‘Creditors may get ₹70k cr under IBC’

TNN | Jan 4, 2019, 07:15 IST Finance minister Arun Jaitley (PTI)

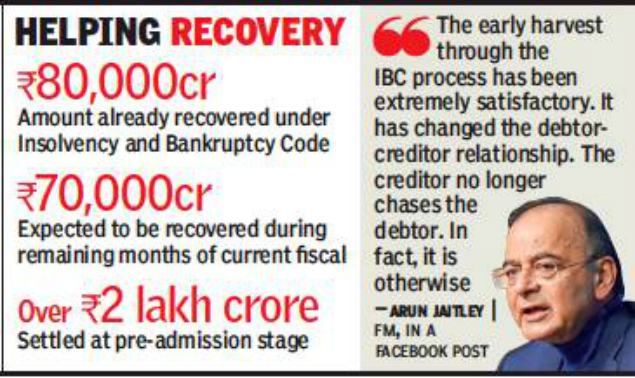

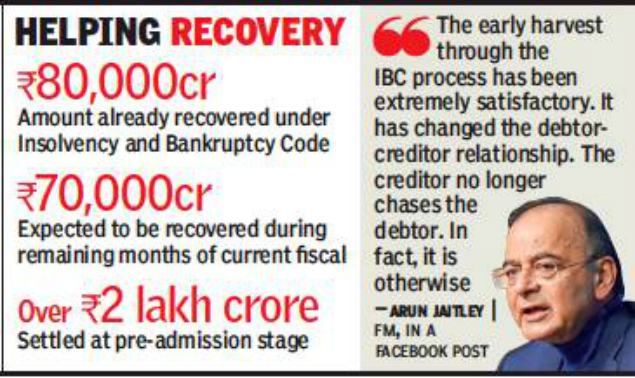

Finance minister Arun Jaitley (PTI)NEW DELHI: Finance minister Arun Jaitley said on Thursday that creditors are expected to get Rs 70,000 crore as some of the big 12 cases, including Bhushan Power & Steel and Essar Steel, are likely to be resolved in this financial year. They have already recovered Rs 80,000 crore from 66 cases resolved by the National Company Law Tribunal (NCLT).

The minister said according to the NCLT database, in 4,452 cases disposed at the pre-admission stage, the amount apparently settled was around Rs 2 lakh crore. He said so far 1,322 cases have been admitted by the NCLT and 66 have been resolved after adjudication. In 260 cases, liquidation has been ordered.

“Increase in conversion of NPAs (non-performing asset) into standard accounts and decline in new accounts falling in the NPA category show a definite improvement in the lending and borrowing behaviour,” the FM said, while praising the two years of the Insolvency and Bankruptcy Code (IBC).

He said the NCLT has become a trusted forum of high credibility.

“Those who drive the companies to insolvency, exit from management. The selection of new management has been an honest and transparent process. There has been no political or governmental interference in the cases,” the FM said.

He said the recoveries of funds parked in insolvent companies have taken place through three methods: First, after the introduction of Section 29 (A), such companies are paying up in anticipation of not crossing the red line and being referred to NCLT.

“As a result, the banks have started receiving monies from potential debtors who pay in anticipation of the default. The defaulters know well that once they get into IBC they will surely be out of management because of Section 29 (A).”

Also, the FM said that once a petition of the creditor is filed before the NCLT, many debtors have been paying at the pre-admission stage so that the declaration of insolvency does not take place. “Third, many major insolvency cases have already been resolved and many are on the way of resolving. Those which cannot be resolved move towards liquidation and the banks are receiving the liquidation value,” the FM said.

The minister said according to the NCLT database, in 4,452 cases disposed at the pre-admission stage, the amount apparently settled was around Rs 2 lakh crore. He said so far 1,322 cases have been admitted by the NCLT and 66 have been resolved after adjudication. In 260 cases, liquidation has been ordered.

“Increase in conversion of NPAs (non-performing asset) into standard accounts and decline in new accounts falling in the NPA category show a definite improvement in the lending and borrowing behaviour,” the FM said, while praising the two years of the Insolvency and Bankruptcy Code (IBC).

He said the NCLT has become a trusted forum of high credibility.

“Those who drive the companies to insolvency, exit from management. The selection of new management has been an honest and transparent process. There has been no political or governmental interference in the cases,” the FM said.

He said the recoveries of funds parked in insolvent companies have taken place through three methods: First, after the introduction of Section 29 (A), such companies are paying up in anticipation of not crossing the red line and being referred to NCLT.

“As a result, the banks have started receiving monies from potential debtors who pay in anticipation of the default. The defaulters know well that once they get into IBC they will surely be out of management because of Section 29 (A).”

Also, the FM said that once a petition of the creditor is filed before the NCLT, many debtors have been paying at the pre-admission stage so that the declaration of insolvency does not take place. “Third, many major insolvency cases have already been resolved and many are on the way of resolving. Those which cannot be resolved move towards liquidation and the banks are receiving the liquidation value,” the FM said.

Download The Times of India News App for Latest Business News.

All Comments ()+^ Back to Top

Refrain from posting comments that are obscene, defamatory or inflammatory, and do not indulge in personal attacks, name calling or inciting hatred against any community. Help us delete comments that do not follow these guidelines by marking them offensive. Let's work together to keep the conversation civil.

HIDE