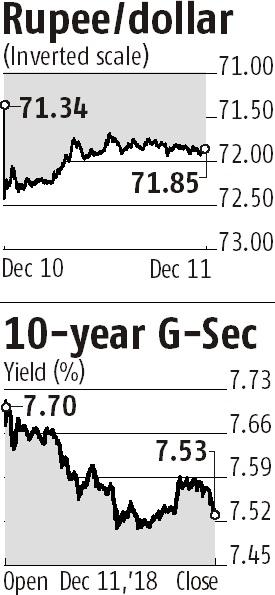

The rupee staged a late rebound after plunging 110 paise in early trade on Tuesday but still ended 53 paise lower at 71.85 against the dollar following RBI Governor Urjit Patel's shock exit coupled with the loss of the ruling BJP in key state elections.

Analysts said the RBI governor's surprise resignation and the ruling BJP's loss in state elections unnerved forex traders initially but a fag-end rebound in domestic equities and dollar selling by some state-owned banks helped in the recovery of the domestic currency.

After opening lower at the Interbank Foreign Exchange (forex) market at 72.42, the rupee clawed back to 71.67 during the day and finally settled at 71.85, down 53 paise over its previous closing price. On Monday, the rupee tumbled 50 paise to close at 71.32 against the dollar.

Meanwhile, the benchmark 10-year bond yield closed down 6 basis points on the day at 7.53 per cent after initially rising as high as 7.71 per cent.