Maharaja's New Clothes

Air India

On her table was an aircraft procurement proposal. The potential aircraft yield mentioned in it seemed a little bloated. If she were to question it, she would throw the spanner in the works. But if she were to let it pass, she would be in the good books of the management.

Brushing aside the conflict in her mind, she put her stamp of approval on the document in front of her. A few months later, she was rewarded with an extension of her services at Air India after retirement.

Such stories abound at the state-owned carrier are often narrated in a hushed tone.

"Even for a small personal gain, many people in Air India have not hesitated in taking a decision that was harmful to the airline. That is what has led it to the mess it is in now," said a former Air India official, who spoke anonymously.

If it's broken, fix it

Innumerable such decisions have landed the airline in a mountain of Rs 55,000-crore debt. And for the nth time, the government is working on a turnaround plan to pare it.

Curiously, while doing so, they are giving little attention to its operational efficiency and effectiveness. They have fixed their eyes unwaveringly on finances.

Jitendra Bhargava, a former senior executive of Air India and author of a book on Air India, tells DNA Money that various governments have never tried to look beyond "finances" to treat the ailing airline, which has relapsed into sickness after every resuscitation.

"The government believes all problems of Air India centre on finances. Therefore, they have been announcing one bailout after another to tackle the debt issue whereas the problem of Air India hangs on several pegs. Some of the glaring issues at the airline are the constitution of the board, whether it (board) is functioning well, its (airline's) leadership and the management, its work culture and other such matters. They are overlooking all these fundamentals which need to be altered," said the author of 'The Descend of Air India'.

Low on Performance Meter

No wonder, despite several bailouts and stimulus schemes by the government in the past, the state-owned carrier's performance chart continues to read pathetically in comparison to its domestic peers.

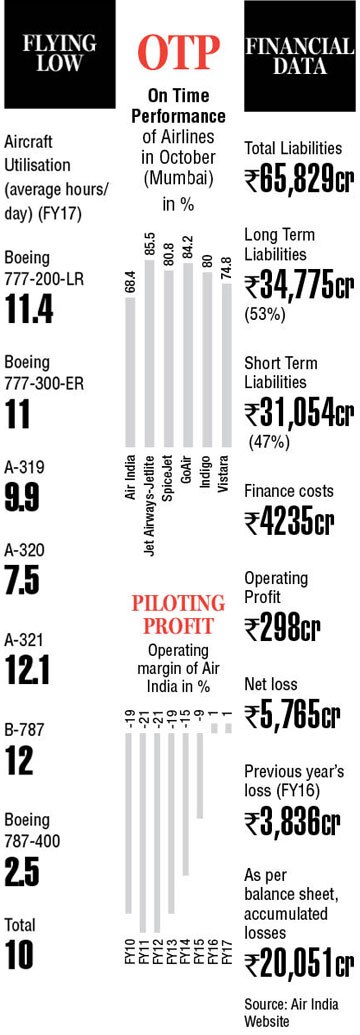

Take, for instance the airline's on-time performance (OTP) in the local market. It has been the lowest for a long time now. The latest number – in October – on this parameter, as per the Directorate General of Civil Aviation (DGCA), shows the national carrier was the lowest at 68.4%. In contrast, the OTP of Jet Airways and JeLite was 85.5%, GoAir's 84.2%, SpiceJet's 80.8% and IndiGo's 80%.

Take, for instance the airline's on-time performance (OTP) in the local market. It has been the lowest for a long time now. The latest number – in October – on this parameter, as per the Directorate General of Civil Aviation (DGCA), shows the national carrier was the lowest at 68.4%. In contrast, the OTP of Jet Airways and JeLite was 85.5%, GoAir's 84.2%, SpiceJet's 80.8% and IndiGo's 80%.

When it comes to average capacity share (number of seats deployed per kilometre) versus market share (number of passengers flown per kilometre) between January and October this year, the national flag carrier's market share at 11.3% lags by 7% to its capacity share of 12.1%. Its bigger rivals IndiGo's and Jet's market shares are behind their capacity shares by just 1%.

Market share of IndiGo, during the first 10 months of the current year, averaged 41.3% and capacity share at 41.6% while that of Jet was 14% and 14.2%, respectively. Surprisingly, SpiceJet's specs on this count are positive with average market share (12.3%) ahead of its average capacity share (10.6) by 16%.

Similarly, Air India's aircraft utilisation averages 10 hours per day compared to low-cost airline IndiGo's 11.68 hours per day. Over the last five years, Air India's market share has only slipped, year after year, to reach 12.2% till October this year from 18.4% in 2014.

Cosmetic Measures

And so, when the government draws up yet another revival plan for the beleaguered airline, there is much scepticism all around. It is being seen as nothing more than window dressing of Air India's balance sheet to woo investors for stake sale.

Bhargava sees the doses given by the government to Air India for recovery till now as being symptomatic. At best, he said, they offer temporary relief to the airline but the ailment continues to fester underneath.

"Those (recently proposed government measures) come in the ambit of resolution of financial problems. But they can't resolve the financial problems because they can reduce or minimise the debt, but six months or a year down the line, you will again have debt on your books. As long as operational issues like productivity practices benchmarked against the best carriers, etc. are not taken up, you really cannot change things. These are temporary reprieve or breather being given to the airline to stay afloat but they are not lasting solutions to Air India's problems," he said.

In the recent past, almost all blueprints of government's plan to infuse life into Air India have looked more or less the same. On the top of the list for things to be done is monetisation of the airline's non-core assets like real estate and properties in prime locations of metros. Selling profitable group companies have also featured in most of the revival plans. Cost and revenue enhancement have also been common fixtures on them. But each time the government has had to return to the drawing board.

Pankaj Pandit, a Bengaluru-based analyst and former Air India employee, blames the recycling of restructuring strategy on lack of vision among the ministry of civil aviation bureaucrats.

"These are cosmetic steps. They need to work on the basic issue of making their own operations profitable. This has to be done in such a way that operations generate enough surplus to offset the working capital loan costs. I don't think there is a vision or plan for that," he said.

Pandit believes structuring the revival plans around AI's working capital debt would resolve a lot of its troubles. The government-promoted airline's Rs 55,000-crore debt is split into aircraft and working capital debts.

"Rationalisation of debt should be the second level of action. First, the earnings before interest and taxes have to be improved and then they should look at debt. You need to have a working capital surplus. Right now, AI's operation is a leaking pot. Something needs to be done to increase the yields," said the analyst, who has previously worked with Europe's leading global distribution system (GDS) Sabre.

The Fresh Attempt

Air India's latest revival proposal is looking at transferring Rs 29,000 crore of its total Rs 55,000-crore debt to a special purpose vehicle (SPV) to trim interest outgo. Its total borrowings is at an annual average interest rate of 9%. This is likely to almost halve the interest liabilities to Rs 1,700 crore from the current Rs 4,400 crore.

The government plans to migrate to the SPV only the borrowings which are not backed by collateral. The SPV will service the non-secured debt through monetisation of the airline's non-core assets. It will explore raising extra-budgetary revenues (EBRs) to pay off debts to ease the burden on the exchequer.

It envisages extensive monetisation of assets, which include sale of Air India's ground-handling arm Air India Air Transport Services Limited (AIATSL), Hotel Corporation of India, Air India Engineering Services Ltd (AIESL) and its valuable real estate and other such assets to repay the lenders.

Loans that are secured by aircraft assets will stay on the AI's books and will be serviced by it. Through this exercise, the government is looking to wean away Air India from budgetary assistance. With the rollout of this plan, it would need just Rs 2,000 crore of equity infusion under the Rs 30,231-crore 10-year Turnaround and Financial Restructuring Plan implemented just a few years back. Till now, close to Rs 28,000 crore of equity has been pumped into the airline through this scheme, which is expected to end by 2022-23.

Measures taken on the operational side through cost savings and improvement in revenue generation is likely to accrue gains of Rs 2,000 crore to the national carrier. The government is expecting Air India to execute this plan in 2-3 years post which it will re-initiate divestment that will involve the combined sale of Air India, Air India Express (AIE) and Air India Singapore Airport Terminal Services. This proposal is yet to be approved by the cabinet.

Even as these suggestion are being considered, the government has sought Parliament's nod for an equity infusion of Rs2,300 crore in the airline.

Pandit says asset monetisation is the easiest available option to the government but not enough by itself; "monetisation is the easiest thing to do and that is what they are doing. It is necessary but not sufficient. All assets have to be efficiently utilised. The fault does not lie in the (utilisation of) real estate but the aircraft. How about using them more appropriately and profitably. That is not being done. AI has the best aircraft but they are not using it optimally," he said.

According to him, low-cost airline IndiGo has more pricing advantage preference than the full-service Air India because of the former's superior "dispatch reliability" and optimal aircraft utilisation strategy.

Need Cash on Hand

A former chairman and managing director (CMD) of Air India, who spoke on condition of anonymity, said the reduction in interest burden will release cash for the improvement of operations. This, he said, will help in positively altering the national carrier's overall operational performance.

"The performance of AI would be altered radically as it will then (after interest burden is slashed) be left with money that can be used for the maintenance of planes and for expenditures which can improve its efficiency. Operational efficiency of airlines suffer on two counts – maintenance of planes and availability of planes," he said.

The former AI head said while the aircraft loan was normal, it is the huge working capital debt that is dragging down finances and operations of the airline.

"It has to be nurtured back to health. When the sale was taking place (earlier this year), senior people were condemning it. You can't condemn a product and then sell it. The whole objective behind the 2012 plan was to nurture it back to health by 2021-22 so that it will at least break-even and start making a profit by 2027-28. The whole plan was to make it profitable and then privatise it," he said.

The recent restructuring exercise was kicked off after the ministry of civil aviation failed in its bid to sell 76% stake in Air India, which included 100% holding in low-fare international subsidiary Air India Express and 50% stake in AISATS.

The former AI chief attributed the failure to the timing of the privatisation. "Taking the decision at the beginning of the tenure (of the current government) would have been easier. Taking it in the last year of the tenure raises questions and investors would be careful. They would not be very confident," he said.

Perception Matters

A low-cost airline's senior executive, who did not want to be named, said Air India needed a complete overhaul of operations and perception if it wants to find a suitor for itself.

"It should begin with fixing its bloated cost structure. Then, the strategy, fleet and network have to be re-aligned, along with services being redefined. The focus should be on on-time performance and overall customer services have to be absolutely changed. Once these things start happening over the next three to six months, there will be a better consumer perception. They have to improve the perception of Air India. That perception has to be changed through activities, including cost reduction, revenue optimisation, control on OTP, efficiency and productivity," he added.

He said the current image of Air India was diluting its core strength of attractive slots in metros, traffic rights, slots in the international market, huge infrastructure and others.

Look Beyond Window Dressing

Meanwhile, Bhargava feels that the Maharaja – sobriquet given to Air India – was losing out to agile airline players in the market with every passing year.

"When I wrote my book in 2013, Air India was being patronised by one in seven passengers. Today, it is one in nine. With Air India only being managed financially to the extent of keeping it afloat and very little thought being given to its growth, the airline could get further marginalised. So, today's one in nine patronising of Air India could become one in 12 tomorrow. It is not working in a static environment, other airlines are growing rapidly," he warned.

The aviation writer said the government should look at the "full picture" rather than working in piecemeal.

"I keep saying one of the factors which kept away people (investors) is do we have a productive workforce? Is the government taking steps to improve work practices and make employees more productive? No measures are being taken to that effect. It is difficult for high-cost airlines to compete with airlines whose costs are relatively lower. Ultimately, it's the markets that are determining the fares. Revenues are dependent on that. So, you can't say I can continue to operate at the high-cost structure," he reasoned.

Bhargava cautioned just window-dressing the balance sheet will not attract investors. He said the government will have to look at structurally transforming the airline to get a suitor interested in the state-owned carrier.

"Once you remove these debts and sell properties and assets, your balance sheet will look rosier but when a prospective investor is going to look at the acquisitions of Air India, he just does not look at the balance sheet. He goes much deeper. The airline's depth is its remaining assets, its productive practices, its manpower, its marketing ability and other such things. You have to make it more attractive. Air India is growing and still adding flights, which is a good sign but its passenger market share is shrinking. It is growing but the market is growing at a much faster pace. That is not good for its valuation," he said.

Pandit also believes Air India has not been able to fully cash in on the aviation boom in the domestic market.

"With the market growing at 20% and if you are losing money it means there is something terribly wrong with your revenue model and internal operations. The wind is blowing but your sail is not set to catch the wind," he added.