparts. All of them have an AUM of less than ₹1,000 crore. Investors looking to diversify their portfolios may consider adding these schemes.

Being small has its own advantages. A small fund can manoeuvre its portfolio better and change tack faster than a large-sized fund. Any position that a small-sized fund, particularly from the mid- or small-cap categories, takes in a company is tiny relative to the company’s total market value. As the size of the bet is small, the fund manager can quickly enter into or exit from the position without having to worry about the liquidity in that counter or its cost impact. Larger funds, on the other hand, tend to stagger their entry and exit from stocks as they have large positions.

Mind you, a small corpus does not mean that the fund house lacks credibility or expertise. Schemes from midsized fund houses often get moderate inflows simply because their distribution is not supported by banking franchises as is the case with most larger players.

Experts insist that the size of a fund should not matter as long as its performance is consistent and the investor is comfortable with its risk profile. They should see if a fund has delivered superior risk-adjusted returns over different market cycles. If the long-term returns of a fund are not impressive, it should be avoided, irrespective of its size.

At the same time, the performance should not be seen in isolation. “If a small-sized fund does well, find out the reasons behind it. The scheme is worth investing in provided the performance is due to a consistent investing philosophy and not because the fund manager took undue risk,” says Amol Joshi, Founder, PlanRupee Investment Services.

(With Sameer Bhardwaj)

The numbers show the extent of the indifference to the Cinderalla funds. Invesco India Mid Cap Fund has been a strong performer over the years and is the best performing mid-cap scheme on 10-year returns. An investment of ₹10,000 made 10 years ago would now be worth over ₹84,000. Yet the fund has an AUM of only ₹270 crore, which is a tiny fraction of the total AUM of the mid-cap category. Axis Small Cap Fund was the best performing small-cap scheme in 2018, but its AUM is only ₹358 crore. This clearly indicates that advisers shy away from recommending well-performing schemes to clients just because of their small size.

Bigger funds usually hit headlines and get advertised more because fund houses like to flaunt their gigantic AUMs and lengthy track record.

It is also not surprising that the top 10 fund houses in the country by asset size account for 81% of the total assets of equity mutual funds in India, while the bottom 20 manage just 3.4%.

We have identified nine diversified equity schemes that are punching above their weight. These schemes have delivered healthy risk-adjusted returns over the past five years, but are yet to see high inflows like their larger counterparts. All of them have an AUM of less than ₹1,000 crore. Investors looking to diversify their portfolios may consider adding these schemes.

Being small has its own advantages. A small fund can manoeuvre its portfolio better and change tack faster than a large-sized fund. Any position that a small-sized fund, particularly from the mid- or small-cap categories, takes in a company is tiny relative to the company’s total market value. As the size of the bet is small, the fund manager can quickly enter into or exit from the position without having to worry about the liquidity in that counter or its cost impact. Larger funds, on the other hand, tend to stagger their entry and exit from stocks as they have large positions.

Mind you, a small corpus does not mean that the fund house lacks credibility or expertise. Schemes from midsized fund houses often get moderate inflows simply because their distribution is not supported by banking franchises as is the case with most larger players.

Experts insist that the size of a fund should not matter as long as its performance is consistent and the investor is comfortable with its risk profile. They should see if a fund has delivered superior risk-adjusted returns over different market cycles. If the long-term returns of a fund are not impressive, it should be avoided, irrespective of its size.

At the same time, the performance should not be seen in isolation. “If a small-sized fund does well, find out the reasons behind it. The scheme is worth investing in provided the performance is due to a consistent investing philosophy and not because the fund manager took undue risk,” says Amol Joshi, Founder, PlanRupee Investment Services.

(With Sameer Bhardwaj)

Download The Times of India News App for Latest Business News.

All Comments ()+^ Back to Top

Refrain from posting comments that are obscene, defamatory or inflammatory, and do not indulge in personal attacks, name calling or inciting hatred against any community. Help us delete comments that do not follow these guidelines by marking them offensive. Let's work together to keep the conversation civil.

HIDE