Now, ex-CEA Arvind Subramanian says RBI funds can ease govt debt

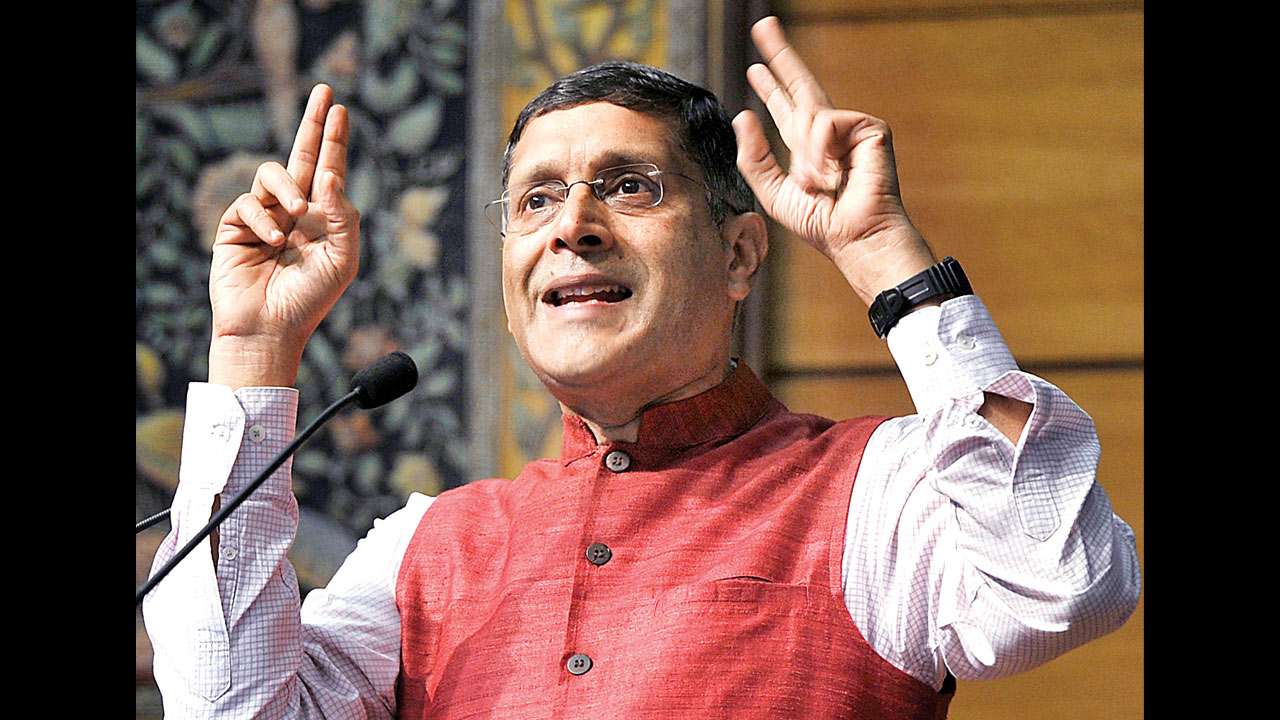

Arvind Subramanian Arvind Subramanian

The Reserve Bank of India (RBI) has a high level of capital stores and it would be prudent to use them to retire government debt or to recapitalise banks, says a study conducted by the government's former chief economic adviser Arvind Subramanian, and three other economists.

The study – which undertook a granular study of the RBI's balance sheet said the central bank has an unusually high level of capital compared to other central banks around the globe.

"If the choices made by other central banks are used as a benchmark, the RBI appears to have a minimum of Rs 5 lakh crore in excess capital or even as high as Rs 5.7 lakh crore and Rs 7.9 lakh crore. As of end-June 2018, it has total assets of Rs 36 lakh crore, of which 73% are Foreign Currency Assets (FCA), 17% are rupee securities, and 4% is gold," says the study published in the Economic and Political Weekly (EPW).

It further says, "A clear rule, enshrined in law and agreed between the central bank and government, could stipulate that the government will never allow central bank capital to fall below a jointly agreed threshold. That way, the benefits of excess capital can be reaped without compromising the integrity of the central bank's balance sheet and without undermining its policy effectiveness."

However, the study warned that "the excess capital, of course, does not imply that this amount is simply available for the government to use as it likes."

But if the special dividend or excess capital is used to finance budgetary spending, this would inflate the money supply, since the cash would be injected into the economy, rather than returned to the central bank creating inflationary pressures for RBI. "So, to be clear, transfers from the valuation reserves should only be used for operations such as recapitalising PSU banks and retiring debt," the report added.

The Malegam Committee, in its report submitted in 2013, had said that the total capital to cover various risks faced by a central bank such as the RBI was in excess of what was required. It recommended the transfer of the entire surplus to the government, over a period of three years starting from 2014.

However, former RBI governor Raghuram Rajan has said that if the central government finances themselves are weak, then the central bank will be unable to turn to the government for recapitalisation under difficult circumstances.

"Maintaining excess capital in the central bank can create an opportunity cost for society," the study said, "This cost can be measured as the difference between the average return on the central bank's assets and the social return from deploying that capital elsewhere. A very conservative proxy for this social return is the average debt servicing cost for the general government."

The transfer of the surplus reserves, the study said, must be taken co-operatively, not adversarially, to avoid any sense of the government raiding the RBI. After the global financial crisis, major central banks (including the US Fed and the European Central Bank) across the world have used their balance sheets to pull economies out of the financial mess. "Against this evolving view of central banking, the suggestion that the RBI's excess capital should be deployed elsewhere — to rehabilitate the banking system conditional on reforms being implemented — is actually tame and perhaps even conservative," the report added.

The other authors of the report are research officer Abhishek Anand of the economic division in the Ministry of Finance, Josh Felman, director of JH consulting; and Navneeraj Sharma, an independent researcher. The report claims inputs from discussions with Viral Acharya, deputy governor of the RBI and Raghuram Rajan, RBI's former governor. It was quoted in an article in the Economic and Political Weekly (EPW).