Imagine having your global car production centered in the UK and Brexit uncertainty being only fourth or fifth on your list of headaches. That is the nightmare facing Jaguar Land Rover as it slumped to a loss in the first half of 2018 amid falling sales, high costs and production freezes.

JLR has been an industry success story since Tata Motors purchased the struggling Land Rover SUV and Jaguar sports sedan brands from Ford Motor in 2008. Back then, JLR was “near bankruptcy,” says Ralph Speth, the former BMW executive who was hired to turn around the British company

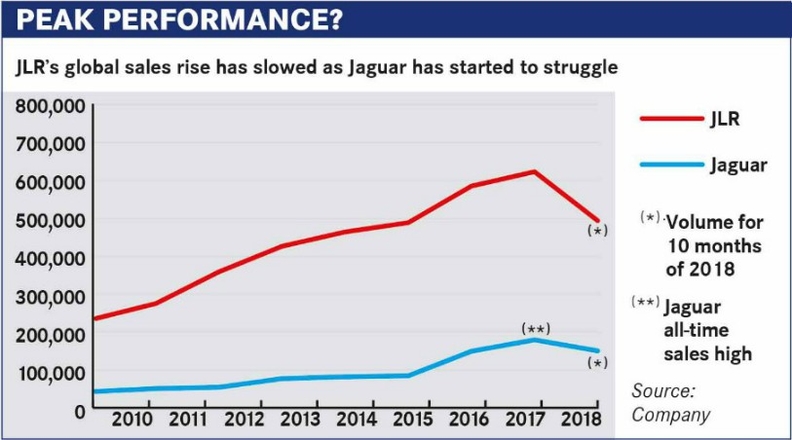

Under Speth and his management team, also largely recruited from JLR's German premium rivals, sales almost tripled to 604,000 in the automaker's 2017 fiscal year from 241,000 in the 2011. JLR has capitalized on surging global sales of SUVs, posting record profit after record profit, peaking at 2.6 billion pounds (2.9 billion euros) in the 2015 financial year.

Fast forward to 2018 and the company lost 354 million pounds in the first six month of its current financial year (which runs until March 31, 2019). This caused S&P Global Ratings to lower the credit rating of Tata Motors and JLR deeper into junk status last month, citing weaker-than-expected profitability at JLR.

In response, JLR plans to slash costs by cutting jobs and reducing its r&d budget. Falling sales have already forced JLR to lower production and reduce the size of its contract staff. The closure of one of its four UK assembly plants is looking more likely and the fallout is expected to include a dramatic change of direction for the stuttering Jaguar brand.

Just before Christmas, Tata Motors publicly backed its troubled UK subsidiary amid speculation about JLR's future.

"There is no truth to the rumors that Tata Motors is looking to divest our stake in JLR or discontinue the Jaguar brand. We have great belief in the potential of JLR’s distinctive premium products and brands as well as in JLR’s design and engineering capabilities," Tata Motors and JLR Chairman, Natarajan Chandrasekaran, said in an emailed statement on Dec. 24.