Mutual fund SIPs, inflows remain strong despite volatility

M Allirajan | TNN | Updated: Nov 10, 2018, 12:41 ISTHighlights

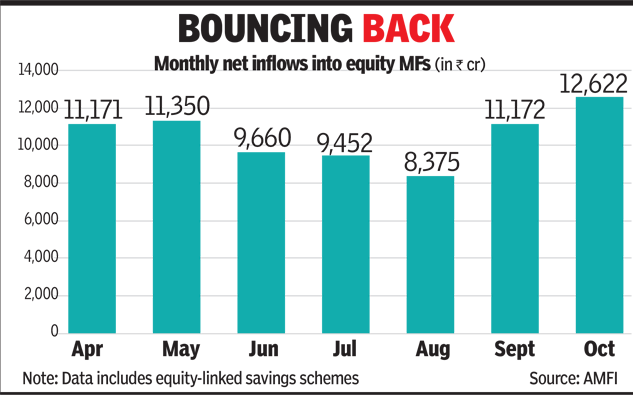

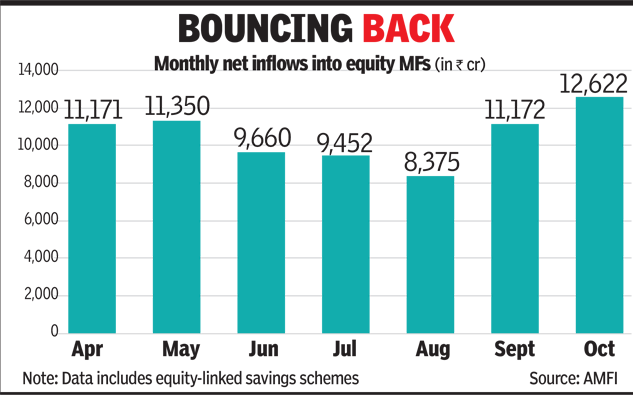

- Net inflows into equity MFs (including ELSS) stood at Rs 12,622 crore in October, a 6.5% improvement over the previous month, data with the AMFI showed

- Net inflows into equity MFs in October was the highest since February this year

(Representative image)

(Representative image)NEW DELHI: Despite the sustained selling pressure in the equity markets, investors continue to put money in mutual funds (MFs). Fund houses received Rs 7985 crore through systematic investment plans (SIPs) in October, a 42% increase on a year-on-year (y-o-y) basis.

Net inflows into equity MFs (including equity-linked savings schemes or ELSS) stood at Rs 12,622 crore in October, a 6.5% improvement over the previous month, data with the Association of Mutual Funds in India (AMFI) showed. Net inflows into equity MFs in October was the highest since February this year. A reduction in redemptions or investor exits also boosted inflows in October. Redemptions in equity MFs fell 14% in October on a month-on-month (m-o-m) basis.

The benchmark Sensex lost about 5% while the broad-based Nifty fell 5.6% in October. "The industry showed resilience despite the recent market events and the ensuing volatility in both debt and equity segments," said NS Venkatesh, chief executive officer, AMFI.

"Retail inflows showed a healthy improvement of almost 30% over last month. SIPs continue to show an upward trend with monthly contributions of Rs 7985 crores as against Rs 7727 crores last month," he said. SIPs are done almost entirely in equity funds. The fixed income segment contributes only about 5% in volume terms and about 2% in value terms to overall SIPs.

MFs saw net inflows of Rs 35529 crore on an overall basis (across all categories) in October compared to outflows of about Rs 2.3 lakh crore in the previous month, AMFI data showed. The overall net inflows stood at around Rs 51000 crore in October 2017.

"Over the last year there has been a 30% growth in retail folios, 14% growth in retail AUM assets under management and over 40% growth in monthly SIP contributions. This shows that the retail investors continue to repose their faith in mutual funds," Venkatesh stated. The AUM of the MF industry improved marginally on a m-o-m basis to around Rs 22.23 lakh crore in October.

Net inflows into equity MFs (including equity-linked savings schemes or ELSS) stood at Rs 12,622 crore in October, a 6.5% improvement over the previous month, data with the Association of Mutual Funds in India (AMFI) showed. Net inflows into equity MFs in October was the highest since February this year. A reduction in redemptions or investor exits also boosted inflows in October. Redemptions in equity MFs fell 14% in October on a month-on-month (m-o-m) basis.

The benchmark Sensex lost about 5% while the broad-based Nifty fell 5.6% in October. "The industry showed resilience despite the recent market events and the ensuing volatility in both debt and equity segments," said NS Venkatesh, chief executive officer, AMFI.

"Retail inflows showed a healthy improvement of almost 30% over last month. SIPs continue to show an upward trend with monthly contributions of Rs 7985 crores as against Rs 7727 crores last month," he said. SIPs are done almost entirely in equity funds. The fixed income segment contributes only about 5% in volume terms and about 2% in value terms to overall SIPs.

MFs saw net inflows of Rs 35529 crore on an overall basis (across all categories) in October compared to outflows of about Rs 2.3 lakh crore in the previous month, AMFI data showed. The overall net inflows stood at around Rs 51000 crore in October 2017.

"Over the last year there has been a 30% growth in retail folios, 14% growth in retail AUM assets under management and over 40% growth in monthly SIP contributions. This shows that the retail investors continue to repose their faith in mutual funds," Venkatesh stated. The AUM of the MF industry improved marginally on a m-o-m basis to around Rs 22.23 lakh crore in October.

Download The Times of India News App for Latest Business News.

All Comments ()+^ Back to Top

Refrain from posting comments that are obscene, defamatory or inflammatory, and do not indulge in personal attacks, name calling or inciting hatred against any community. Help us delete comments that do not follow these guidelines by marking them offensive. Let's work together to keep the conversation civil.

HIDE