Written by Liz Alderman

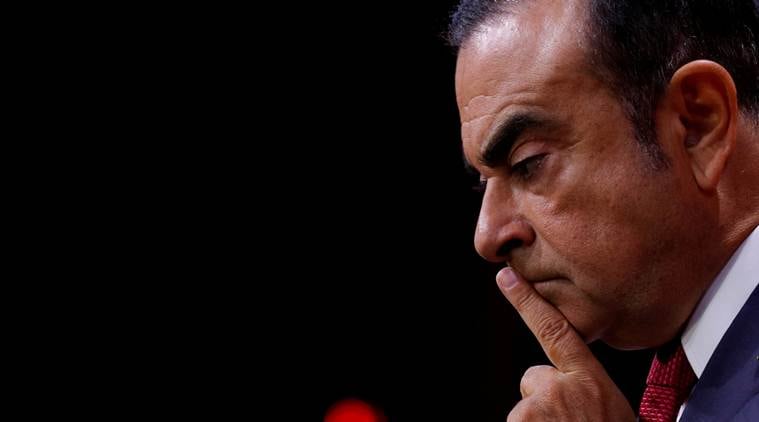

After standing by Carlos Ghosn since his arrest in Japan two months ago, French automaker Renault is preparing to replace its longtime leader on Thursday, turning its focus to securing the future of the world’s biggest auto alliance.

Renault’s lawyers are negotiating with Ghosn over whether he will resign as chief executive and chairman of Renault or be removed, and the company is calculating the retirement pensions and other remuneration to which he is entitled, according to a person with knowledge of the situation who spoke on the condition of anonymity because he was not authorized to discuss it publicly. The preference at Renault is for Ghosn to step down, to remove any legal uncertainty over his role, although he would remain a member of the board until a meeting of general shareholders in June.

The push for a leadership change comes after the French government, the largest shareholder in Renault, turned up pressure on the company to cut ties with Ghosn to focus on strengthening its alliance with Japanese automakers Nissan and Mitsubishi. The partnership has employees around the world, and Renault, with over 47,000 workers, is one of France’s biggest employers. Bruno Le Maire, France’s finance minister, said last week that preserving jobs was a “priority.”

Renault’s nomination committee is expected to recommend Jean-Dominique Senard, chief executive of French tire maker Michelin, as chairman of the board, the person said, and Thierry Bolloré, Renault’s chief operating officer, as chief executive. Bolloré has filled in for Ghosn since he was arrested in November on accusations of financial misconduct at Japanese automaker Nissan, where he was also chairman.

Renault installed temporary leadership but kept Ghosn officially at the helm even as Nissan and Mitsubishi Motors fired him as chairman. “We now must move to a new phase,” Le Maire said last week.

After replacing Ghosn, Renault plans to intensify efforts to repair the acrimonious rift that opened with Nissan, the dominant partner in the alliance, after his arrest. Since then, each company has viewed the other as trying to seize the opportunity to tip the balance of power in its favor. Ghosn was the dominant personality who held the alliance together, overseeing the operation and performance of the three companies simultaneously.

Addressing the leadership crisis may fall mainly to Senard, a veteran industrialist known in France for his no-nonsense management style. He will need to “install a climate of confidence between all the parties,” said Ollivier Lemal, managing director for France of the management consulting firm EIM.

“The key issue is not so much the leadership of Renault, but who is going to lead, manage and develop the alliance,” he said. “And for that, you need someone who is going to devote all his time and energy to restore dialogue between the manufacturers.”

The replacement of Ghosn at Renault would be a turning point in the dramatic saga of one of the most powerful executives in the auto industry. Over two decades, he built one of the world’s most successful groups in the sector by reviving Nissan and Renault, an alliance that later expanded to include Mitsubishi Motors.

A Japanese court declined again Monday to release Ghosn on bail, making it likely he will remain in prison for months until his trial. Prosecutors seized Ghosn aboard his private jet after it landed at a Tokyo airport on Nov. 19. He has since been indicted on multiple charges of hiding more than $80 million in compensation while chairman of Nissan, and of improperly transferring personal losses to Nissan’s books. He has denied all the charges.

Last week, Mitsubishi Motors also accused Ghosn of financial wrongdoing, saying he had secretly received compensation of 7.8 million euros, or almost $9 million, from a joint venture of the two automakers. Renault has said an internal review turned up no issues with Ghosn’s compensation.

A chief concern of Renault and the French government is that Nissan may seek to even out the companies’ shareholding structure. Renault owns a 43 percent stake in Nissan, while Nissan holds a 15 percent share in Renault that does not carry voting rights, a situation the Japanese automaker has expressed discomfort with for years.

Last week, Hiroto Saikawa, Nissan’s chief executive, dismissed as “absurd” reports that his company had plotted to oust Ghosn, and refrained from discussing rebalancing power in the alliance.

At the same time, Saikawa declined a request by Bolloré to urgently fill two of the three seats Renault holds on the Nissan board, left empty by the arrests of Ghosn and Greg Kelly, a top aide to Ghosn who was indicted on charges of having helped his boss conceal income. His deferral of the matter until a Nissan board meeting in March fanned concerns in Paris that the Japanese company was maneuvering to prevent Renault from participating in alliance decision-making at a crucial moment.

In an unusual move, French government officials flew to Tokyo to weigh in. Martin Vial, one of two French government representatives on the Renault board, and Emmanuel Moulin, the chief of staff for Le Maire, the finance minister, met last week with Japanese officials and Nissan stakeholders.

Soon after the visit, Japanese news outlets reported that France was seeking to compel a merger between Nissan and Renault, prompting a heated denial by Le Maire. “No shareholding rebalancing or modification of cross shareholdings between Renault and Nissan are on the table,” he said in an interview published Sunday in the French weekly Le Journal du Dimanche.

A spokeswoman for the Finance Ministry added that Ghosn had an explicit mandate from Renault shareholders to “strengthen and consolidate the alliance.” “Right now, the priority is ensuring the stable and solid governance of the alliance and managing forthcoming changes,” she said. “There will be a dialogue about other issues. This is a step-by-step process.”

Renault has maintained that the No. 1 priority is to smooth strained relations with Saikawa and Nissan, strengthen the alliance and move past the governance fiasco to focus on the carmakers’ performance at a time when markets worldwide are showing signs of weakness.

It is a challenge that Senard, 66, the longtime leader of Michelin, would take up immediately if he is confirmed as chairman of the Renault board. The son of a diplomat and a meticulous businessman who steers clear of the limelight, he is a striking contrast to Ghosn, a prominent executive whose success imbued him with a rock-star image. Senard was scheduled to step down from Michelin in May to make way for a successor there.

Demand for cars is falling in China, the United States and Europe, the three biggest markets, and the partnership that Renault and Nissan founded in 1999 to share buying power and expertise is essential if they, and Mitsubishi, are to stay competitive, analysts say. To succeed, the companies will have to act quickly to put their differences behind them.

In a nod to the importance of scale, Ford Motor and Volkswagen announced plans last week to build their own broad alliance, to speed the development of electric and self-driving cars, possibly adding to competition for the Renault-Nissan-Mitsubishi group.

Renault still relies on financial contributions from Nissan, the alliance’s dominant performer, and some Renault officials have expressed concern that Nissan’s sales and financial performance are slipping.