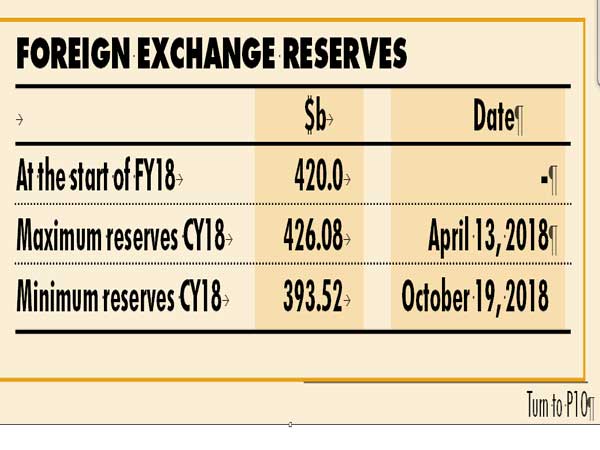

From its peak of $426.08 billion as on April 13, 2018, India’s forex reserves have slumped to $392.078 billion as on October 26, a fall of $34.01 billion in six months.

The decline can be attributed to central bank continuously intervening in the forex market to reduce rupee volatility.

With the Fed expected to keep increasing rates every quarter to 2.50 per cent by end-2018 and to 3.50 per cent by end-2019, the dollar’s uptrend is likely to extend into mid-2019. In addition the US sanctions on Iran have taken effect from Sunday which would further lead to increase in oil prices and inflationary concerns in the economy that could wield downward pressure on the rupee. So, will the forex reserves situation turn precarious? No, say experts.

However if the depletion of reserves continues in the same speed (as seen in the last six months) then there will be a need for raising new resources in foreign currency reserves.

However, a part of it has been addressed by raising inter-government swap arrangement with Japan of up to $75 billion (it is one fifth of India’s reserves). India and Japan agreed to enter into a bilateral swap arrangement of $75 billion last week and has helped to stem the rupee’s fall. The other options would be issuing NRI bonds, or raise funds from the IMF.

Ashutosh Khajuria, executive director at Federal Bank, said: “There is a cost to maintenance of reserves. So, what accreted in calendar year (CY) 2017 is being spent in CY 18 and should not be taken as a big risk. It should be seen in the context of what happened in CY 2017 when the rupee appreciated by nearly 7 per cent vis-à-vis the dollar. So, if we take October 2016 as the base and compare it to October 2018 the rupee has depreciated by 7-8 per cent. The US inflation is at 2 per cent compared to India’s inflation of 5-6 per cent. So, following the inflation corrected parity principle, the rupee should depreciate by 2-3 per cent against the dollar per year.”

The RBI policy tilt is no longer accommodative, and forex reserves at $392 billion still provide a decent 9 months of import cover (versus a low of 6.7 months seen in 2013). The RBI has hiked the repo rate twice successively to the tune of 50 basis points in total. By keeping policy rates on hold in October, the RBI hinted that it will not use interest rate defence as a tool to manage currency weakness.

The dollar-rupee rate fell from an average 67 during April-June to 68.7 in July, 69.6 in August to 72.3 in September. “Unlike in 2013, even as the rupee has weakened by 15 per cent calendar year-to-date against the dollar, it remains outside that group of most vulnerable currencies and the country's forex reserves position is still reasonable based on the reserve adequacy matrix (though reversing fast),” UBS analyst Gautam Chhaochharia said in the report.

Foreign investors continue to remain on a selling spree. During April to October till date, foreign investors have sold Rs 55,610 crore in equity and Rs 57,520 crore in debt and Rs 132 crore in hybrid funds. Thus they have been net sellers to the tune of Rs 1.13 lakh crore in India.

Positives of rupee depreciation—India’s trade gap narrowed to a five month low in September, driven by slower growth in imports even as exports contracted compared to a year ago. The gap between exports and imports stood at $13.98 billion, compared with $8.9 billion in the same month last year. The trade gap has narrowed from a five-year high of $17.4 billion in August showed government data. This is likely to strengthen the current account deficit as CAD deficit is mostly because of the trade deficit.

In October so far, the RBI has lost $$8 billion as against accumulation of forex reserves by $1.24 billion in September. According to Madhavi Arora, economist, forex and rates at Edelweiss Securities, “We think amid intensified Indian rupee pressures after the October MPC policy and sharp and consistent foreign outflows seen in October, RBI would have possibly increased spot intervention and we may possibly see further loss in reserves in October month.”