By Liz Alderman & Jack Ewing

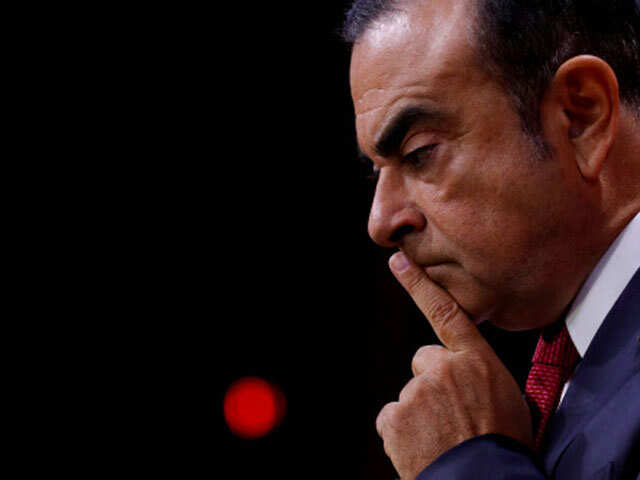

PARIS: When Carlos Ghosn was arrested on his private jet in Japan last month on charges of violating the nation’s financial reporting laws, Nissan promptly removed him as its chairman. At the French automaker Renault, the management stuck by Ghosn, its chief executive and chairman.

But an intensifying storm is putting pressure on Renault’s defensive posture.

Ghosn was detained just as Renault was suffering a slump in sales in Europe and confronting a worsening power struggle with Nissan, its long-time partner. There is even a political dimension. In the Yellow Vest protests that have galvanised France, Ghosn has become a symbol of excess wealth and runaway corporate power.

Renault’s position is becoming increasingly untenable the longer Ghosn sits in jail.

His chances of being released soon from his tiny prison cell in Tokyo, where he has been held since November 19, dimmed considerably on Sunday after a Japanese judge ruled that he could be held at least through January 1 and perhaps longer, to give prosecutors more time to question him. Before that, on Friday, authorities arrested Ghosn again based on new allegations of financial misconduct.

At stake is not only Ghosn’s position atop Renault, but also the fate of the company’s long-standing alliance with Nissan, which Ghosn also led. Renault and Nissan are being forced to confront the frictions between them and agree on new leadership for their unique auto-making union.

Ghosn, a larger-than-life figure who forged a global auto empire out of Renault, Nissan and Mitsubishi Motors, which joined in 2016, was stripped of his chairmanship posts by both Japanese carmakers after an investigation by Nissan alleged that he had illegally omitted reporting millions in compensation in Japanese securities filings.

But at Renault, where Ghosn was a star executive for two decades, top management refrained from passing judgment, while a temporary leadership team runs the company in his absence.

It’s a difficult time for the carmakers to be uncertain about their leadership. Demand for cars in China, US and Europe, the three biggest auto markets, is falling. Analysts agree that the alliance that Renault and Nissan founded in 1999 to share purchasing and expertise is essential if the companies are to remain competitive in an industry where size provides a crucial advantage.

Sales of new Renault cars in Europe, the company’s core market, plunged 16% in November, according to the European Automobile Manufacturers Association. And it is losing ground in market share there.

In the United States, Nissan is facing the consequences of a strategy focused on winning market share at the expense of profit, championed by Ghosn. Nissan is trying to dial back its discounts just as the overall market enters a downturn, and as the Ghosn arrest tarnishes its image.

“It’s going to be hard to ratchet back incentives when other companies are ratcheting them up,” said Michelle Krebs, executive analyst at Autotrader, an online buying and selling platform. “Their strategy came home to roost.”

Renault needs Nissan, the dominant performer in the alliance, to continue contributing to Renault financially. Some Renault officials are concerned that Nissan’s operating margin has been slipping, including since the scandal erupted.

Renault officials have been waiting to hear Ghosn state his own defence before making a formal decision about his future with the company, according to two people familiar with the situation. That has been impossible while he has been incarcerated, unable to receive visits from his lawyers, family or anyone at Renault.

If Renault hears from Ghosn soon, the board may meet in January, before a formal February meeting, to discuss how to proceed, one of those people said.

Officially, Renault and the French government, which is Renault’s biggest shareholder, say they support the presumption of his innocence. But behind closed doors, it has become increasingly difficult to see how Ghosn can continue his leadership.