Goa government notifies fees to change zone of non-settlement land

Murari Shetye | TNN | Nov 23, 2018, 05:50 IST Town and country planning (TCP) minister Vijai Sardesai.

Town and country planning (TCP) minister Vijai Sardesai.PANAJI: The state government’s notification on Thursday with regard to change of zone may open up a Pandora’s box and a change in Goa’s landscape might also be in the offing.

The notification not only mentions rates for change of zones from orchard land to commercial (settlement), but also mentions that those lands shown as settlement zones in Regional Plan (RP) 2001 but marked as No Development Zones (NDZ) in RP 2021 can be changed to settlement zones for no fee.

“Every application will be scrutinised. Only after verifying each and every case, we will permit land conversion,” a TCP official told TOI on Thursday. Asked if the change of zone law applies to only existing orchard land owners, the official replied that it applies to orchard lands owned at any point in time.

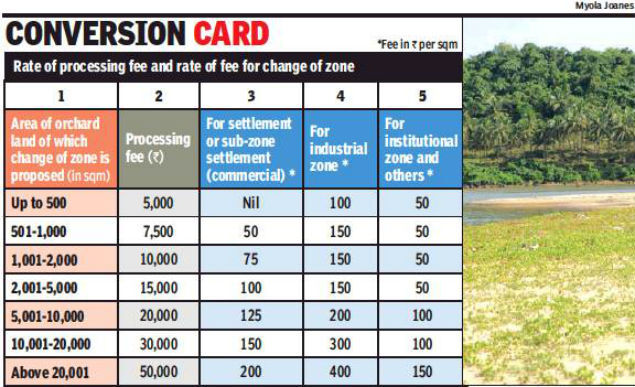

The notification further states that the fee rates are applicable for land in VP -2 (Village Panchayat -2) category villages in the talukas of Pernem, Bardez, Tiswadi, Ponda, Mormugao, Salcete and Canacona. It further states that the rate of fee in VP-2 category villages in the talukas of Bicholim, Sattari, Quepem, Sanguem and Dharbandora shall be charged 80% of the rates notified.

The notification states that the fee for land in VP-1category villages and M2 class municipal areas/coastal villages shall be increased by 20% and 40% respectively over the rate specified for VP-2 category villages.

‘The rate of fee for change of zone from industrial zone to settlement zone shall be as specified in column No. 3 and the rate of fee for change of zone from settlement zone to industrial zone shall be as specified in column No. 4,’ states the notification.

Relief to common man, says TCP minister Vijai Sardesai

Speaking to reporters earlier, town and country planning (TCP) minister Vijai Sardesai said that the state government brought in Section 16 B through an amendment in the TCP Act for individual cases. “I had said in the assembly that some persons used to take money for land conversion and the government never got any revenue. Well levy charges to convert land. This will bring relief to the common man. We’ve kept higher fees for those who want to convert land for industrial purpose. and a low rate for those who want to convert it for institutions.”

The notification not only mentions rates for change of zones from orchard land to commercial (settlement), but also mentions that those lands shown as settlement zones in Regional Plan (RP) 2001 but marked as No Development Zones (NDZ) in RP 2021 can be changed to settlement zones for no fee.

“Every application will be scrutinised. Only after verifying each and every case, we will permit land conversion,” a TCP official told TOI on Thursday. Asked if the change of zone law applies to only existing orchard land owners, the official replied that it applies to orchard lands owned at any point in time.

The notification further states that the fee rates are applicable for land in VP -2 (Village Panchayat -2) category villages in the talukas of Pernem, Bardez, Tiswadi, Ponda, Mormugao, Salcete and Canacona. It further states that the rate of fee in VP-2 category villages in the talukas of Bicholim, Sattari, Quepem, Sanguem and Dharbandora shall be charged 80% of the rates notified.

The notification states that the fee for land in VP-1category villages and M2 class municipal areas/coastal villages shall be increased by 20% and 40% respectively over the rate specified for VP-2 category villages.

‘The rate of fee for change of zone from industrial zone to settlement zone shall be as specified in column No. 3 and the rate of fee for change of zone from settlement zone to industrial zone shall be as specified in column No. 4,’ states the notification.

Relief to common man, says TCP minister Vijai Sardesai

Speaking to reporters earlier, town and country planning (TCP) minister Vijai Sardesai said that the state government brought in Section 16 B through an amendment in the TCP Act for individual cases. “I had said in the assembly that some persons used to take money for land conversion and the government never got any revenue. Well levy charges to convert land. This will bring relief to the common man. We’ve kept higher fees for those who want to convert land for industrial purpose. and a low rate for those who want to convert it for institutions.”

All Comments ()+^ Back to Top

Refrain from posting comments that are obscene, defamatory or inflammatory, and do not indulge in personal attacks, name calling or inciting hatred against any community. Help us delete comments that do not follow these guidelines by marking them offensive. Let's work together to keep the conversation civil.

HIDE