Sanjeev Prasad of Kotak Institutional Equities expects earnings growth to be the biggest driver of the Indian market in FY19/FY20.

The market was highly volatile in 2018, but the benchmark indices managed to close the year with single-digit gains.

Swings in crude oil prices, rupee volatility, trade tensions between US and China, liquidity crisis in non-banking finance companies, state elections, Fed rate hikes. etc. were prominent reasons for rangebound market in last year.

Most experts feel some of these above reasons could be dominant in 2019 also, in addition to Lok Sabha elections, global growth concerns and earnings recovery.

According to them, first half of the year is expected to be volatile due to general elections, but the second half is likely to be largely driven by earnings, macro and global factors. Hence, double-digit return in frontline indices can't be ruled out, they said.

"Current macro-economic conditions and valuations are quite supportive and drive expectations of decent (10-15 percent) equity returns in 2019," Sanjeev Prasad of Kotak Institutional Equities said.

He believes the market is reasonably valued although the reasonable valuations reflect strong earnings revival over FY19-21.

The broader markets largely underperformed frontline indices with the BSE Midcap index falling 13.4 percent and Smallcap losing 23.5 percent in 2018, but it is likely reverse in 2019.

"Midcaps and small caps have seen sharp correction in 2018 and several companies with solid fundamentals are available at much more reasonable valuations now. Given the overall robustness in earnings recovery, 2019 could be a year of midcaps and smallcaps," Harendra Kumar - Managing Director, Institutional Equities, Elara Capital told Moneycontrol.

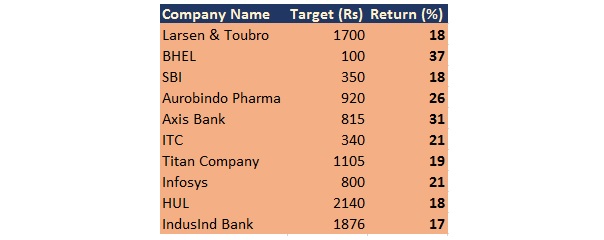

Here are top 10 picks one can consider for the portfolio. These stocks are expected to give 17-37 percent returns in 2019 and at the end of current year, average return could be 23 percent.

So if one can invest Rs 10,000 in each of the 10 stocks, which comes to Rs 1,00,000, he/she could grow the sum to Rs 1,22,658 at the end of 2019, with 23 percent average.

Brokerage: Credit Suisse

L&T | Rating: Outperform | Target: Rs 1,700 | Return: 18%

The research house reiterated its outperform rating based on domestic pick-up, lower Middle East dependence (only 6 percent of total orders in first half of FY19), strong cash flows, upside from divestiture and valuation at around 16x September 2020 estimates EPC earnings.

Upside surprise is likely from better margins on strong execution, opportunities from budding private investment cycle and lower losses from Hyderabad Metro in FY20/21E.

Bharat Heavy Electricals | Rating: Outperform | Target: Rs 100 | Return: 37%

BHEL would have a sustainable opportunity of more than 10 GW per annum. This level of execution can drive sharp EPS recovery and rerating.

The company has tremendous operating leverage, given 42 percent contribution margin on incremental revenues on low base. Target price implies a multipleof 6x EV/EBITDA on FY21E EBITDA and around 1x book.

Key risk relates to the time taken for positive power sector dynamics to strengthen and get broadly recognised. Weak orders in any year, particularly in the near term, could affect sentiment. Large working capital exposure is a risk.

State Bank of India | Rating: Outperform | Target: Rs 350 | Return: 18%

Post several quarters of muted growth, SBI has seen a pick-up in loan growth over the past few quarters.

Post several years of asset quality stress, the research house expects slippages to moderate in the coming quarters, credit costs should normalise in FY20.

The bank would see strong recoveries in second half on account of a couple of large cases.

With stock trading at around 0.9x FY20E core P/B and return on equity expected to improve to around 13 percent as credit costs moderate, the research house maintained outperform call.

Analyst: VK Sharma, Head - PCG and Capital Market Strategy at HDFC Securities

Axis Bank | Rating: Buy | Target - Rs 815 | Return - 31%

Axis has gone through tough times. It has borne the brunt of deterioration of asset quality over the past few quarters. But that is now changing.

The net NPA has come down from 3.09 percent in June to 2.4 percent in September 2019. We see the asset quality improving over the next four quarters and may also write back in a few cases.

The bank is well capitalised at 16.2 percent and has the highest provision coverage ratio in the sector at 73 percent. The beginning of the year 2019 also sees a change of guard at the top which result in a further re-rating of the stock. We see a price target of Rs 815 in a year's time.

ITC | Buy | Target: Rs 340 | Return - 21%

ITC is an attractive consumption stock from a risk reward perspective. It is the most diversified consumer company in the country. Tobacco accounts for 44 percent of the sales and 85 percent of the EBITA.

The company built 25 mother brands in the non-tobacco business of Rs 16,000 crore and plans to take it to Rs 1,00,000 crore by 2030.

The tobacco business, saw a 3.5 percent volume growth in this year, something not seen since many quarters. The implementation of the GST has stabilised its external volatile environment.

We see a re-rating of the company and see the market giving it a higher PE in the days to come. We see a price target of Rs 340 in a year's time.

Prospective investors will do well to accumulate stocks at declines.

Disclosure: Sharma has exposure to ITC stock.

Brokerage: Motilal Oswal

Titan Company | Rating: Buy | Target: Rs 1,105 | Return: 19%

Wedding season demand is scaling up well for Titan. If consumers continue flocking to its stores in the wedding season, jewellery sales growth of 25 percent for the full year is achievable.

Same-store-sales growth (SSSG) is likely to contribute 75-80 percent of jewellery sales growth, which is even higher than the impressive 60 percent that it was reporting earlier. This, in turn, would have extremely positive implications on jewellery EBIT margin.

Revenue growth opportunity of 20 percent is immense and far superior to peers. Also, the margin trajectory appears to be on an uptrend, as revenue is being driven by SSSG. We expect 25 percent EPS CAGR over FY18-20.

Infosys | Rating: Buy | Target: Rs 800 | Return: 21%

Infosys has built capabilities to match spend shifts in the past three years and Digital revenue now accounts for around 30 percent of company’s revenue.

Infosys has also been one of the most disciplined companies in terms of operational efficiency in last couple of years which has helped maintain margins while investing aggressively in building capabilities.

The acceleration in growth momentum, aided by a pick-up in verticals like Financial Services and Retail, and the visibility for its continual from recent deal wins provides confidence of improvement in the coming quarters.

We expect Infosys to register a revenue/PAT of 8 / 13 percent CAGR over the next three years largely driven by Digital segment.

Hindustan Unilever | Rating: Buy | Target: Rs 2,140 | Return: 18%

HUL offers the best earnings growth visibility in the large-cap Indian consumer space.

Four key trends are helping HUL in elevating its earnings growth trajectory to around 20 percent: (1) rapidly improving adaptability to market requirements, (2) recognition and strong execution on Naturals, (3) strong trend toward premiumization and (4) extensive plans to employ technology and create further entry barriers.

The acquisition of GSK Consumer healthcare business pushes HUL among the market leaders in the only key category where it did not have market leadership (Food and Refreshments).

Aurobindo Pharma | Rating: Buy | Target: Rs 920 | Return: 26%

The company has guided for 2x industry growth rate in EU market along with better profitability on account of transfer of 97 products from EU to India.

We remain positive on Aurobindo on robust ANDA filings rate, strong pace of approvals, minimal regulatory hurdles and the company outperforming the industry in the EU market.

We expect Aurobindo to record 24 /22 /18 percent CAGR for revenue/EBITDA/Adjusted PAT over FY18-20E, with RoE/RoCE of 22 /16 percent in FY20E.

Brokerage: Axis Securities

IndusInd Bank | Rating: Buy | Target - Rs 1,876 | Return: 17%

IndusInd Bank has an ideal mix of loan book with niche presence in vehicle finance and corporate banking inclined towards working capital finance. Strong NIM, higher other income and stable asset quality have resulted in consistent operating performance.

We expect the bank with its high share of CASA (44 percent) to be amongst the key beneficiaries of the higher spreads and softening yields in the near term.

Key monitorables are the Bharat Financial merger, IL&FS exposure and changes in top management.

Disclaimer: The views and investment tips expressed by investment expert on moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.