Mindtree gets battle-ready as Siddhartha finalises his exit

Boby Kurian, Shilpa Phadnis | TNN | Updated: Jan 21, 2019, 11:23 IST Coffee Day founder V G Siddhartha (File photo)

Coffee Day founder V G Siddhartha (File photo)MUMBAI/BENGALURU: Coffee Day founder V G Siddhartha is set to sell his 21% shareholding in Mindtree, triggering a takeover move on the Bengaluru-based mid-tier IT services company. Siddhartha is in advanced talks with L&T Infotech, KKR, Baring Private Equity Partners Asia and Prem Watsa’s Fairfax and is expected to conclude a deal with one of them in the next 10 days, people directly aware of the matter said.

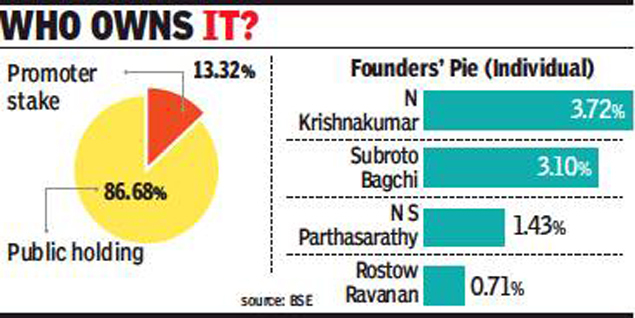

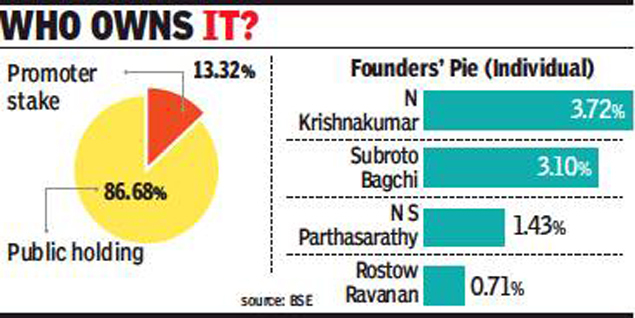

Siddhartha, the largest shareholder of Mindtree, decided to cash out after monthslong wait to carry the founders along as part of a broader M&A deal. The four founders-—Subroto Bagchi, N S Parthasarathy, Krishnakumar Natarajan and CEO Rostow Ravanan, who together own around 13%—have rebuffed plans to sell or merge Mindtree to buyout funds or rival IT companies.

It left Siddhartha, who seed-funded and anchored the company as a passive investor for nearly 20 years, to script his own exit plans. This not only throws open Mindtree to all possibilities, including ‘hostile’ moves, but has serious ramifications for the company’s public shareholders and their wealth.

Most potential acquirers have indicated that they would offer a lower price, if founders are not part of the deal and management control doesn’t come along. The buyer would then acquire Siddhartha’s stake and mop up some more from the stock markets to trigger an open offer, besides calling shareholders’ meet to rejig the board. “If it delivers management rights, the offer price would be significantly higher. It would slightly lag prevailing price otherwise,” said a person involved with the developments but speaking in private citing confidentiality clauses.

Mindtree shares have perked up in recent days and ended at Rs 889 apiece on Friday, giving the company a market value of over $2 billion.TOIreported on December 17 that Siddhartha’s exit could trigger takeover jitters for Mindtree. Siddhartha did not respond to calls and text messages over the weekend. Mindtree spokesperson said, “This is a speculative report. As a matter of policy, the company does not comment on speculation.”

But founders showed no signs of giving up and reiterated plans to retain control in last week’s investor call following the latest quarterly results. Mindtree, like its bigger peer Infosys, has a tradition of passing the baton to all the founders to steer the company as chief executive. Ravanan, still in his late 40s, would be the last in the line of founders to lead the company.

Founders have repeatedly argued that hostile takeovers don’t work in outsourcing business. They think Mindtree should not be dragged into Siddhartha’s exit as it must just be a case of one shareholder talking to another potential investor. But one of the suitors said not many investors would be willing to be passive partners like Siddhartha, whom he, in a lighter vein, called the longest running angel investor for Mindtree. The next option would be to gain the backing of a large investor without needing too much control. KKR has had multiple direct conversations with founders but it isn’t clear if the latter were comfortable with some of the conditions put forth by the marquee American investor.

An L&T team, led by its group chief executive S N Subrahmanyan, met with Mindtree founders on Friday to pitch for a deal but the talks didn’t yield any breakthrough, sources said. L&T tried to impress upon the synergistic fit and how the deal would provide a stable, bigger platform for Mindtree employees.

Siddhartha, the largest shareholder of Mindtree, decided to cash out after monthslong wait to carry the founders along as part of a broader M&A deal. The four founders-—Subroto Bagchi, N S Parthasarathy, Krishnakumar Natarajan and CEO Rostow Ravanan, who together own around 13%—have rebuffed plans to sell or merge Mindtree to buyout funds or rival IT companies.

It left Siddhartha, who seed-funded and anchored the company as a passive investor for nearly 20 years, to script his own exit plans. This not only throws open Mindtree to all possibilities, including ‘hostile’ moves, but has serious ramifications for the company’s public shareholders and their wealth.

Most potential acquirers have indicated that they would offer a lower price, if founders are not part of the deal and management control doesn’t come along. The buyer would then acquire Siddhartha’s stake and mop up some more from the stock markets to trigger an open offer, besides calling shareholders’ meet to rejig the board. “If it delivers management rights, the offer price would be significantly higher. It would slightly lag prevailing price otherwise,” said a person involved with the developments but speaking in private citing confidentiality clauses.

Mindtree shares have perked up in recent days and ended at Rs 889 apiece on Friday, giving the company a market value of over $2 billion.TOIreported on December 17 that Siddhartha’s exit could trigger takeover jitters for Mindtree. Siddhartha did not respond to calls and text messages over the weekend. Mindtree spokesperson said, “This is a speculative report. As a matter of policy, the company does not comment on speculation.”

But founders showed no signs of giving up and reiterated plans to retain control in last week’s investor call following the latest quarterly results. Mindtree, like its bigger peer Infosys, has a tradition of passing the baton to all the founders to steer the company as chief executive. Ravanan, still in his late 40s, would be the last in the line of founders to lead the company.

Founders have repeatedly argued that hostile takeovers don’t work in outsourcing business. They think Mindtree should not be dragged into Siddhartha’s exit as it must just be a case of one shareholder talking to another potential investor. But one of the suitors said not many investors would be willing to be passive partners like Siddhartha, whom he, in a lighter vein, called the longest running angel investor for Mindtree. The next option would be to gain the backing of a large investor without needing too much control. KKR has had multiple direct conversations with founders but it isn’t clear if the latter were comfortable with some of the conditions put forth by the marquee American investor.

An L&T team, led by its group chief executive S N Subrahmanyan, met with Mindtree founders on Friday to pitch for a deal but the talks didn’t yield any breakthrough, sources said. L&T tried to impress upon the synergistic fit and how the deal would provide a stable, bigger platform for Mindtree employees.

Download The Times of India News App for Latest Business News.

All Comments ()+^ Back to Top

Refrain from posting comments that are obscene, defamatory or inflammatory, and do not indulge in personal attacks, name calling or inciting hatred against any community. Help us delete comments that do not follow these guidelines by marking them offensive. Let's work together to keep the conversation civil.

HIDE