With a sharp decline in awarding highway projects, primarily due to challenges in raising funds in the Hybrid Annuity Model (HAM) space, the Union government may prefer engineering, construction and procurement (EPC) model to push through its Bharatmala programme.

After the failure of Build-Operate-Transfer (BOT) model, the government was relying on EPC model to award highway projects.

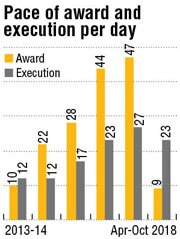

As per the latest report by Care Ratings on the Indian road sector, a decline in awarding of projects is expected during the ongoing fiscal over the previous one.

Already, there is a slowdown in project awards by the National Highways Authority of India (NHAI) and the Ministry of Road Transport & Highways.

Due to high award activity, the construction pace had shot up, but it resulted in an early slowdown in awarding HAM projects.

Due to high award activity, the construction pace had shot up, but it resulted in an early slowdown in awarding HAM projects.

"EPC would be the preferred mode of award till improvement in fundraising environment and bidding appetite of developers. Sponsors with demonstrated execution capability are expected to complete the ongoing HAM projects within time or ahead of schedule, which, in turn, is expected to boost the pace of execution for NHAI. However, quick action on the matter of descoping of unavailable land is crucial to enhance lender's confidence," said the Care report.

An analyst said the situation may not change for a few months after the Lok Sabha elections. "Till the time liquidity crisis in the Indian economy is not addressed, the challenges would remain," the expert said.

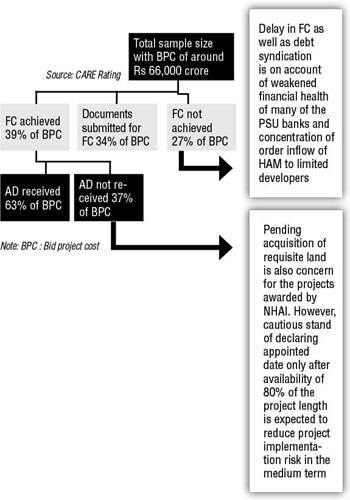

According to Care Ratings, effective implementation of contractual reforms under HAM, increase in time and cost for land acquisition and contraction in valuations of developers as well as EPC contractors are among the other concerns. There's also a concentration of order inflow of HAM to limited developers.

Care Ratings's analysis of sample bid project cost (BPC) of Rs 56,300 crore of HAM projects that have received appointed date has revealed that projects with around 15% of BPC have been delayed, with around half of them from the initial milestone itself. Delay in the execution is mainly attributed to weak or modest credit profile of sponsor and non-availability of land as well as clearances.

In another sample study of BPC aggregating of around Rs 66,000 crore showed that financial closure has not been achieved for 27% of BPC, while 37% of BPC have not received appointed date.

In another sample study of BPC aggregating of around Rs 66,000 crore showed that financial closure has not been achieved for 27% of BPC, while 37% of BPC have not received appointed date.

Last year, the finance ministry had rejected NHAI's proposal to go for an Infrastructure Investment Trust, or InvIT. Now, after the bumper success of maiden toll-operate-transfer (TOT) to monetise operational road assets, NHAI came up with the second package that gave a completely opposite response.

While the first TOT has been secured at 54% above the base price, the bidding appetite has reduced in second TOT with highest bidder quoting around 14% lower than the base valuation.

Vikash Kumar Sharda, Partner of Infranomics Consulting LLP concurs that HAM is going the BOT way. The BOT model went kaput just before the previous Lok Sabha elections as too many projects flooded the sector apart from actual traffic turning out to be lower than the estimates during bidding. "The NHAI may have to look to the EPC mode for highway construction in the coming years because many HAM projects are yet to achieve financial closure and bankers' resistance to finance small and new public-private project developers. However, funding could be a major constraint for EPC projects which can create Catch-22 situation for the government," Sharda