Tax evasion, rate cuts may hit GST collections

Tax evasion , Istock

Nine months after the government estimated an average monthly Goods and Services Tax (GST) collection of Rs 1.12 lakh crore in their budget, it is becoming increasingly apparent that it was an "ambitious" target.

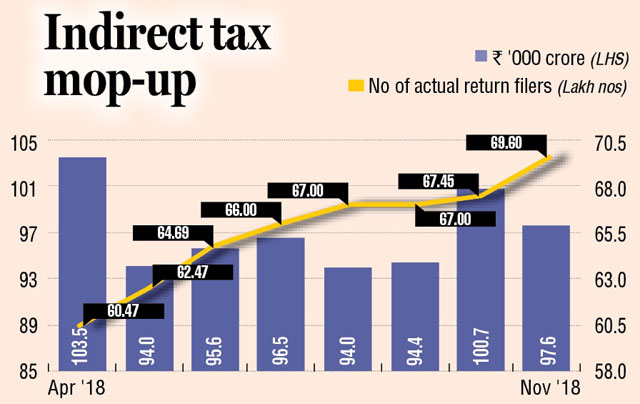

This assumption is based on the actual monthly GST revenue trend till November, which has averaged at Rs 97,000 crore. This shows that actual monthly collection has lagged the projected revenue by Rs 15,000 crore. On an annual basis, it works out to a shortfall of Rs 1.80 lakh crore.

Pratik Jain, partner and leader, PwC India, told DNA Money the government could have miscalculated the tax buoyancy and gone wrong on their expectation of "self-policing" on the part of taxpayers.

"In hindsight, if you look now, in December, you can say it (budgetary estimate of GST collection) was ambitious. The tax buoyancy and self-policing they were expecting it would bring have perhaps not happened. The process is perhaps taking much longer time than what the government expected earlier," he said.

Jain, though, is heartened with the growth in monthly GST revenue this fiscal compared to last year. For the first eight months of the current fiscal, it was up to Rs 97,000 crore from Rs 89,000 crore last year. The budget has estimated annual GST collections at Rs 13.44 lakh crore in the current fiscal.

Suresh Rohira, partner, Grant Thornton India LLP, expects monthly collection numbers to further trend downwards as GST Council looks at more rate rationalisations with general election approaching.

Giving an estimate, he expects GST revenues to average between Rs 90,000 and Rs 1 lakh crore.

"They would come anywhere between Rs 90,000 to Rs 1 lakh crore. I am presuming that there would again be some rate reduction. It could be timed politically. As far as discussions are concerned, they (Council) will once again relook at other sectors. Cement and auto parts could be taken up next for rate cut," he said.

On Saturday, GST rates on 23 items, including TVs, movie tickets and others, were slashed. This is expected to hit the GST revenue by around Rs 5,000 crore.

Finance minister Arun Jaitley said cement, which is currently in the highest tax slab of 28%, would be targeted next.

Rohira said in an election year, winning election could become the primary agenda, making revenues the second consideration while taking a decision on rates.

"So long as they (government) would get Rs 90,000 crore per month, it would still be higher than last fiscal. They would remain in power vis-a-vis with a collection of Rs 93,000 crore or a 94,000 crore where they would not remain in power. They might think let me as well reduce the rate and win the battle. Revenues may become the secondary agenda and winning election primary," he said.

Pointing to factors that have led to the GST estimates for the current fiscal go awry, the Grant Thornton tax specialist said, "Trade and sales have not grown as was expected at the beginning of the year. The government also says people have shifted back to dispatching goods without invoices and thereby evasion going up again".

The number of actual returns being filed by taxpayers has progressively moved up since the beginning of the fiscal from 60.47 lakh in April to 69.6 lakh in November.

M S Mani, partner, Deloitte India, told DNA Money the government would have to ensure growth in GST revenues to "minimise" its shortfall.

"It is essential that the upward trend in GST collections continue in the ensuing months so as to minimise the GST revenue deficit as the moderation of GST rates would normally result in the expansion of the tax-base leading to improvement in collections. Enhanced scrutiny of monthly returns and input tax credits and focus on non-filers and occasional filers could also be steps that the tax authorities would be contemplating as we approach the last quarter of the current fiscal," he said.

Another tax expert, who spoke anonymously, said another option available for the government was to show GST revenues for 13 months in this fiscal to make up for last year when only 11-month GST collection was considered.

"One very easy way to bolster their finances is to advance the timeline for the payment of annual GST to March 31, 2019, instead of April 20, 2019. If they just do this they can fix the budget hole because the government works on a cash basis. Last year, they had one-month revenue shortfall so they would be justified in wanting month additional revenue instead of 12 months," he said.

Recently, a State Bank of India's research wing came out with a report, which pegged the shortfall in GST and excise collections at around Rs 90,000 crore for the current fiscal. CLSA, the global brokerage firm, has also estimated GST revenues to fall short by as much as Rs 1 lakh crore.