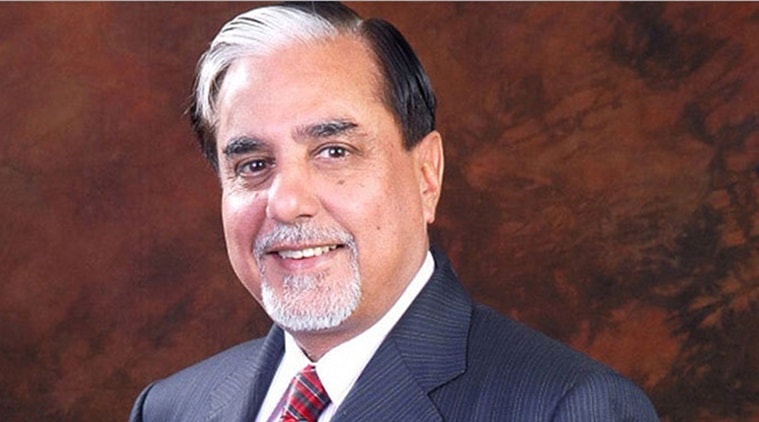

FACING repayment pressure on an estimated debt of Rs 20,000 crore, Zee and Essel Group chairman Subhash Chandra Friday apologised to his “bankers, NBFCs and mutual funds” for not living up to their expectations “despite the best of my intentions”.

In an open letter, hours after Zee’s flagship company Zee Entertainment’s share crashed over 25 per cent alongside a fall in other listed companies of his group, Chandra blamed certain “negative forces” for attacking the share price and “sabotaging Zee Entertainment’s strategic sale process.”

He also blamed the IL&FS meltdown which he said halted roll-overs and diminished the group’s ability to service its borrowings. He admitted that his business calls on infrastructure and purchase of Videocon’s D2H have weighed heavily on the group’s financial health.

Market experts said that while Chandra claimed the fundamentals of his flagship company are intact, the letter betrays a sense of panic and Chandra could be staring at the possibility of losing control of the company if the pledged shares are sold by the lenders. Chandra reiterated that “all operating companies, especially our most precious one which is Zee Entertainment, are performing exceptionally well and are under no stress whatsoever. The debt burden is purely at the promoter level, which is reflecting negatively on the companies.”

In the quarter ending December 2018, Zee Entertainment (with market cap of Rs 30,600 crore on Friday), announced a 65 per cent jump in its net profit at Rs 603 crore, on a revenue of Rs 1930 crore, which also grew 24 per cent.

Chandra blamed himself for not taking the right call on his infrastructure projects saying that could have saved him from bleeding Rs 4,000 crore to Rs 5,000 crore. He also blamed himself for the D2H acquisition from Videocon and said that it cost him and his brother “a fortune”.

Earlier in an analyst concall, the group accepted that it has an overall debt of around Rs 20,000 crore but said that it is close to selling projects worth Rs 20,000 crore.

An analyst, however, confirmed that of the Rs 20,000 crore the company plans to raise from selling its projects, almost 60 per cent or Rs 12,000 crore would be utilised to repay debt related to these projects and the balance to release pledged shares.

“These are just plans…The group has been planning to sell Zee Entertainment for some time now,” said a top official with a leading mutual fund.

While Chandra said that he was in London this week and returned Thursday night after a series of “positive meetings” with potential suitors, a fund manager said the company needs to act fast and look to conclude the planned strategic sale.

In his letter, he urged lenders not to react in “an anarchical manner and maintain patience” until the process of Zee Entertainment’s stake sale is completed. “Post-sale process, we will be positively able to repay the entire dues, but if the lenders react in panic, it will only hurt them and us,” he warned and claimed that he is not desirous of keeping a “single rupee” and that no promoter ever has decided to sell his “jewel crown” in face of financial troubles as he is trying to do.

The promoter’s holding in Zee Entertainment is 41.6% of which 59.3% is pledged.