The general election may be next year but its bugle has been sounded. While political pundits have started calculating the probability of wins for different parties, economists are keenly watching the government's expenditures and receipts as it will reveal which way the fiscal deficit is headed.

The year started with optimism on the fiscal deficit with good growth in the goods and services tax (GST) tax collection compared to last year and public expenditure boosting growth. However, towards the year-end, it seems to be sagging.

Now, most of the economists are not seeing fiscal deficit figure at the right spot. They say the chances of missing the fiscal deficit target, which is at 3.3% of the gross domestic product, are very high.

As per the government data, for the seven months – April to October – fiscal deficit stood at 104% of the Budget Estimate. The other number that has the economists worried is the GST collection. Till November, its monthly average of around Rs 97,000 crore was 13% below the budgetary target of Rs 1.12 lakh crore per month.

Devendra Pant, chief economist and senior director, India Ratings and Research (Fitch Group), said while the direct tax revenue was on track, there was a concern over severe shortfall in GST revenues.

Devendra Pant, chief economist and senior director, India Ratings and Research (Fitch Group), said while the direct tax revenue was on track, there was a concern over severe shortfall in GST revenues.

"The major challenge is the indirect tax. If you look at the first seven months of the GST collections, there is no doubt that it is better than what it was last year. But on a monthly basis, this is falling short of budgeted growth of 11.5%," he said.

Pant expects this revenue to fall further with the latest rate cut by the government on over 30 items under GST. He believes indirect tax could further get hit by excise duty snip on fuel.

Gross direct tax collections grew at a robust rate of 15.7% to Rs 6.75 lakh crore up to November this fiscal.

The concern is not just on the revenue side. Economists are foreseeing government expenditures also to soar in a pre-election year. Last week, the government sought Parliament's approval for additional gross spend of Rs 85,948.86 crore in the current fiscal.

India Ratings economist said his consultancy firm is expecting 2018-19 to end with a fiscal deficit of 3.5% of GDP. That would be a slippage of 20 basis points.

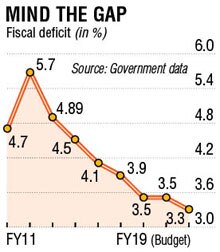

What is worrying most economists is that the government has not been able to budge the fiscal deficit number to lower than 3.5% of the GDP. It has been stuck at that figure for the last two fiscals. If the government were to land on the same number this fiscal too, it would be the third year.

Going by the fiscal discipline roadmap drawn over five years back, the 3% of the GDP target should have been reached in FY17.

D K Srivastava, chief policy advisor, EY India, told DNA Money the government cannot afford one more slippage on fiscal deficit. He said such an eventuality would could hit their credibility in a big way.

"It is already a target which has been postponed time and again. Establishing credibility is very important. The government should try and adhere to the 3.3% fiscal deficit target because it is already a revised target. Slippage on this would adversely impact India's credibility in terms maintaining fiscal discipline," he said.

Srivastava said it would reflect negatively on India's rating. "That will be a negative consideration for our rating. Fiscal deficit is a summary measure of overall discipline and management of government's public finances. It's given important in overall rating of a country because it has an impact on government debt."

Since FY12, fiscal deficit has tapered from 5.7% to 4.9% in FY13, 4.5% in FY14, 4.1% in FY15, 3.9% in FY16, 3.5% in FY17 and 3.5% in FY18.

The EY economist expects the shortfall in GST revenues to be made up by "either more than budgeted direct taxes or additional reserves from the Reserve Bank of India (RBI) in some form."

"Unless these two things happen, there is going to be considerable pressure on maintaining fiscal deficit target of 3.3% of the GDP," he said.

Both Srivastava and Pant see government pruning capital expenditure, increasing the amount of subsidy bills to be rolled over to the next year or resorting to other such accounting engineering to rein in the fiscal deficit.

"Since the government budgets are on cash basis, the government always rolls over capital expenditure to the next year. One way they may do it is to share the IGST (integrated GST) with the states next year rather than this year. In reality, we are looking at a difficult fiscal situation," said Pant.

According to him, the belief that fiscal deficit shoots up in an election year is a myth. "There is a little co-relation between election years and fiscal deficit." Last election fiscal – FY15 – had seen fiscal deficit drop to 4.1% of the GDP from 4.5% of the GDP in FY14.

Economists, though, seem confident on the divestment estimate of Rs 80,000 crore in the budget for this fiscal being achieved.

"They would also try to meet the divestment target. If nothing else happens, they would eventually cut down on capital expenditure but my estimate is it (fiscal deficit) would be between 3.3% and 3.5%," said Srivastava.

WORRYING SIGNS

- As per the government data, for the seven months – April to October – fiscal deficit stood at 104% of the Budget Estimate

- Till November, monthly average GST collection at around Rs 97,000 crore was 13% below the budgetary target of Rs 1.12 lakh crore per month