Loan sizes higher when women borrow

Rachel Chitra | TNN | Updated: Jan 23, 2019, 12:18 ISTHighlights

- When it came to car-buying patterns, the data shows that when a woman is the primary loan applicant, they tend to steer away from big-ticket car purchases

- Male borrowers borrowed up to Rs 49.9 lakh for a car, whereas the highest female car loan ticket size was Rs 12.9 lakh

(Representative image)

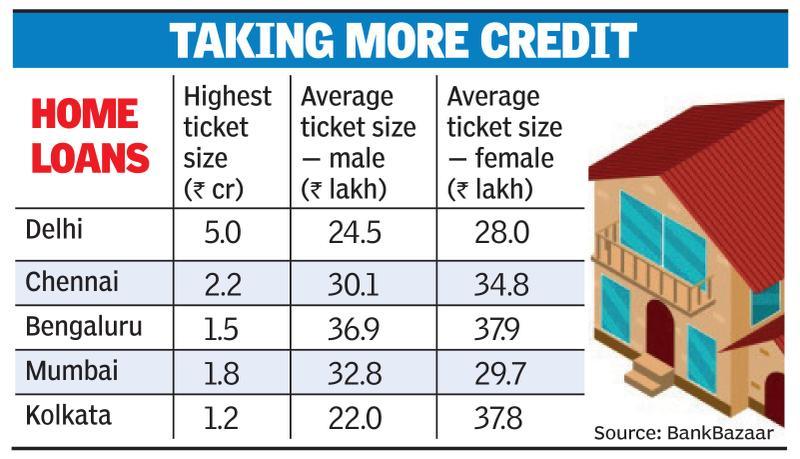

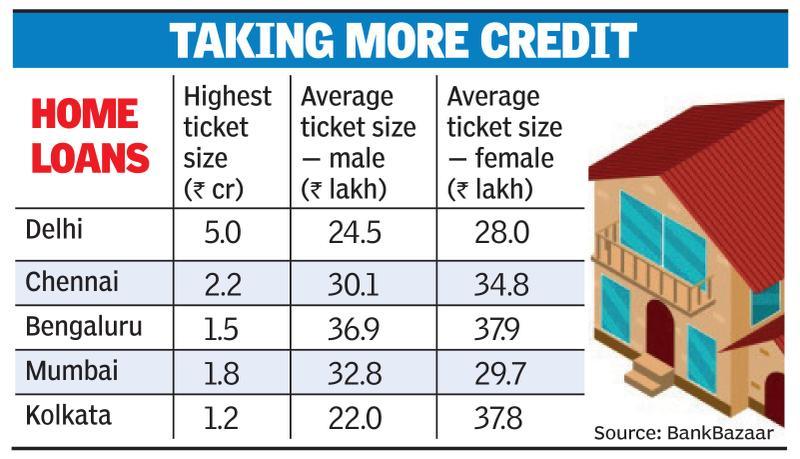

(Representative image)BENGALURU: The average ticket size of a home loan when women borrow is significantly higher (Rs 27 lakh) than when a man borrows (just under Rs 23 lakh), according to data from 1.6 million loan applications in 2018 on BankBazaar, one of India’s biggest online financial services aggregators.

BankBazaar CEO Adhil Shetty said the higher loan amount when a woman applies could indicate it’s a household with two incomes, unlike when a male applies, where he could be the only breadwinner. Banks also have special loan offers for women, with interest rates many basis points (100bps = 1 percentage point) lower than for men.

When it came to car-buying patterns, the data shows that when a woman is the primary loan applicant, they tend to steer away from big-ticket car purchases. Male borrowers borrowed up to Rs 49.9 lakh for a car, whereas the highest female car loan ticket size was Rs 12.9 lakh.

But in terms of the average car loan size taken by women, it’s significantly higher (Rs 5.5 lakh) than when men are the sole applicants (Rs 5.3 lakh). “Again, I think when women apply, they are an indicator of a double-income household,” said Shetty.

This trend of women boosting the household’s purchasing capacity could be seen across metros. The average ticket size of home loans in Delhi for women borrowers was Rs 28 lakh, compared to male borrowers at Rs 24.5 lakh. In Bengaluru, women borrowed Rs 37.9 lakh — higher than men at Rs 36.9 lakh, and in Chennai women borrowed Rs 34.8 lakh compared to men at Rs 30.1 lakh. However, the situation was the opposite in Mumbai, where men borrowed more in home loans at an average of Rs 32.8 lakh compared to women at Rs 29.7 lakh.

For personal loans, women seem to borrow less than men. The average ticket size for female applicants was Rs 2.7 lakh, compared to men who borrowed Rs 2.8 lakh.

Women seem to now have the firepower for globe-trotting just as much as men — women’s applications for travel credit cards grew 73%, slightly higher than male applications that increased 71.5%. In lifestyle credit cards too, applications from women grew at a 10.5% rate, compared to men at 8%.

BankBazaar CEO Adhil Shetty said the higher loan amount when a woman applies could indicate it’s a household with two incomes, unlike when a male applies, where he could be the only breadwinner. Banks also have special loan offers for women, with interest rates many basis points (100bps = 1 percentage point) lower than for men.

When it came to car-buying patterns, the data shows that when a woman is the primary loan applicant, they tend to steer away from big-ticket car purchases. Male borrowers borrowed up to Rs 49.9 lakh for a car, whereas the highest female car loan ticket size was Rs 12.9 lakh.

But in terms of the average car loan size taken by women, it’s significantly higher (Rs 5.5 lakh) than when men are the sole applicants (Rs 5.3 lakh). “Again, I think when women apply, they are an indicator of a double-income household,” said Shetty.

This trend of women boosting the household’s purchasing capacity could be seen across metros. The average ticket size of home loans in Delhi for women borrowers was Rs 28 lakh, compared to male borrowers at Rs 24.5 lakh. In Bengaluru, women borrowed Rs 37.9 lakh — higher than men at Rs 36.9 lakh, and in Chennai women borrowed Rs 34.8 lakh compared to men at Rs 30.1 lakh. However, the situation was the opposite in Mumbai, where men borrowed more in home loans at an average of Rs 32.8 lakh compared to women at Rs 29.7 lakh.

For personal loans, women seem to borrow less than men. The average ticket size for female applicants was Rs 2.7 lakh, compared to men who borrowed Rs 2.8 lakh.

Women seem to now have the firepower for globe-trotting just as much as men — women’s applications for travel credit cards grew 73%, slightly higher than male applications that increased 71.5%. In lifestyle credit cards too, applications from women grew at a 10.5% rate, compared to men at 8%.

Download The Times of India News App for Latest Business News.

All Comments ()+^ Back to Top

Refrain from posting comments that are obscene, defamatory or inflammatory, and do not indulge in personal attacks, name calling or inciting hatred against any community. Help us delete comments that do not follow these guidelines by marking them offensive. Let's work together to keep the conversation civil.

HIDE