Gujarat has 4 years to bridge Rs 10,296 cr gap

TNN | Updated: Jan 29, 2019, 10:23 IST Representative image

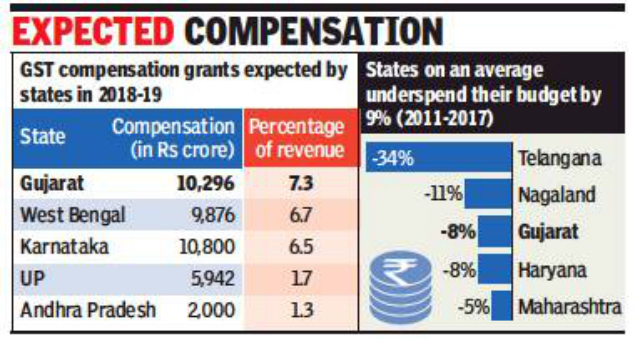

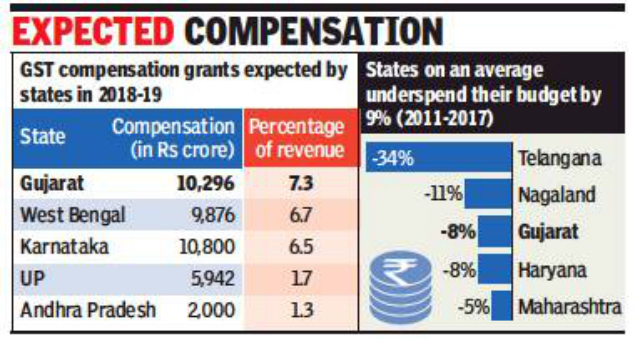

Representative imageAHMEDABAD: From this budget year, the countdown to Gujarat’s Goods and Services Tax (GST) compensation package has begun. Today, the state receives the highest percentage of compensation among 15 major states — which is close to 7.3% of the state’s revenue receipts since the state’s GST Act came into force. This annual aid is valid only for five years. By another four years, Gujarat will have to close this gap of Rs 10,296 crore with additional avenues of earning revenue.

Apart from Gujarat, the compensation gap is significant in states like Karnataka, and West Bengal (6.5%-6.7%) of their revenue receipts. When petroleum products are brought under GST, the gap can widen.

In Gujarat Value Added Tax (VAT) levied on petrol and diesel, as on November 1, 2008, is 22%. Thus, if GST is levied on petrol and diesel, the Centre’s revenue will come from a levy of 14% CGST, which is eight percentage points lower than the present rate in case of both petrol and diesel. This fact has emerged from a detailed budget analysis by PRS Legislative Research, a Delhi-based policy think-tank.

The report, ‘State of state finances’ states, “GST reduces states’ flexibility on their receipts. In 2018-19, transfers from the Centre are estimated to make 48% of states’ revenue. With implementation of GST, the autonomy of states is expected to reduce on an additional 17% of their revenue.” The report further adds, “The decision-making power of states will be limited to 35% of their revenue. However, several states have seen a boost in revenue as the Centre has guaranteed 14% annual growth on the taxes subsumed by GST for a period of five years.”

The report further adds that between 2011 and 2019, on average, 56% of revenue receipts of states have come from their own revenue, and 44% from central transfers. “There are variations across states. The contribution of own revenue is significantly higher (more than 70% of total state receipts) in states such as Gujarat (73%), Goa (75%), Haryana (79%), Kerala (72%), Maharashtra (76%), Punjab (73%), and Tamil Nadu (72%). On the other hand, states such as Bihar, Jammu and Kashmir, and the northeastern states depend on central transfers for most of their revenue.

Apart from Gujarat, the compensation gap is significant in states like Karnataka, and West Bengal (6.5%-6.7%) of their revenue receipts. When petroleum products are brought under GST, the gap can widen.

In Gujarat Value Added Tax (VAT) levied on petrol and diesel, as on November 1, 2008, is 22%. Thus, if GST is levied on petrol and diesel, the Centre’s revenue will come from a levy of 14% CGST, which is eight percentage points lower than the present rate in case of both petrol and diesel. This fact has emerged from a detailed budget analysis by PRS Legislative Research, a Delhi-based policy think-tank.

The report, ‘State of state finances’ states, “GST reduces states’ flexibility on their receipts. In 2018-19, transfers from the Centre are estimated to make 48% of states’ revenue. With implementation of GST, the autonomy of states is expected to reduce on an additional 17% of their revenue.” The report further adds, “The decision-making power of states will be limited to 35% of their revenue. However, several states have seen a boost in revenue as the Centre has guaranteed 14% annual growth on the taxes subsumed by GST for a period of five years.”

The report further adds that between 2011 and 2019, on average, 56% of revenue receipts of states have come from their own revenue, and 44% from central transfers. “There are variations across states. The contribution of own revenue is significantly higher (more than 70% of total state receipts) in states such as Gujarat (73%), Goa (75%), Haryana (79%), Kerala (72%), Maharashtra (76%), Punjab (73%), and Tamil Nadu (72%). On the other hand, states such as Bihar, Jammu and Kashmir, and the northeastern states depend on central transfers for most of their revenue.

All Comments ()+^ Back to Top

Refrain from posting comments that are obscene, defamatory or inflammatory, and do not indulge in personal attacks, name calling or inciting hatred against any community. Help us delete comments that do not follow these guidelines by marking them offensive. Let's work together to keep the conversation civil.

HIDE