Clear bank dues when loans are waived: Nabard to states

Sidhartha | TNN | Updated: Dec 24, 2018, 04:31 ISTHighlights

- In 2016, while announcing the Rs 6,000-crore loan waiver, Tamil Nadu, for instance, had decided to clear the dues of over Rs 3,200 crore to cooperative institutions over five years.

- States, such as Uttar Pradesh, have cleared the dues to lenders, the sources added.

New Delhi: Amid a flurry of farm loan waivers, financial institution Nabard has written to states advising them to ensure that dues of banks that actually write-off the loan are immediately cleared to ensure that the credit cycle is not broken.

The move follows the experience of several lenders in Andhra Pradesh and Tamil Nadu, where the dues have remained pending although they had written off the loans based on announcements from the state governments, banking sources said. In 2016, while announcing the Rs 6,000-crore loan waiver, Tamil Nadu, for instance, had decided to clear the dues of over Rs 3,200 crore to cooperative institutions over five years. States, such as Uttar Pradesh, have cleared the dues to lenders, the sources added.

Nabard's advisory will put pressure on the states to ensure that they have funds in their budget as most states that have announced a loan waiver ignored their financial position. "The credit cycle stops if our dues are not cleared by the states," said a banker. With a large amount yet to be reimbursed banks go slow on lending to farmers at a time when their non-performing assets soar due to farmers stopping their regular loan repayments.

At a recent state-level bankers' committee meeting in Karnataka, which announced a loan waiver earlier this year, it was pointed out that there was a Rs 5,353 crore fall in the outstanding agricultural loans between March and June, 2018. With farmers complaining of pressure on their income, Nabard is keen to ensure that loan flow is not choked in any manner, the sources said.

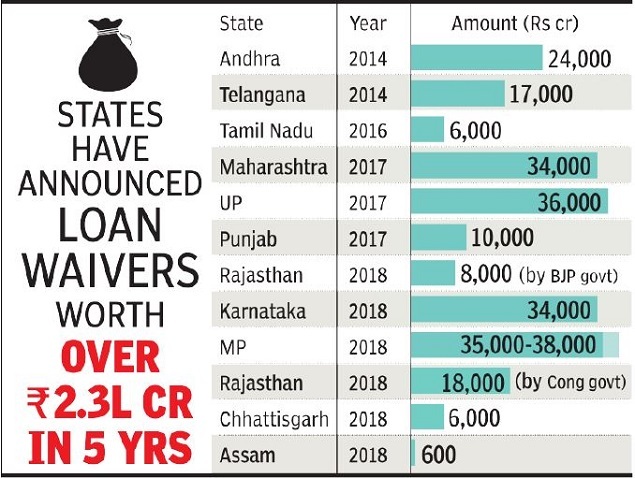

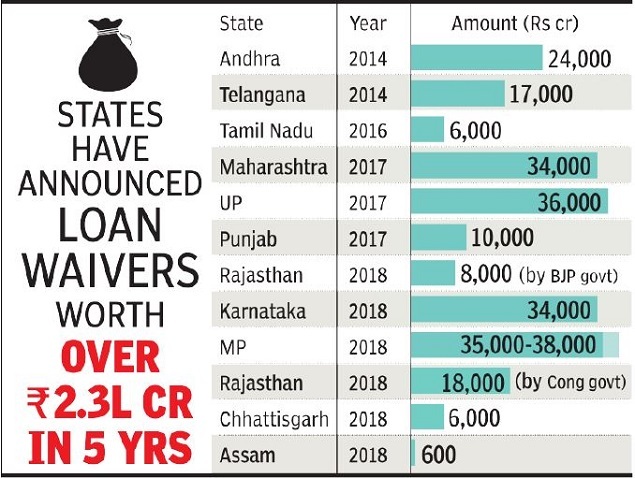

At least three Congress-ruled states - Madhya Pradesh, Rajasthan and Chattisgarh - have joined the list of states announcing farm loan waivers. Between them, they plan to provide loan amnesty of around Rs 60,000 crore, taking the total to Rs 2.3 lakh crore spread across 12 states.

The move follows the experience of several lenders in Andhra Pradesh and Tamil Nadu, where the dues have remained pending although they had written off the loans based on announcements from the state governments, banking sources said. In 2016, while announcing the Rs 6,000-crore loan waiver, Tamil Nadu, for instance, had decided to clear the dues of over Rs 3,200 crore to cooperative institutions over five years. States, such as Uttar Pradesh, have cleared the dues to lenders, the sources added.

Nabard's advisory will put pressure on the states to ensure that they have funds in their budget as most states that have announced a loan waiver ignored their financial position. "The credit cycle stops if our dues are not cleared by the states," said a banker. With a large amount yet to be reimbursed banks go slow on lending to farmers at a time when their non-performing assets soar due to farmers stopping their regular loan repayments.

At a recent state-level bankers' committee meeting in Karnataka, which announced a loan waiver earlier this year, it was pointed out that there was a Rs 5,353 crore fall in the outstanding agricultural loans between March and June, 2018. With farmers complaining of pressure on their income, Nabard is keen to ensure that loan flow is not choked in any manner, the sources said.

At least three Congress-ruled states - Madhya Pradesh, Rajasthan and Chattisgarh - have joined the list of states announcing farm loan waivers. Between them, they plan to provide loan amnesty of around Rs 60,000 crore, taking the total to Rs 2.3 lakh crore spread across 12 states.

Download The Times of India News App for Latest Business News.

All Comments ()+^ Back to Top

Refrain from posting comments that are obscene, defamatory or inflammatory, and do not indulge in personal attacks, name calling or inciting hatred against any community. Help us delete comments that do not follow these guidelines by marking them offensive. Let's work together to keep the conversation civil.

HIDE