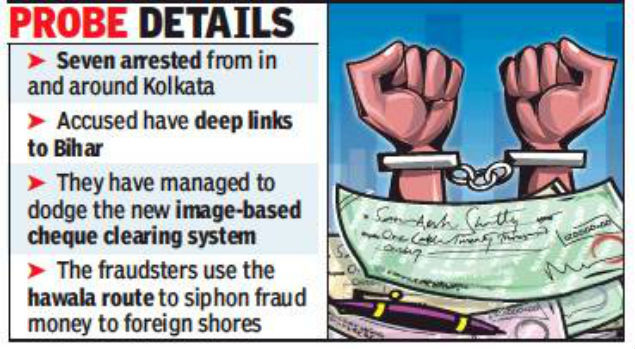

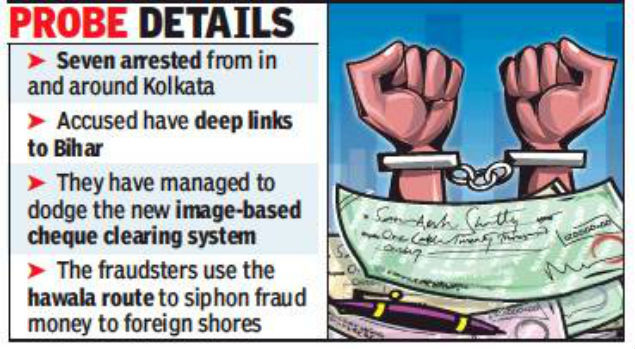

Seven held in cheque-fraud racket bust; stolen amount may run into crores

Rupak Banerjee | TNN | Dec 4, 2018, 08:07 IST Representative image

Representative image HOWRAH: The Howrah police on Monday tracked down an inter-state gang of bank fraudsters operating in Kolkata and its outskirts who forged cheques so neatly that they could fake even the magnetic ink character recognition (MICR) data. Seven persons have been arrested and the total fraud amount could be several crores, police said. Officers added they were also probing inputs that some of this money could have been sent to foreign shores through the hawala route.

Anish Kumar Thakur, a metal scrap dealer based in Salkia, had submitted a cheque worth Rs 6.3 lakh to Canara Bank’s Salkia branch. When the bank tried to process it, they noticed a signature mismatch, police said. While pursuing the matter with the person who had issued the cheque, Md Ali, the bank realized it was forged. The bank then lodged a formal FIR at Golabari police station on Saturday and Thakur was arrested.

Police said while Thakur initially told interrogators that Ali had forged his own signature, he later spilled the beans. Based on his inputs, Howrah police arrested Manish Gupta from Garia, Ranjan Yadav, Irfan Ali and Tauheed Alam from Ballygunje and Siddiqui Ali from Rajarhat over the last two days. Police said they have seized forged cheque books of five nationalised banks and six private sector banks from them. They have also seized 30 ATM cards, whose authenticity they are trying to establish by writing to the card-issuing banks.

Preliminary probe indicated that the amount misappropriated could run into several crores. The last transaction they carried out, according to their statements, was of Rs 5 crore, which was allegedly sent to Dubai through hawala. Police, however, refused to confirm or deny these assertions. By some accounts, the total amount misappropriated could even be over Rs 50 crores. A police source also claimed that the probe has thrown up a link to Pakistan, but this could not be verified. “We can’t comment till the statements are verified. It is an inter-state gang entrenched in Bihar and Bengal,” an officer said.

Cops said what has left them worried is the gang’s ability to dodge the Cheque Truncation System (CTS) or Imagebased Clearing System (ICS), which is being used by the banks according to RBI mandates. CTS is based on a cheque truncation or online image-based cheque clearing system where cheque images and MICR data are captured at the collecting bank branch and transmitted electronically.

Anish Kumar Thakur, a metal scrap dealer based in Salkia, had submitted a cheque worth Rs 6.3 lakh to Canara Bank’s Salkia branch. When the bank tried to process it, they noticed a signature mismatch, police said. While pursuing the matter with the person who had issued the cheque, Md Ali, the bank realized it was forged. The bank then lodged a formal FIR at Golabari police station on Saturday and Thakur was arrested.

Police said while Thakur initially told interrogators that Ali had forged his own signature, he later spilled the beans. Based on his inputs, Howrah police arrested Manish Gupta from Garia, Ranjan Yadav, Irfan Ali and Tauheed Alam from Ballygunje and Siddiqui Ali from Rajarhat over the last two days. Police said they have seized forged cheque books of five nationalised banks and six private sector banks from them. They have also seized 30 ATM cards, whose authenticity they are trying to establish by writing to the card-issuing banks.

Preliminary probe indicated that the amount misappropriated could run into several crores. The last transaction they carried out, according to their statements, was of Rs 5 crore, which was allegedly sent to Dubai through hawala. Police, however, refused to confirm or deny these assertions. By some accounts, the total amount misappropriated could even be over Rs 50 crores. A police source also claimed that the probe has thrown up a link to Pakistan, but this could not be verified. “We can’t comment till the statements are verified. It is an inter-state gang entrenched in Bihar and Bengal,” an officer said.

Cops said what has left them worried is the gang’s ability to dodge the Cheque Truncation System (CTS) or Imagebased Clearing System (ICS), which is being used by the banks according to RBI mandates. CTS is based on a cheque truncation or online image-based cheque clearing system where cheque images and MICR data are captured at the collecting bank branch and transmitted electronically.

All Comments ()+^ Back to Top

Refrain from posting comments that are obscene, defamatory or inflammatory, and do not indulge in personal attacks, name calling or inciting hatred against any community. Help us delete comments that do not follow these guidelines by marking them offensive. Let's work together to keep the conversation civil.

HIDE