This summer, executives at a tiny leasing startup thought they had landed the deal of a lifetime after inking a partnership with Tesla Inc. to manage leases of the electric Model S sedan and Model X crossover. But just months later, the future of the company — MUSA Auto Finance — is in doubt after the Tesla business quickly overloaded its capital resources.

In an October email, MUSA, a Dallas company founded in 2016, told dealer customers it could no longer finance new deals after the partnership with Tesla caused MUSA's leasing volume to increase sixfold from August to September. As of mid-December, lease approvals had yet to resume, MUSA dealer clients said. The abrupt halt in business has left dealer partners without funding and some customers without the vehicles they had leased.

MUSA's sudden turn of fortune created snarls that Dave Guttenberg, owner of Automotive Imports, a used-vehicle store in Denver, still is navigating. Even though dealers were told MUSA — known for its automated decision- making software — would honor all leasing contract approvals sent before the October email, Guttenberg says he is owed nearly $180,000 for three pending lease agreements secured before the announcement. He still is waiting for funding — and answers — from the company.

"We didn't want to have to call customers up and say, ‘We're sorry — remember that really good lease deal that you were skeptical about? Well, we can't lease you that car,'" he said.

MUSA and Tesla officials declined requests to talk about the partnership. But MUSA's sudden standstill can be pieced together with information from interviews with dealers, leasing experts and people familiar with the matter, as well as information gathered from the companies' websites, email communications, social media channels and court filings.

Until last week, Tesla listed MUSA as a partner on its leasing page. Now, the listing is gone.

Growing pains

In the Oct. 16 email to dealers, which was obtained by Automotive News, MUSA said the sudden increase in its leasing volume from the Tesla business "forced us to look closely at how we fulfill our obligations to our core dealers and OEM partner" referring to Tesla, which doesn't sell through dealers.

"Effective today, we can no longer approve new applications until we retool some of our business processes," said the email, signed by Derek Walker, MUSA vice president of sales and marketing. "We're hoping this is a very short process, maybe a week."

Walker ended with a plea: "Please stay with us. Please believe in us. These are just growing pains for a start-up auto finance company with big dreams that grew faster than anyone expected."

Two months have passed since Walker sent the email, and the company has not funded any new leases, according to multiple dealer customers.

MUSA didn't have nearly enough money to handle its Tesla partnership, a person familiar with the matter told Automotive News. The company is now seeking more investors to fund the business, said the person, who asked not to be identified.

More than a year before it struck the Tesla deal, MUSA announced it had secured funding capacity of $175 million to originate leases.

Michael Buckingham, senior director of J.D. Power's automotive finance practice in Costa Mesa, Calif., said leasing contracts — especially for autos that often sell for $100,000 or more — must have made quick kindling of that skimpy credit line.

"With the high ticket price of autos, you burn through that rather quickly," Buckingham told Automotive News. "They simply ran out of capital."

Tesla deal

MUSA executives spent several months negotiating with Tesla, said the person, after an introduction by mutual partner Goldman Sachs, one of the biggest and most influential banks on Wall Street.

Goldman Sachs provided $125 million of MUSA's credit line. The firm was also a lead underwriter of Tesla's initial public offering in 2010 and has granted CEO Elon Musk hundreds of millions of dollars in personal loans. Goldman also has made millions underwriting Tesla's debt offerings, according to Bloomberg. Goldman declined to comment for this report.

Tesla, which struggled to automate its assembly lines, was attracted by MUSA's automated approval system for leases, the source said.

By submitting through Dealertrack, RouteOne or MUSA's own online portal, qualifying customers could receive almost instant approval on leasing contracts. On its website, MUSA said applications for consumers with prime credit scores would be approved within 30 seconds.

Tesla was also eager to shift vehicle financing to outside companies so it could preserve capital for other operations, the person said. U.S. Bank, which also facilitates Tesla leases, declined to comment.

Chaos at Tesla

Conserving capital was key during Tesla's negotiations with MUSA, which occurred during the first half of 2018 as Tesla struggled to stay afloat while ramping up to volume production on its newest vehicle, the Model 3. Musk told news service Axios in November that the EV maker was "within single-digit weeks" of failure during the Model 3 buildup.

"The company was bleeding money like crazy, and if we didn't solve these problems in a very short period of time, we would die," Musk said.

But Musk's solution soon created a new crisis — at MUSA.

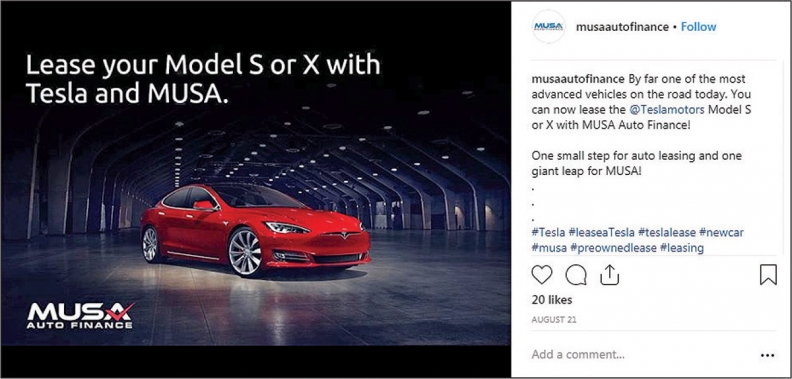

In August, MUSA touted the new Tesla business on its social media accounts, calling it "one small step for auto leasing and one giant leap for MUSA!"

But that leap turned out to be too big.

The contracts, on average $80,000 per lease, according to the source, strained MUSA beyond its capacity. In October 2017, MUSA's former president told Automotive News it had expanded into 29 states and was working with about 400 dealerships with an average lease of $45,000.

Legal battle

Turmoil at MUSA preceded the Tesla-triggered stall.

That former president, Richard Frunzi, is no longer at MUSA and sued the company in September for unpaid severance. MUSA also has gone through two CFOs since forming its operating team in December 2016, and the company lists no one in that position on its website.

Frunzi's lawsuit, filed in district court in Dallas, seeks 18 months of base pay and benefits worth between $200,000 and $1 million. It also alleges "improper" behavior by CEO Jeff Morgan that "could negatively harm MUSA and its investors." The lawsuit does not detail that behavior.

MUSA was founded by Morgan, who also owns Mortgages USA and Internet Auto Group. Frunzi, co-founder and former COO of Exeter Finance Corp., joined MUSA in 2016 to get the leasing operation rolling.

In an Oct. 22 court response, MUSA asserted that Frunzi's employment had been properly terminated "for cause" under his employment agreement, rendering Frunzi ineligible for any further severance or compensation.

A trial is set for Oct. 22, 2019.

Dealer dichotomy

Not all MUSA dealer customers were left in the lurch.

"I don't have anything negative to say about them," a representative of Michael's Auto Sales, a luxury used-vehicle retailer in West Park, Fla., told Automotive News. "I got paid on my deals. They stopped originating, but we've had other companies stop originating and left us holding the bag."

But Colorado dealer Guttenberg and others like him are in a pickle.

Such dealers have two options, J.D. Power's Buckingham said: Find another lender willing to buy the unfunded contract or take control of the leases themselves. Both are unappealing.

Another lender may not agree to the same terms, forcing the dealer to subsidize the remainder of the lease, Buckingham said. And taking control of the lease would require the dealer to act as a lender, a process for which most retailers aren't equipped.

"It's time-consuming, and that's not what the dealer is in the business to do," he said.

Guttenberg said two customers proved understanding, but he's had trouble getting back a Land Rover that had been delivered to a customer in Chicago.

Rather than terminate the lease, the customer wants an almost $7,000 credit to move forward with a purchase, said Guttenberg, who used MUSA to fund all but 10 of the 127 vehicles he leased out last year.

Guttenberg said he even called MUSA to confirm its commitment to fund the lease.

"We sent this car out of state out of good faith [because] they told us everything was OK," he said. "They promised us."

Hannah Lutz contributed to this report.