Kotak Mahindra Bank under the able guidance of a strong leadership team adopts the best risk weighted growth strategy in the industry

Kotak Mahindra Bank (KMB) delivered in line performance that left little room for complaint.

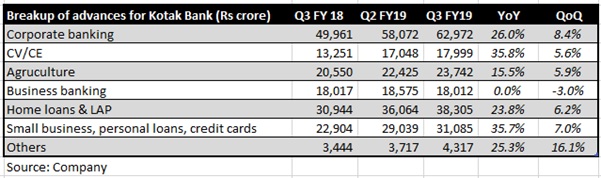

Key positives- Business momentum remains strong: Advances grew 23.5% year-on-year driven by corporate as well as retail segments. This is the sixth consecutive quarter of over 20% growth and the management feels confident of maintaining this momentum

- The bank is witnessing a return of loan pricing power and has experienced a 13 basis points sequential improvement in interest margin to 4.33%. The outlook on margin is positive thanks to the waning competitive intensity and the management’s relentless focus on reducing funding costs

- The deposit profile is extremely impressive with the bank having industry leading CASA (low cost current and savings account) ratio of 50.7%. In the quarter under review, while overall deposits grew by 18.2%, CASA grew much faster at 28.5%

- Core fee grew by over 25% despite softness in distribution fees as business related fees grew well

- Asset quality remained pristine with gross and net NPA at 2.07% and 0.71%, respectively, and provision cover (provision held against non-performing assets) at 66%. Slippages at Rs 345 crore was much lower than Rs 422 crore that was witnessed in the year ago quarter

- Its life insurance arm reported a healthy margin as well as growth. The asset management business too showed a jump in profit on discontinuation of upfront commission to distributors post the regulatory directive.

- The bank is extremely well-capitalised with capital adequacy ratio of 18.1% (Tier I: 17.6%) to take advantage of emerging opportunities

- The capital market-linked subsidiaries like securities and investment banking had a soft last quarter due to subdued sentiment in the capital market

- Its non-banking finance company too felt the impact of the NBFC crisis and had a relatively subdued showing

- Falling interest rates led to revaluation of pension liabilities and the company also incurred additional operating expenses (on advertising etc) that led to a spike in its cost to income ratio to 50.33% on a reported basis

- Overhang of RBI’s directive for diluting promoter stake from the current level of over 30% to 20%. The deadline of December 31, 2018 has expired and the matter is currently sub judice.

Key observations- The MD sounded cautious on three sectors: residential real estate, NBFCs and housing finance companies as well as small & medium enterprises (SME)

- The bank sees early signs of caution in the loan against property market

OutlookKMB under the able guidance of a strong leadership team adopts the best risk weighted growth strategy in the industry. It is, therefore, likely to face the upcoming tumult in the macro as well as political environment well. We see potential for a substantial value unlocking from its subsidiaries. Despite the optically heady valuation (3.7 times its estimated FY20 core banking book), we feel the bank is an ideal core holding for investors for a long term multi-year compounding journey.