Best ways to save tax: Things to know

TNN | Updated: Jan 21, 2019, 18:41 ISTHighlights

- Find out which tax-saving instrument fulfils your requirements

(Representative image)

(Representative image)NEW DELHI: ELSS funds are the best way to save tax. Though the SIP window has closed for taxpayers who would have had to show proof of Sec 80C tax-saving investments by now, experts say one can still put money in 2-3 tranches into ELSS funds before the 31 March deadline.

It is important to note that not all ELSS funds carry the same risks. Some allocate more to small- and mid-cap stocks, while others stick with stable large-cap stocks. Choose the one that best suits your risk appetite.

ELSS funds have a lock-in of three years, the shortest among all tax-saving options.

ELSS is the best way to save tax for young taxpayers. They should stagger their investments with monthly SIPs.

ULIPs:

Even before the tax on capital gains was announced, Ulips had a distinct tax advantage over mutual funds. Ulips not only offer equity funds but also debt and liquid fund options to investors. Switching from equity to debt or vice versa does not have any tax implications. Short-term gains from debt funds and income from fixed deposits is taxed at the marginal rate while long-term capital gains from debt funds are taxed at 20% after indexation. But income from Ulips is tax free. The new Ulips launched by insurance companies are low on costs and compete with direct plans of mutual funds on charges.

A child Ulip secures a child’s long-term goals. If a parent dies, premium is waived and plan continues to invest.

Pension plans:

The popularity of the NPS has eclipsed pension plans from insurance firms. Investors in NPS get an additional deduction of ₹50,000 for contributions under Sec 80CCD(1b). More tax can be saved by contributing through the employer. However, pension plans from insurers are not eligible for these deductions. There are other problems too. The pension plans from insurance companies are still not very cheap. They have opaque structures and many charges are not clearly explained.

Pension plans are opaque and many of the charges are not clearly explained.

Insurance:

Traditional policies are not able to offer the insurance cover that a person actually needs. Experts say one should have a cover of at least 6-8 times his annual income. So, someone earning ₹50,000-60,000 a month at the age of 30 should have a life insurance cover of roughly ₹40-50 lakh. An endowment plan offering a cover of ₹40-50 lakh will cost the buyer almost ₹4-5 lakh per year. This is nearly 60-70% of his total income. However, a term cover for ₹1 crore will cost him just ₹7,000-8,000 a year, which will be only 1% of his income. Keep this math in mind when you go shopping for a tax-saving instrument this year.

Parents often suggest endowment plans to their kids, not realising that these can be a millstone around their kids’ necks.

National Pension Scheme:

Changes in investment and tax rules have just made the NPS more attractive. Firstly, the entire 60% of the corpus that can be withdrawn at the time of retirement will now be tax free.

Secondly, investors can now allocate up to 75% to equities in the active choice option of the NPS. You can also remain invested till the age of 70 and stagger your withdrawals.

NPS can help save tax under three different sections. Contributions of up to ₹1.5 lakh can be claimed as deduction under Sec 80C. An additional deduction of up to ₹50,000 is available under Sec 80CCD(1b). If your employer puts up to 10% of your basic salary in the NPS, that amount will not be taxable.

60% of the corpus that can be withdrawn at the time of retirement will now be tax free.

NSCs:

An interest rate of 8% make National Savings Certificates (NSCs) a good option for those who want to invest in a hurry. The interest earned on the NSC is eligible for deduction under Sec 80C in the following years. Suppose an investor buys ₹50,000 worth of NSCs in January 2019. A year later, the investment would have earned an interest of ₹4,000. The investor can claim deduction for this ₹4,000 for the year 2019-20.

The tax deduction on the interest effectively makes the NSC tax free for investors in the 5% tax bracket.

Bank FDs:

Tax-saving bank fixed deposits are a good choice for those who may have left their tax planning for the last minute. Though the interest rates are not as high as small savings instruments, these deposits offer the convenience of online banking. Senior citizen taxpayers who don’t want to stand in a queue in a post office will also find this useful.

But there is a high price for this convenience. The interest earned on bank deposits is fully taxable, which brings down the post-tax return for those in the higher income bracket. Please note that you cannot invest in a fixed deposit in somebody else’s name using your Netbanking account.

Bank FD interest rates are not as high as small savings instruments, but they offer the convenience of online banking.

Public Provident Fund:

PPF rates were hiked in October 2018 after a sustained rise in bond yields. Though bond yields subsequently came down in the third quarter of 2018-19, PPF rates have remained unchanged. Advisers say PPF remains a good bet because the interest is tax free, giving the small savings scheme a distinct advantage over fixed deposits. The interest from FDs is fully taxable, which brings down returns to just 5% in the highest tax bracket. Advisers also warn against bingeing on fixed income instruments. “If you already contribute to the Provident Fund, there is little utility in investing more in a fixed income option,” says Sudhir Kaushik, Co-founder, Taxspanner.

PPF scores high on safety, flexibility and ease of investment. An account can be opened in a post office or designated bank branches. Opt for a bank that allows online access to the account.

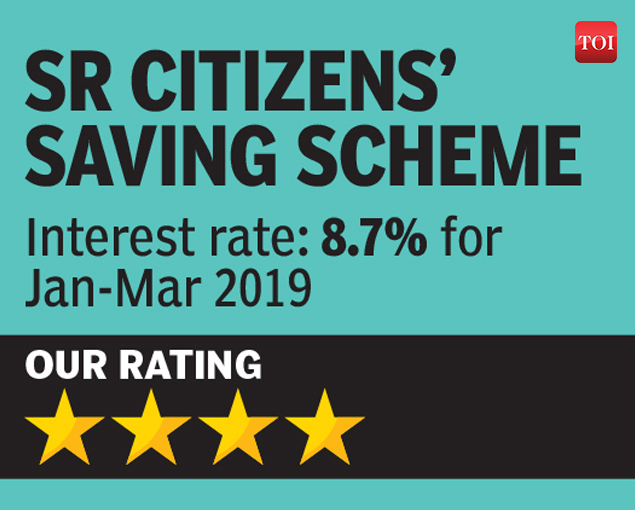

Senior citizens' saving scheme:

The Senior Citizens’ Savings Scheme (SCSS) was the best tax-saving option for those above 60, and last year’s Budget made it more attractive by offering seniors an additional ₹50,000 exemption on interest income. This means the overall tax exemption for those above 60 is now ₹3.5 lakh and for above 80 is ₹5.5 lakh.

The 8.7% offered by SCSS is the highest among all small savings schemes. The tenure of SCSS investment is five years, which is extendable by another three years. However, there is a ₹15 lakh overall investment limit. Also, the scheme is open mostly to investors above 60. If the investor has opted for voluntary retirement and not taken up another job, the minimum age is relaxed to 58.

Senior citizens get an additional ₹50,000 tax exemption for interest income.

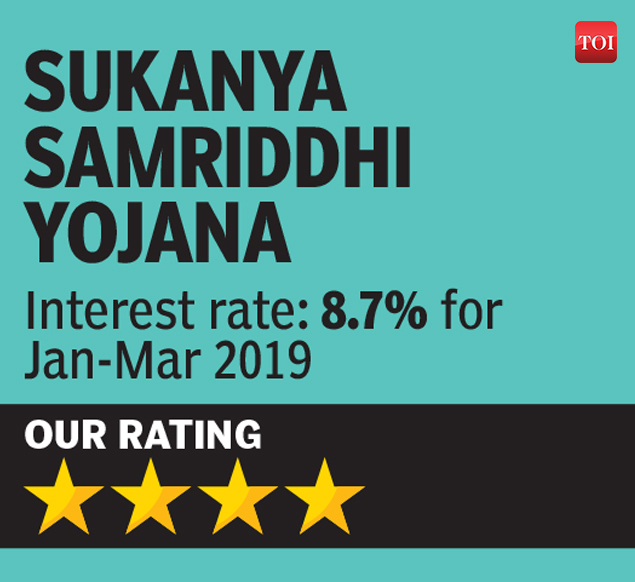

Sukanya Samriddhi Yojana:

For taxpayers with a daughter below 10 years, the Sukanya Samriddhi Yojana is a good way to save. The interest rate will be 8.5% till March and could change in April.

The Sukanya scheme offers a higher rate than the PPF. Just like the PPF, the interest earned is tax free and there is an annual cap of ₹1.5 lakh on the investment. Accounts can be opened in any post office or designated banks with a minimum investment of ₹1,000. A parent can open an account for a maximum of two daughters, but the combined investment in the two accounts cannot exceed ₹1.5 lakh in a year. The best part is that the account is opened in the name of the child and the maturity proceeds have to be used for her education and marriage.

The account is in the name of the girl child. It is her money after she turns 18.

It is important to note that not all ELSS funds carry the same risks. Some allocate more to small- and mid-cap stocks, while others stick with stable large-cap stocks. Choose the one that best suits your risk appetite.

ELSS funds have a lock-in of three years, the shortest among all tax-saving options.

ELSS is the best way to save tax for young taxpayers. They should stagger their investments with monthly SIPs.

ULIPs:

Even before the tax on capital gains was announced, Ulips had a distinct tax advantage over mutual funds. Ulips not only offer equity funds but also debt and liquid fund options to investors. Switching from equity to debt or vice versa does not have any tax implications. Short-term gains from debt funds and income from fixed deposits is taxed at the marginal rate while long-term capital gains from debt funds are taxed at 20% after indexation. But income from Ulips is tax free. The new Ulips launched by insurance companies are low on costs and compete with direct plans of mutual funds on charges.

A child Ulip secures a child’s long-term goals. If a parent dies, premium is waived and plan continues to invest.

Pension plans:

The popularity of the NPS has eclipsed pension plans from insurance firms. Investors in NPS get an additional deduction of ₹50,000 for contributions under Sec 80CCD(1b). More tax can be saved by contributing through the employer. However, pension plans from insurers are not eligible for these deductions. There are other problems too. The pension plans from insurance companies are still not very cheap. They have opaque structures and many charges are not clearly explained.

Pension plans are opaque and many of the charges are not clearly explained.

Insurance:

Traditional policies are not able to offer the insurance cover that a person actually needs. Experts say one should have a cover of at least 6-8 times his annual income. So, someone earning ₹50,000-60,000 a month at the age of 30 should have a life insurance cover of roughly ₹40-50 lakh. An endowment plan offering a cover of ₹40-50 lakh will cost the buyer almost ₹4-5 lakh per year. This is nearly 60-70% of his total income. However, a term cover for ₹1 crore will cost him just ₹7,000-8,000 a year, which will be only 1% of his income. Keep this math in mind when you go shopping for a tax-saving instrument this year.

Parents often suggest endowment plans to their kids, not realising that these can be a millstone around their kids’ necks.

National Pension Scheme:

Changes in investment and tax rules have just made the NPS more attractive. Firstly, the entire 60% of the corpus that can be withdrawn at the time of retirement will now be tax free.

Secondly, investors can now allocate up to 75% to equities in the active choice option of the NPS. You can also remain invested till the age of 70 and stagger your withdrawals.

NPS can help save tax under three different sections. Contributions of up to ₹1.5 lakh can be claimed as deduction under Sec 80C. An additional deduction of up to ₹50,000 is available under Sec 80CCD(1b). If your employer puts up to 10% of your basic salary in the NPS, that amount will not be taxable.

60% of the corpus that can be withdrawn at the time of retirement will now be tax free.

NSCs:

An interest rate of 8% make National Savings Certificates (NSCs) a good option for those who want to invest in a hurry. The interest earned on the NSC is eligible for deduction under Sec 80C in the following years. Suppose an investor buys ₹50,000 worth of NSCs in January 2019. A year later, the investment would have earned an interest of ₹4,000. The investor can claim deduction for this ₹4,000 for the year 2019-20.

The tax deduction on the interest effectively makes the NSC tax free for investors in the 5% tax bracket.

Bank FDs:

Tax-saving bank fixed deposits are a good choice for those who may have left their tax planning for the last minute. Though the interest rates are not as high as small savings instruments, these deposits offer the convenience of online banking. Senior citizen taxpayers who don’t want to stand in a queue in a post office will also find this useful.

But there is a high price for this convenience. The interest earned on bank deposits is fully taxable, which brings down the post-tax return for those in the higher income bracket. Please note that you cannot invest in a fixed deposit in somebody else’s name using your Netbanking account.

Bank FD interest rates are not as high as small savings instruments, but they offer the convenience of online banking.

Public Provident Fund:

PPF rates were hiked in October 2018 after a sustained rise in bond yields. Though bond yields subsequently came down in the third quarter of 2018-19, PPF rates have remained unchanged. Advisers say PPF remains a good bet because the interest is tax free, giving the small savings scheme a distinct advantage over fixed deposits. The interest from FDs is fully taxable, which brings down returns to just 5% in the highest tax bracket. Advisers also warn against bingeing on fixed income instruments. “If you already contribute to the Provident Fund, there is little utility in investing more in a fixed income option,” says Sudhir Kaushik, Co-founder, Taxspanner.

PPF scores high on safety, flexibility and ease of investment. An account can be opened in a post office or designated bank branches. Opt for a bank that allows online access to the account.

Senior citizens' saving scheme:

The Senior Citizens’ Savings Scheme (SCSS) was the best tax-saving option for those above 60, and last year’s Budget made it more attractive by offering seniors an additional ₹50,000 exemption on interest income. This means the overall tax exemption for those above 60 is now ₹3.5 lakh and for above 80 is ₹5.5 lakh.

The 8.7% offered by SCSS is the highest among all small savings schemes. The tenure of SCSS investment is five years, which is extendable by another three years. However, there is a ₹15 lakh overall investment limit. Also, the scheme is open mostly to investors above 60. If the investor has opted for voluntary retirement and not taken up another job, the minimum age is relaxed to 58.

Senior citizens get an additional ₹50,000 tax exemption for interest income.

Sukanya Samriddhi Yojana:

For taxpayers with a daughter below 10 years, the Sukanya Samriddhi Yojana is a good way to save. The interest rate will be 8.5% till March and could change in April.

The Sukanya scheme offers a higher rate than the PPF. Just like the PPF, the interest earned is tax free and there is an annual cap of ₹1.5 lakh on the investment. Accounts can be opened in any post office or designated banks with a minimum investment of ₹1,000. A parent can open an account for a maximum of two daughters, but the combined investment in the two accounts cannot exceed ₹1.5 lakh in a year. The best part is that the account is opened in the name of the child and the maturity proceeds have to be used for her education and marriage.

The account is in the name of the girl child. It is her money after she turns 18.

Download The Times of India News App for Latest Business News.

All Comments ()+^ Back to Top

Refrain from posting comments that are obscene, defamatory or inflammatory, and do not indulge in personal attacks, name calling or inciting hatred against any community. Help us delete comments that do not follow these guidelines by marking them offensive. Let's work together to keep the conversation civil.

HIDE