Videocon loan case: Former ICICI Bank CEO Chanda Kochhar named in CBI FIR

TIMESOFINDIA.COM | Updated: Jan 25, 2019, 11:34 ISTHighlights

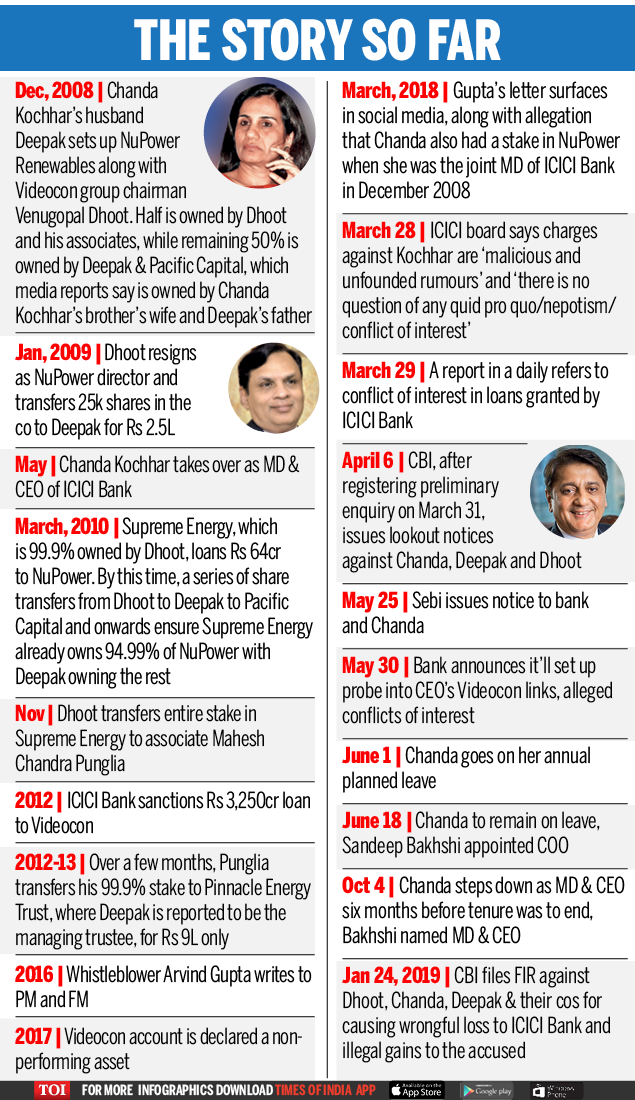

- It is alleged that Videocon chairman provided crores of rupees to a firm promoted by Deepak Kochhar and two relatives, six months after Videocon group got Rs 3,250 crore as loan from ICICI Bank in 2012

- The amount was part of the Rs 40,000-crore loan that Videocon group secured from a consortium of 20 banks led by SBI

Former ICICI Bank chief Chanda Kochhar (File photo)

NEW DELHI: The Central Bureau of Investigation (CBI) has named former ICICI Bank chief Chanda Kochhar, her husband Deepak Kochhar and Videocon chairman Venugopal Dhoot in its FIR. Ten months after it filed a preliminary enquiry (PE) to probe Kochhars' dealings with Videocon chief, CBI has registered a case in the matter.

Chanda Kochhar and others have been booked for criminal conspiracy, cheating and prevention of corruption act. It has been alleged that she sanctioned loans to private companies in a criminal conspiracy with other accused to cheat the ICICI Bank.

CBI said that total loans of Rs 1,575 crore given by ICICI Bank to the Videocon group had turned non-performing assets (NPAs). The agency will also probe the roles of top ICICI Bank officials including Sandeep Bakshi, K Ramkumar, Sonjoy Chatterjee, N S Kannan, Ms Zarin Daruwala, Rajiv Sabharwal, K V kamath and Homi Khusrokhan in its case.

CBI stated that Videocon was given credit facilities (loans) after Chanda Kochhar took over the charge of ICICI Bank as MD-CEO on May 1, 2009. She herself was one of the members in one of the sanctioning committees which sanctioned a loan of Rs 300 crores to Videocon International Electronics Ltd (VIEL) and Rs 750 crore to Videocon Industries Ltd (VIL).

CBI added that Chanda Kochhar got "illegal gratification" through her husband from Dhoot for sanctioning the loan. In all, ICICI Bank sanctioned six high value loans to various Videocon companies between June 2009 and October 2011.

The agency teams on Thursday carried raids at Videocon offices at Nariman Point, Mumbai and Aurangabad other than at Deepak Kochhar’s company NuPower Renewables Pvt Ltd (NRPL).

It is alleged that Dhoot provided crores of rupees to a firm promoted by Deepak Kochhar and two relatives, six months after Videocon group got Rs 3,250 crore as loan from ICICI Bank in 2012. The amount was part of the Rs 40,000-crore loan that Videocon group secured from a consortium of 20 banks led by SBI. Dhoot allegedly gave Rs 64 crore in 2010 through a fully owned entity to NRPL that he had set up with Deepak Kochhar and two of his relatives. It is alleged that he transferred proprietorship of the company to a trust owned by Deepak Kochhar for Rs 9 lakh, six months after he received the loan from ICICI Bank.

A PE is the first step to investigate an alleged act of corruption/fraud. As part of the procedure, the CBI collects material to determine if there is prima facie criminality requiring the registration of an FIR. If investigators conclude that there is not enough basis to register a regular case, the PE is closed after approval from the CBI director. The agency can file a PE on the basis of a complaint, on the directions of central/state governments/courts and also on its “source information report (SIR)”. There is no time frame to finish a probe registered as a PE.

During the enquiry, the agency had examined Chanda Kochhar’s brother in law Rajiv Kochhar, Deepak Kochhar, employees of Videocon, NRPL and ICICI Bank, sources said.

At the time of registration of PE, ICICI Bank had defended Chanda Kochhar and said it reposed “full faith” in her. It had also said there was no question or scope of any favouritism, nepotism or quid pro quo in the loans to Videocon.

However the matter snowballed into a controversy and led to Kochhar's exit from the bank.

Chanda Kochhar and others have been booked for criminal conspiracy, cheating and prevention of corruption act. It has been alleged that she sanctioned loans to private companies in a criminal conspiracy with other accused to cheat the ICICI Bank.

CBI said that total loans of Rs 1,575 crore given by ICICI Bank to the Videocon group had turned non-performing assets (NPAs). The agency will also probe the roles of top ICICI Bank officials including Sandeep Bakshi, K Ramkumar, Sonjoy Chatterjee, N S Kannan, Ms Zarin Daruwala, Rajiv Sabharwal, K V kamath and Homi Khusrokhan in its case.

CBI stated that Videocon was given credit facilities (loans) after Chanda Kochhar took over the charge of ICICI Bank as MD-CEO on May 1, 2009. She herself was one of the members in one of the sanctioning committees which sanctioned a loan of Rs 300 crores to Videocon International Electronics Ltd (VIEL) and Rs 750 crore to Videocon Industries Ltd (VIL).

CBI added that Chanda Kochhar got "illegal gratification" through her husband from Dhoot for sanctioning the loan. In all, ICICI Bank sanctioned six high value loans to various Videocon companies between June 2009 and October 2011.

The agency teams on Thursday carried raids at Videocon offices at Nariman Point, Mumbai and Aurangabad other than at Deepak Kochhar’s company NuPower Renewables Pvt Ltd (NRPL).

It is alleged that Dhoot provided crores of rupees to a firm promoted by Deepak Kochhar and two relatives, six months after Videocon group got Rs 3,250 crore as loan from ICICI Bank in 2012. The amount was part of the Rs 40,000-crore loan that Videocon group secured from a consortium of 20 banks led by SBI. Dhoot allegedly gave Rs 64 crore in 2010 through a fully owned entity to NRPL that he had set up with Deepak Kochhar and two of his relatives. It is alleged that he transferred proprietorship of the company to a trust owned by Deepak Kochhar for Rs 9 lakh, six months after he received the loan from ICICI Bank.

A PE is the first step to investigate an alleged act of corruption/fraud. As part of the procedure, the CBI collects material to determine if there is prima facie criminality requiring the registration of an FIR. If investigators conclude that there is not enough basis to register a regular case, the PE is closed after approval from the CBI director. The agency can file a PE on the basis of a complaint, on the directions of central/state governments/courts and also on its “source information report (SIR)”. There is no time frame to finish a probe registered as a PE.

During the enquiry, the agency had examined Chanda Kochhar’s brother in law Rajiv Kochhar, Deepak Kochhar, employees of Videocon, NRPL and ICICI Bank, sources said.

At the time of registration of PE, ICICI Bank had defended Chanda Kochhar and said it reposed “full faith” in her. It had also said there was no question or scope of any favouritism, nepotism or quid pro quo in the loans to Videocon.

However the matter snowballed into a controversy and led to Kochhar's exit from the bank.

Download The Times of India News App for Latest Business News.

All Comments ()+^ Back to Top

Refrain from posting comments that are obscene, defamatory or inflammatory, and do not indulge in personal attacks, name calling or inciting hatred against any community. Help us delete comments that do not follow these guidelines by marking them offensive. Let's work together to keep the conversation civil.

HIDE