A course correction in the Goods and Services Tax (GST) regime is some time away and will surely be painful to begin with. But this correction is the right path to take and, eventually, India should move towards a much-improved taxation regime where the number of rate slabs will reduce and the compliance burden will consequently become lighter. An indication of this came from the thoughts finance minister Arun Jaitley penned on Monday in a Facebook post, where he spoke of a single standard rate instead of the two – 12% and 18% - currently and also said that India will eventually have only three rate slabs: 5%, the standard rate and a slab for sin and luxury goods.

"With the GST transformation completed, we are close to completing the first set of rate of rationalisation i.e. phasing out the 28% slab except in luxury and sin goods. A future roadmap could well be to work towards a single standard rate instead of two standard rates of 12% and 18%. It could be a rate at some mid-point between the two. Obviously, this will take some reasonable time when the tax will rise significantly. The country should eventually have a GST which will have only slabs of zero, 5% and standard rate with luxury and sin goods as an exception," Jaitley said.

When the GST regime became operational in India in July last year, there were multiple slabs: zero, 5%, 12%, 18%, 28% and 28% plus cess for what were called 'sin and luxury' goods. The GST replaced the earlier tax regime that consisted of multiple levies from the centre and state on each good and service. But GST was still far from perfect with its multiple rates and other issues. After the GST became operationalisation, the opposition as well as tax experts were unhappy with its structure and argued that this would neither ease the life of the taxpayer nor will it generate nearly enough revenue for the state. In fact, Congress had proposed that there be a single standard rate and the then government's Chief Economic Advisor, Arvind Subramanian, had proposed a 15% standard rate.

But a multi-rate GST regime was implemented due to a lack of consensus between the Centre and states on multiple issues since India is a multiparty federal structure and the centre and states have fiscal autonomy. Along the way, though, there has been gradual but consistent ironing out of the kinks. The GST Council – which comprises state representatives too – has met 31 times and has been rationalising rates on many items to reduce the burden on the common man. But what would the eventual scenario, where most items will be charged at a single standard rate instead of 12% and 18% slabs, look like?

Abhishek Jain, tax partner at EY, told DNA Money "Merging the current 18% and 12% rate into a single rate at some mid-point would be a significant achievement in terms of GST simplification. However, an important aspect would be what is that mid-point as when goods which are currently at 12% move to a higher mid-point, it may have a negative impact on the industry and end consumers". Put simply, if the standard rate were to become 15% say – as was proposed by Subramanian and also by some opposition members – then those items which are currently at 12% will possibly see price hikes. And this may not please any stakeholder.

Meanwhile, in its meeting on December 22, the Council decided to slash tax rates on retreaded tyres, cinema tickets, televisions and a host of other items, with only limited items remaining in "sin and luxury items" category along with cement and some auto parts. GST rate rationalisation has drilled a revenue hole of Rs 80,000 crore annually.

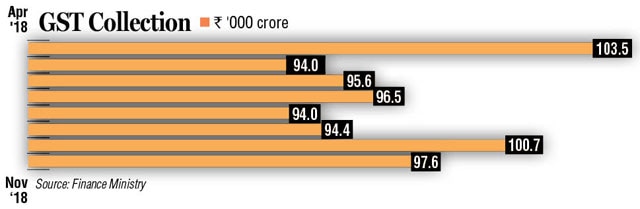

Have GST collections, therefore, remained below expectations this fiscal? The FM said collections averaged Rs 97,100 crore a month this fiscal against Rs 89,700 crore last fiscal. He said revenue targets set for states were "unprecedently high", "almost unachievable" and yet, six states have already achieved these, seven others close to arriving there but 18 states were still more than 10% short.

"By the third, fourth and fifth year, as in the case of VAT, the ability to increase revenues and close the gap will substantially increase. Those states which do not achieve the target of 14% are paid out of the compensation cess. The requirement of compensation cess in the second year is expected to be much lower than the first year. This increase in the tax collection has to be factored keeping in mind the significant rate reduction which has taken place in the GST. The reduction in monetary terms amounts to about Rs 80,000 crore per year," said Jaitley.

NOT IN SYNC

- Rs 97,000 cr – indirect tax collections averaged per month in this fiscal

- Rs 89,700 cr – GST mop-up averaged per month in FY18

- Rs 30,000 cr – Revenue shortfall seen due to GST rate rationalisation