Deutsche Bank said earnings revisions risks remain to the downside, but the growth incremental is in the right direction with normalising liquidity situation

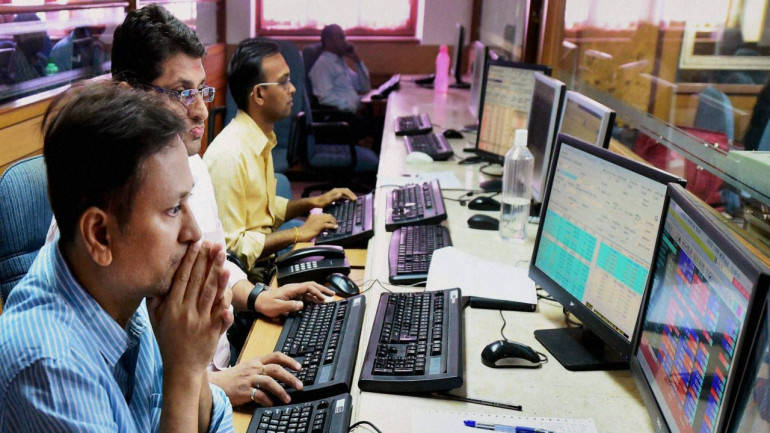

Benchmark indices surged on December 12 after pricing in big events—states elections results, RBI governor's resignation, deferment of Brexit voting, etc.—which had cautioned the market for last few sessions.

Key states poll outcome favoured Congress which raised more anxiety over general elections and other states elections in 2019, experts said, adding that the volatility was likely to rule in the coming year.

"We expect Indian equity to remain rangebound in the near future and political developments may keep valuations under check," Deutsche Bank said.

Crude oil prices, so far, remained in favour of India which imports around 85 percent of its requirement. Inflation is also under the RBI's target which rules out rate hikes in coming policies, according to experts. They, however, raised concerns over less than expected second quarter earnings. It raises worries about earnings for the second half of FY19.

Deutsche Bank said earnings revisions risks remain to the downside, but the growth incremental is in the right direction with normalising liquidity situation.

The global research house sees most favourable earnings revisions for IT services, and reasonable valuations and stock-specific favourable drivers for industrial & utilities.

"Financials see improving liquidity situation, accelerating credit growth as the worst of NPAs are behind us," Deutsche said, adding it prefers private banks with high CASA and select industrials among beta stocks.

The research house said the worst with respect to liquidity is over for the better-quality non-banking finance companies, but it would stay away from the smallcaps as we head into 2019.

The global investment firm is bullish on rural-oriented stocks for the last 1-1.5 years.

It believes emerging markets will do much better next year. "Mood towards emerging markets is grim and negative currently, due to China."

Deutsche Bank said it would see some private capex kicking in, after the 2019 general elections.

The government acted very fast on the appointment of RBI governor after Urjit Patel's resignation. The government announced Shaktikanta Das as the new RBI governor.

Deutsche said the market is looking at new RBI Governor's take on Prompt Corrective Action (PCA), liquidity and corporate governance.

The research house has added Marico, Colgate Palmolive, Asian Paints and Cummins India to its model portfolio and has dropped BHEL, HUL and Jubilant Foodworks. "We have increased weight in Axis Bank and reduced in HDFC."

Disclaimer: The above report is compiled from information available on public platforms. Moneycontrol advises users to check with certified experts before taking any investment decisions.